It’s happened yet again.

Yesterday afternoon, another billionaire investor predicted a financial collapse. This time, it was Ray Dalio, founder of the largest hedge fund in the world, Bridgewater Associates.

Here’s what he had to say:

“I think it will be more severe in terms of the social, political problems. And I think it will be more difficult to handle … It won’t be the same in the terms of the big-bang debt crisis. It’ll be a slower growing, more constricting sort of debt crisis that I think will have bigger social implications and bigger international implications.”

However, unlike the rest of the “doomsayers” out there (like Warren Buffett), Dalio thinks that we are still several years away from a major financial crisis – this time revolving around debt, as usual.

In a recently published book, called A Template for Understanding Debt Crises, he compares our current economic situation to 1935-1940, and lists the similarities between the 2008 housing bubble and what happened leading up to the Great Depression in 1929.

Much like in the early stages of the Depression, financial crises forced the hands of monetary policymakers in America – making them gobble up financial assets while printing money hand-over-fist.

The combination of the two fiscal policies caused those recently purchased assets to skyrocket in price, widening the wealth gap in America and kicking off a decade of economic turmoil.

Policymakers these days seemingly haven’t learned anything from the past, as the “go-to” response to a financial crisis is to simply introduce gobs of new money into circulation via the central bank.

This process, known as quantitative easing, was an “economic cure-all” utilized by the Obama administration (and by proxy, the Federal Reserve), that seemed at face value to be working after the housing bubble burst.

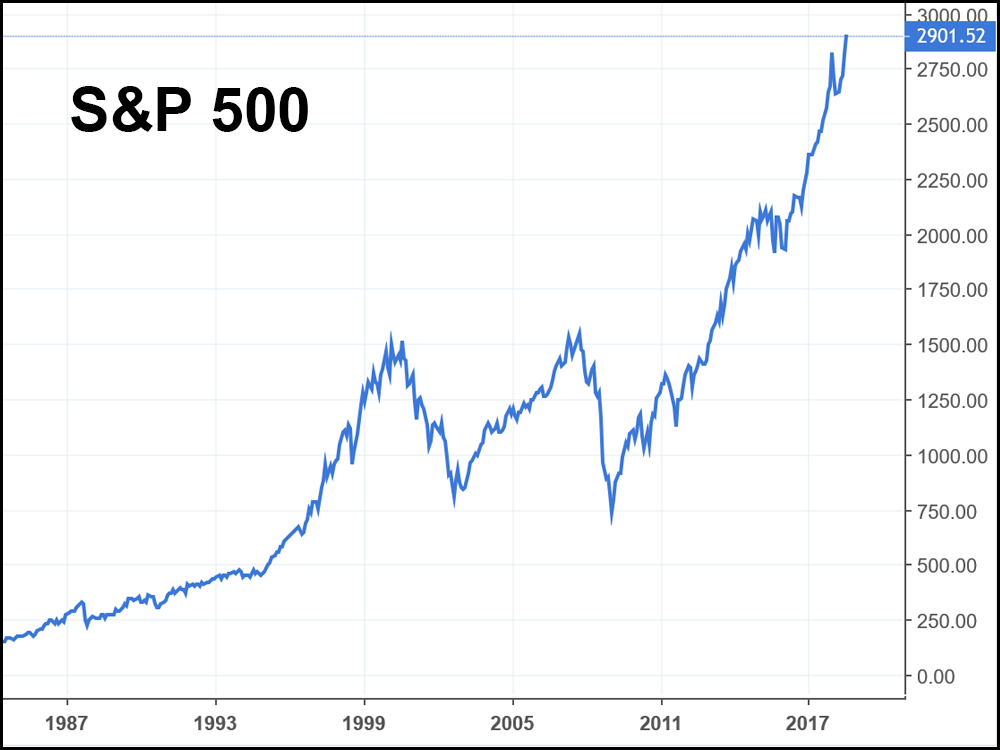

After all, the market did eventually climb out of the hole that it fell in over the course of 2008.

Supporters of the decision to “ease” money (or more appropriately, shoot it at alarming speed) into circulation are happy to cite this fact. Just like in 1929, when the Great Depression began, the Fed churned out cash in 3 different quantitative easing packages.

But instead of the government snapping up financial assets, this time private citizens and corporations were doing it.

So, the market started to rise, as a populace now inundated with oodles of money (and low interest rates) started to purchase assets.

The problem, though, is that it took 5 years for the market to get its head back above water to pre-housing bubble prices.

That’s certainly a long time when you consider what happened back in 2000, when the dot com bubble burst. The market eventually recovered as well in a span of 6 years – but it managed to do so without direct interference from the Fed via the out of control printing of currency (and propping up of a weak market).

What has Dalio so shook up is interesting to me, because it doesn’t echo the same sentiment of the other so called “experts” that are calling for a bear market in the near future.

In this case, he’s worried that the American market has grown fat on quantitative easing. It’s been a large driver in lifting the market since 2009, and we’ve had almost a decade of rock-bottom interest rates pumping up assets.

Everything is becoming more expensive, arguably too fast, and it’s continued to grow unchecked. This is something that has some analysts – Dalio included – worried that equities are currently way overvalued.

And you know what? He could be right.

But he also might be totally wrong.

After all, the world has changed significantly since the 1920’s, and this recent bull run has been prodded along by corporate earnings growth – NOT speculation driven by freely flowing cash.

But in the end, it doesn’t matter if Dalio’s right.

It doesn’t matter which way equities are headed, if you understand this one little secret I’ve learned over the years:

If you know how to navigate the market, you can still make money in spite of the current trend – up or down.

By judiciously using a set of rules that have been carefully honed over tens of thousands of trades, it’s absolutely possible to identify winning scenarios, time after time.

Especially if we’re in the midst of a full-blown financial crisis.

You’d be surprised at the opportunities that pop up when the average investor is in hysterics.

So, while hedge fund managers like Ray Dalio are searching for signs of the next collapse, I’ll be watching and waiting to see what the market kicks back in the meantime – pocketing winning trades regardless of what eventually happens, all thanks to a few simple rules.

Care to join me?