With the S&P 500 at all-time high levels and companies like Apple Inc. (NASDAQ: AAPL) breaking market cap records, it’d be easy to get caught up in the rush of positive energy being thrown around the current bull market – even if a trade war against China and the threat of a currency crisis threaten to topple the whole system.

After all, the market has always gone up long-term, and what we’re seeing right now is simply a continuation of it. This is largely caused by improvements in technology, productivity, and population – a crucial cocktail that continues to grow the markets, year in and year out.

But many analysts argue that “the end is nigh”, and that there’s a massive downturn on the horizon just waiting to bury portfolios all over the world. They claim that the current uptrend is simply a house of cards, waiting to fall once the United States and China start to shake-up the global economy – something that, in my opinion, the major indexes would easily be able to overcome.

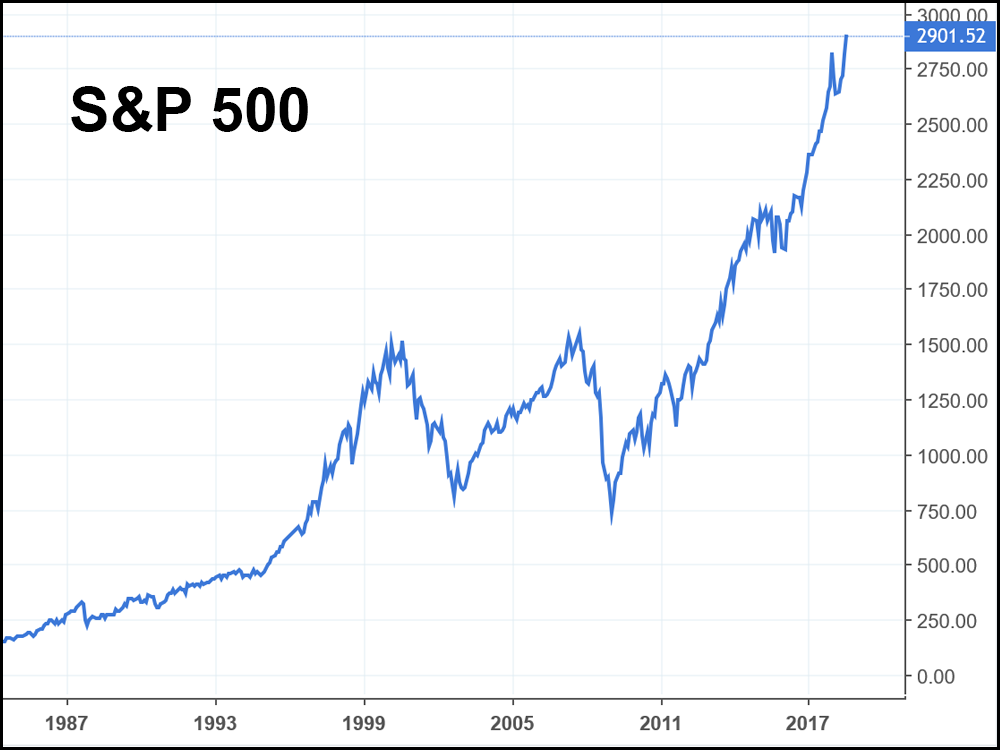

Looking at the S&P 500 over the last 30 years, you can easily see that despite enduring several major economic crises, it has enjoyed a positive net growth:

However, not every market has been able to produce the same results. Simply existing is not enough to guarantee regular growth,as we have seen in Japan, as reflected in the Nikkei 225 index over that same period of time:

Both the United States and Japan are free, capitalist countries that have highly productive work forces. They also both play host to major corporations in some of the most important industries – so what gives? What key difference between the two nations has made one stock market grow, while the other declined?

One word:

Deflation

Since the early 90’s, the Japanese economy has suffered from a chronic case of deflation, despite their central bank’s best efforts to eliminate it. Back in 2001, they even reduced interest rates to almost 0 percent (no, I’m not kidding) as a part of a “quantitative easing” strategy that sadly didn’t work.

Japan – who currently has the lowest interest rates in the developed world – is still, after all these years, plagued by deflation, which was likely caused by an equity and real estate bubble in the 80’s. The market plunged after the bubble burst, and deflation has arguably kept it down.

But why?

Why would that keep Japan’s economy in the gutter? Isn’t inflation – the decrease of purchasing power – the typical culprit here?

While yes, out-of-control inflation is certainly dangerous, a low, controlled amount can actually be healthy (and even promote) a growing economy.

In Japan’s case, deflation has caused huge issues for debt holders within the country.

Say, for example, you have a 30 year mortgage, and let’s assume you live somewhere that has a currency subject to inflation every year. Towards the end of the mortgage, your monthly payments are roughly the same, but goods and services have gotten more expensive and you’re earning more money – all thanks to inflation causing currency to become less valuable.

Assuming that wage growth and the inflation rate are similar, your monthly mortgage payment will become less and less of a burden over time. Simply put, the payment won’t change but you’ll have more money with which to pay it each year.

On the other hand, if your currency is deflating, your burden of debt will increase over time. By the end of your mortgage, your payment will be the same, but you’ll be making less money each year, assuming that the wage decline and deflation rate are roughly the same.

That makes a long-term fixed payment plan on any kind of debt increasingly expensive, and THAT is what the Japanese have been dealing with over the last three decades.

As a result, prosperity has completely stalled in many industries and population groups within Japan. Couple this with an aging population (caused by a higher death rate than birth rate) that has grown extremely risk-averse (meaning they won’t participate in equities) and you’ve got a recipe for continued difficulties.

So, when the so called “experts” claim that the stock market is on the precipice of disaster, all I have to do is look back at a few declining world indexes (like Japan’s Nikkei 225) to find my proof that the American equities will continue to thrive – because our economic landscape is so different from the rest.

It only took one bubble to break the Japanese markets for almost 30 years.

Meanwhile, the American markets have endured several crises (concurrently at times), suffering temporary setbacks before continuing on towards new all-time-highs – something that could most economies just simply couldn’t do.

As Trump continues to target China (and his new adversary, the European Union) in the coming months, it may be worth ignoring the “doomsayers” that will inevitably call for a major market crash.

Yes, a correction will eventually come at some point, but just like we’ve seen in the past, equities will be able to overcome any challenges on the horizon…

…and investors that understand this will be rewarded handsomely for it.