The 10-year Treasury yield has been on a free fall since Fed Chairman Jerome Powell’s July 31st rate cut announcement. As of this morning, it’s approaching an all-time low.

For new home and car buyers, that’s good news. The 10-year Treasury yield is used as a benchmark for mortgage rates and auto loans.

But for the rest of us, the current yield of 1.595% – the lowest it’s been since fall 2016 – could be a sign of something far less desirable.

Like a forthcoming recession according to some analysts.

Recession fears are what caused Powell to cut rates in the first place, even though we aren’t really seeing signs of an economic slowdown outside of treasury yields.

The last jobs report revealed satisfactory employment numbers and the consumer confidence index suggests that Americans still want to buy, buy, buy.

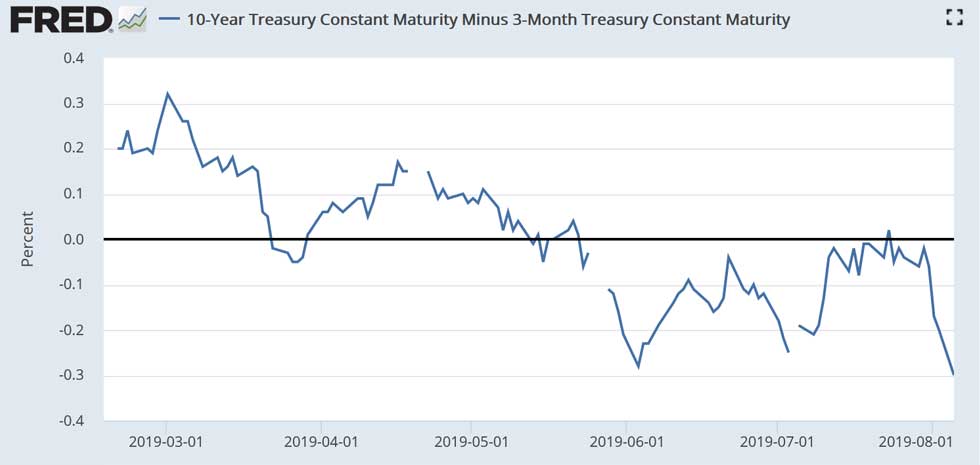

The only significant “warning bell” sounding off has to do with yields. Specifically, the 10-year and 3-month Treasury yield spread.

The last three times that yield spread inverted, the economy entered a recession shortly thereafter. At the moment, it’s sitting in inverted territory.

Is it cause for concern?

Maybe.

Is it time to start freaking out?

Definitely not.

Contrary to what some analysts would have you believe, inverted yield spreads – especially the 10-year vs. 3-month – do not cause recessions.

They’re simply symptoms of a larger problem:

Investors are afraid of economic instability, both at home and abroad.

With China letting their currency, the yuan, drop to a record low right before artificially raising its value a day later, it appears as though the “gloves are off” in the trade war.

The Chinese central bank has become a force of chaos, bobbing-and-weaving around every punch the Trump administration throws at Xi and his cronies.

That has investors worried.

Not because China has the upper hand (they don’t), but because anything could happen these days. How many times now has the market imploded immediately at the open following a tweet from President Trump? Or a candid remark from Jerome Powell?

Don’t forget about the early-June recovery, either. Equities went on a rally for the history books after U.S./China trade talks were reportedly going well.

It’s a hard time to invest, especially as a “buy and hold” investor. Watching your portfolio balance crater one week, only to explode upwards the next can be downright exhausting.

And now, after the market endured its biggest single day drop in 2019, investors are cashing out.

Causing Treasury bond prices to rise and yields to fall, especially after central banks around the world started to cut rates as well.

So, over the last few weeks, it could be argued that the yield spread inversion has not been caused by economic worries.

Nor fears of a recession. At least, not valid fears.

Instead, investors are just sick and tired of the uncertainty that a trade war with China brings. Volatility is tough enough to stomach without a world superpower intentionally manipulating its currency – something China looks intent on exploring further.

And when you’ve got the world’s number one exporter fudging the numbers? All bets are off.

Meaning that all the GDP growth and economic prosperity in the world won’t cause the 10-year/3-month yield spread to un-invert.

Only a real trade war ceasefire will, regardless of which side truly “wins”.