Stocks fell this morning after investors learned that US retail sales slumped by 1.1% month-over-month (MoM) in July, missing the -0.3% MoM consensus estimate badly. June saw a slight bump (+0.6% MoM) that many analysts viewed as a sign of progress at the time.

Last month, however, retail trends quickly reversed. Consumers simply couldn’t keep spending at their previous pace.

Automobiles, clothing, and online retailers endured the largest drop in sales. Retail sales minus food, automobiles, gas, and building materials also disappointed, falling 1.0% MoM vs. 0.2% expected.

Thankfully for bulls, there were still plenty of optimists on Wall Street despite July’s data.

“Although retail sales fell in July, the outlook for consumer spending remains positive,” explained Gus Faucher, chief U.S. economist at PNC.

“However, spending growth will shift from goods to services over the next couple of years, limiting growth in most categories of retail sales.”

BWO Wealth Management’s Yung-Yu Ma gave a more sobering take:

“When we’re looking at the expectations for consumer strength going forward, some of the edge is being taken off by the rise in the delta variant,” he said.

“These challenges aren’t going to go away quickly.”

And though both analysts raised good points, neither mentioned the true driver of July’s retail pullback:

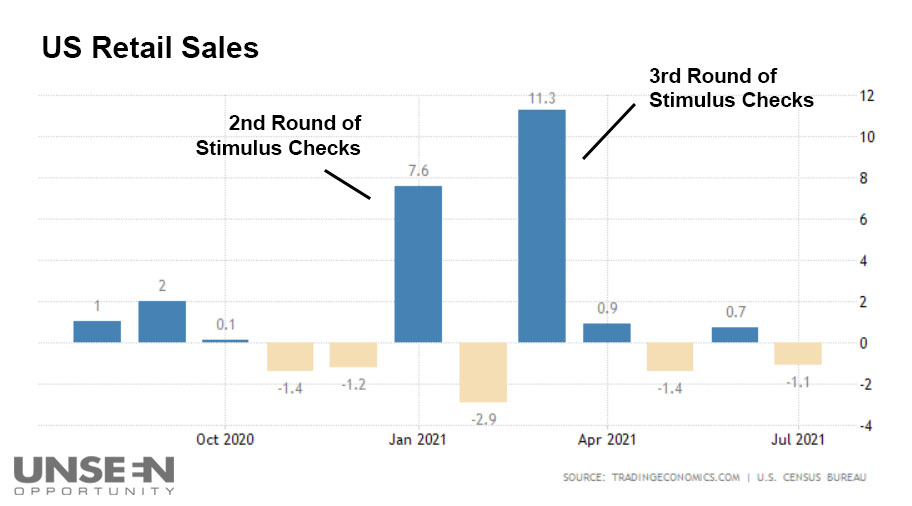

A complete lack of recent stimulus.

Believe it or not, retail sales typically trend lower when the government stops handing out free money.

This should come as no surprise to anyone who’s been paying attention. And July’s -0.3% MoM consensus estimate reflects that to a degree.

But economists missed the mark on just how much consumer spending (and the US economy, by proxy) has slowed. Consumers make up almost 70% of all economic activity in the US. When retail sales decline, it’s typically indicative of a broader economic “crunch.”

The market found out yesterday that China’s dealing with a similar problem after Beijing released its latest economic data. Chinese retail sales in July were up 8.5% year-over-year, also badly missing the 11.5% consensus estimate.

Most analysts agree, though, that China won’t issue stimulus to bring those numbers up (unlike the US). Monetary policy is expected to shift even more dovish instead as Delta variant cases continue to rise in Asia – something Goldman Sachs doesn’t view as a significant hazard for Western markets.

“Rising COVID case growth is likely fueling the slowdown seen in China and the decline in manufacturing sentiment, but the economic impact — at least in the US and Europe — is unlikely to be big,” wrote Goldman analysts in a Monday note to clients, prior to this morning’s release of the US July retail sales data.

All three major indexes – the Dow, S&P, and Nasdaq Composite – plunged in response to the retail slump. But will those losses stick?

Not unless additional selling follows to close out the week. Traders have witnessed plenty of “head fake” corrections over the past 12 months only for the broader indexes to come roaring back, and often in a matter of days.

So, despite today’s drop, exiting the market right now may be a little premature. This morning’s selling could simply be setting up equities for another short-term buying opportunity, followed by a snap-back rally to new highs.

Which, if the S&P’s performance this year is any indication, could easily arrive by month’s end.