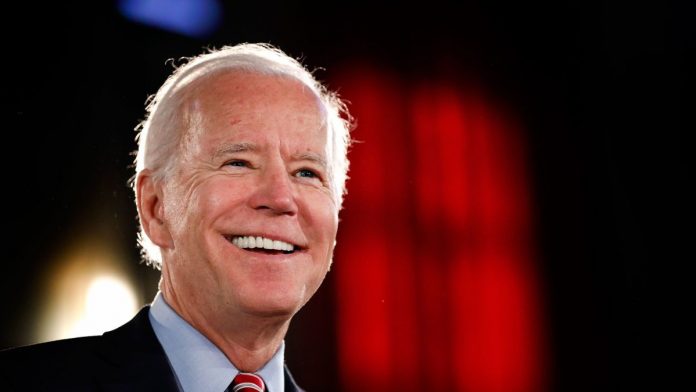

Stocks traded higher this morning after President Biden announced that he struck a deal with Senate Democrats who had initially opposed his new bill. Worth $1.75 trillion, the bill was created to bolster “social spending” and to target climate change.

But its biggest changes have nothing to do with either of those two things. Biden wants to raise the minimum corporate tax rate, limit business losses, tighten international corporate tax rules, and expand the 3.8% investment tax.

In other words:

The bill is really taking aim at taxing big businesses, possibly to fund the White House’s aggressive spending plans.

Biden went over the general concepts of the bill in a press conference today but didn’t provide as much detail as analysts had hoped.

“I know we have a historic economic framework,” he said.

“I’ll have more to say after I return from the critical meetings in Europe this week.”

In order to reach an agreement with Democrat holdout Sen. Joe Manchin, a federal paid family and medical leave system was removed from the bill. However, negotiations aren’t over just yet. The bill could still change dramatically in the meantime before it’s finalized.

And if Congressional progressives get their way, it may increase in size. Others aren’t necessarily happy with its current structure, either.

“It needs to be improved,” remarked Bernie Sanders.

“What we have to do now is, first of all, make sure that the before the [infrastructure bill] vote takes place in the House, to make sure that there is a very explicit legislative language” he continued.

Manchin wasn’t pleased with the bill’s framework, either.

“It’s hands of the House,” he said.

“I’ve been dealing in good faith. I will continue to deal in good faith.”

Regardless, it may be only a matter of time until the $1.75 trillion in spending arrives now that Manchin and Sen. Kyrsten Sinema are seemingly on board.

That’s good news for bulls, especially after the Commerce Department released its quarterly US growth report this morning. US gross domestic product (GDP) grew at an annualized pace of just 2.0% last quarter, falling well short of the 2.8% consensus estimate due to reduced consumer spending and residential investment.

It was also the slowest quarterly post-pandemic gain for US GDP.

“Overall, this is a big disappointment given that the consensus expectation at the start of the quarter in July was for a 7.0% gain and even our own bearish 3.5% forecast proved to be too optimistic,” wrote Capital Economics chief US economist Paul Ashworth.

“We expect something of a rebound in the final quarter of this year — if only because motor vehicles won’t be such a drag and any negative impact from Delta should be reversed.”

If Covid cases continue to trend lower, consumer spending could potentially increase. But that will only happen if the supply chain issues are fixed relatively soon.

But many analysts, economists, and industry heads believe that supply chain struggles will linger well into next year. And they may even get worse as a vaccine mandate deadline approaches.

So, even though Q3 earnings have looked good, investors need to understand that the post-Covid recovery has slowed dramatically. The market may need to adjust its expectations as a result.

Because, eventually, the major quarterly earnings “beats” will end. And when they do, stocks with sky-high valuations are going to look a little pricy, no matter how much the White House intends to spend via new bills.