After debuting a controversial advertisement last week (that featured former NFL starting quarterback Colin Kaepernick), Nike shares plunged over 3% in just one day’s worth of trading. Outspoken customers who disagreed with Kaepernick’s method of protesting police brutality – taking a knee during the national anthem – burned their Nike apparel in retaliation.

The entire affair was a bad look for the company, who’s stock price was up almost 30% on the year before the sudden drop. Investors seemed displeased about Nike’s willingness to throw its hat into such a divisive issue, and still haven’t bought NKE back up to where it was before:

Even though the price did drop, analysts (including our very own) are now reporting that Nike sales increased by 31% over Labor Day weekend, which was higher than the 2017 boost of only 17%.

I guess there really is “no such thing as bad publicity”, isn’t there?

And even though it may seem like Nike was taking a bold political stance, I’ve got a secret to tell you:

The creation and airing of the Colin Kaepernick ad had absolutely nothing to do with politics or virtue signaling.

It was simply a business decision.

Ever since Nike was founded by Phil Knight as Blue Ribbon Sports back in 1964, the company has pushed itself to the fringes of society in order to gain notoriety. “Edgy” promotions have always been a part of Nike’s arsenal, and the company loves to see itself as an eternal renegade.

Because of its “rebel” status (despite being worth $128 billion in equity), young people who buy Nike products are “making a stand” and doing something for the greater good.

Wow – what a noble cause!

Little do they know, however, that Nike could care less about trying to affect social change, for better or for worse. They’ve known for decades now that their target market is most liberal, and will happily take that side of “hot button” topics in order to further entrench the company in the Left’s pockets.

There’s a bittersweet irony in the way that a major corporation (something liberals typically dislike) is extoling their viewpoint’s virtues for marketing purposes and monetary gain.

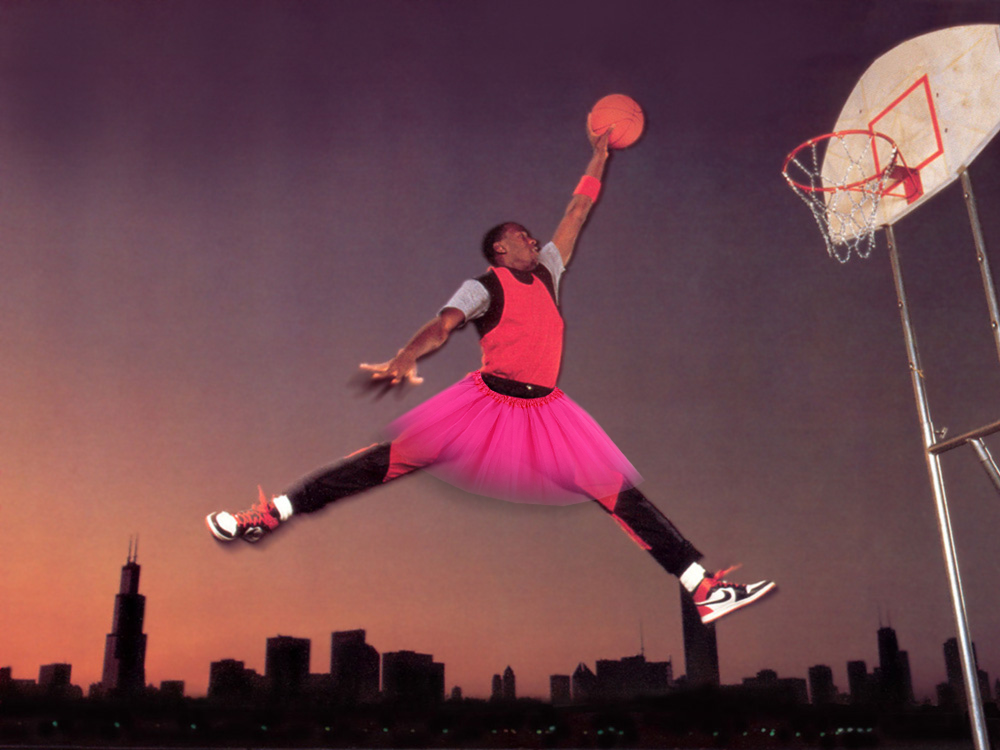

If Michael Jordan protested the national anthem by wearing a pink tutu, I can guarantee you that there would be a commercial with basketball players dunking at the ballet.

And is this a bad thing?

Maybe, maybe not.

There are always going to be opposing viewpoints in America (and the rest of the world), so you’d figure that some corporations would be trying to capitalize on that.

Even though short-term sales may have lifted, this strong stance by Nike ended up scaring off many investors – causing traders around the world to wonder if the company’s stellar bull run could be over.

But regardless of the recent controversy, this whole ordeal may have provided outsiders an “on-ramp” to get NKE shares at discount prices:

I’ve said it before, and I’ll say it again:

The time to get excited about a security is NOT when everyone is in love with the underlying company.

Nike, Inc. is a perfect example of this. It’s shot up like a rocket for almost the entirety of 2018, and now when prices start to falter in the wake of a questionable marketing decision, we can see that investors just won’t let it fall below a support price of around $79.00.

Even with all the noise going on around this company, the market (not analysts reporting sales figures) will ultimately decide its fate – and this is the only thing you need to listen to divine Nike’s future. In this regard, it certainly helps if you are equipped with a time-tested, reliable trading method – something our current members enjoy in spades.

So, before you go out and burn your shares (along with your jogging shoes), it might be worth watching what transpires over the next few days, since the stock just set a key support level.

After all, you don’t want to be left in the dust as NKE “runs away” to a new all-time high, do you?