If you’re brand new to trading, and if you’re interested in going after the huge profit potential that exists in pot stocks, then this is for you.

Today, I’m going to show you a simple way to analyze a popular pot stock – Canopy Growth – so you can make a smarter decision around how to trade it.

First, let’s define two terms:

Support: What does that mean? It’s very simple; support is something that stops you from falling. Be it a cane or leaning against the couch, it is support.

This term means the exact same thing in technical analysis. What prevents the stock from plummeting? Support. Once the stock price hits a certain level usually it will be held at that support level. Pretty simple, right? One more to go.

Resistance: What is resistance? Let’s think about a weight lifter. He can only lift as much weight as his muscles will allow him to lift. Once he hits that level he will usually have to work for weeks in order to break through that resistance. The same applies to stocks.

Usually they can only go so far before they hit an area of resistancebefore it comes back down and then tries again. Okay, I promise you that is it for technical analysis – I don’t want anyone’s brains to explode. Hopefully, I haven’t made anyone turn off the computer.

Now we can talk about this pot stock, examine why I think there are some exciting developments on the horizon, and show you why we like the look of the chart for Canopy Growth.

Canopy Growth is one of Canada’s leading marijuana companies and just recently entered a potentially major partnership, combining two typically separate products into a truly “first-of-its-kind” game changer.

This deal I’m about to mention is probably one of the most creative deals I have seen in a long time. It always amazes me how innovative companies can be in a new, growing industry.

Canopy Growth has entered into a partnership with Constellation Brands (I’m sure you’ve heard of Corona beer).

Constellation has bought roughly a 10% stake of Canopy shares. Both companies are working to create a cannabis-infused alcoholic product line – something that has never been attempted on a large scale ever before. If it sells well, it could spawn an entirely new class of beer products that other players in the industry will soon try to replicate.

Outside of new partnerships, though, Canopy Growth still has a bright future with purely marijuana-focused products. Canopy has eight growing facilities, totaling about 2.4 million square feet growing capability, making them one of the largest operations in the world. As of right now, they are on pace to DOUBLE their production annually – which will continue to grow the company.

I’m pretty sure you are saying to yourself, “Fine, Canopy is a medical marijuana company. This isn’t anything new. Why do I care about this one in particular, when there are so many others to choose from?”

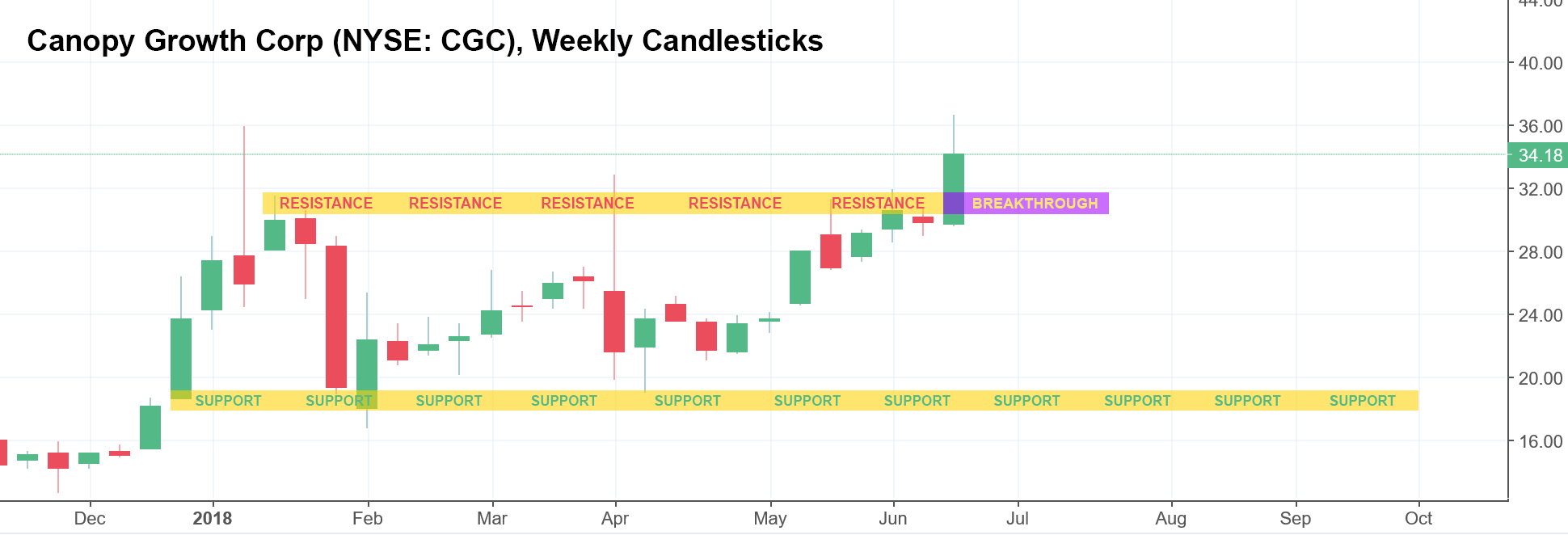

In order to see why I’m so excited about Canopy Growth, we need to look at the chart and what the stock has done over the last couple of months:

Canopy has passed its resistance and hit a new all-time high. As of the close of the market, Canopy broke through and we are at all-time highs.

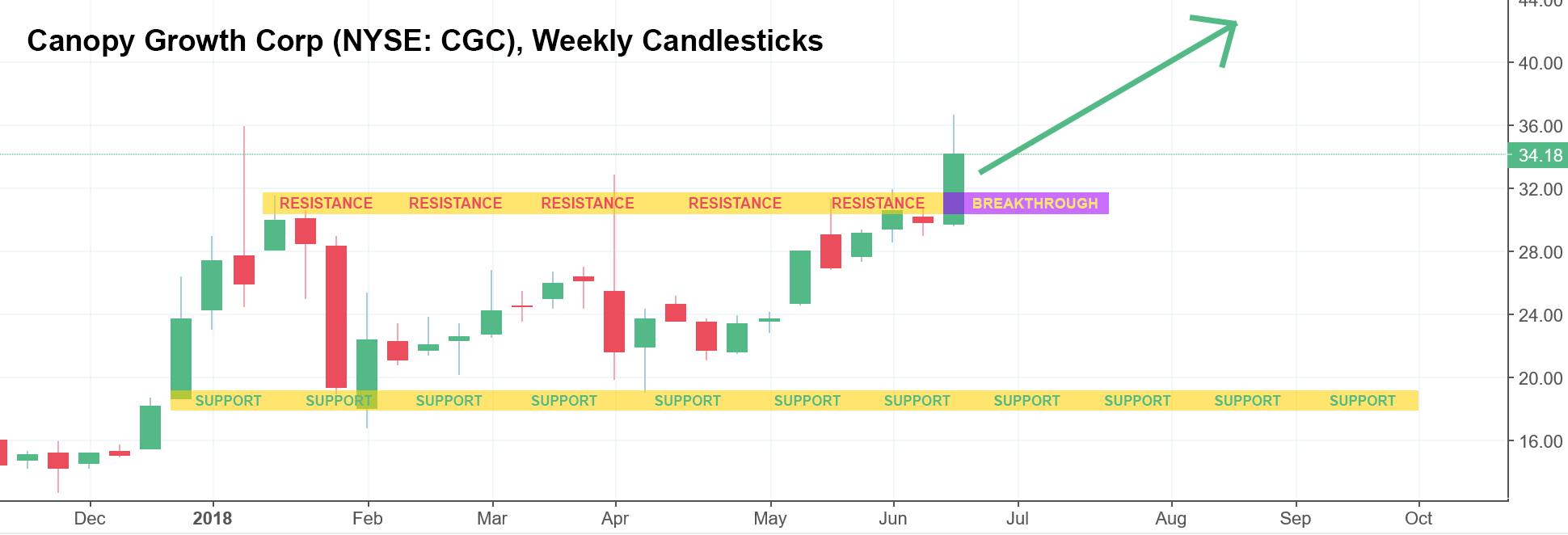

Why is this important? Remember resistance? It broke through. That is amazing news! Now that it has done so, a few things that can happen from here. First, Canopy can just keep going up in value (remember there isn’t any more resistance):

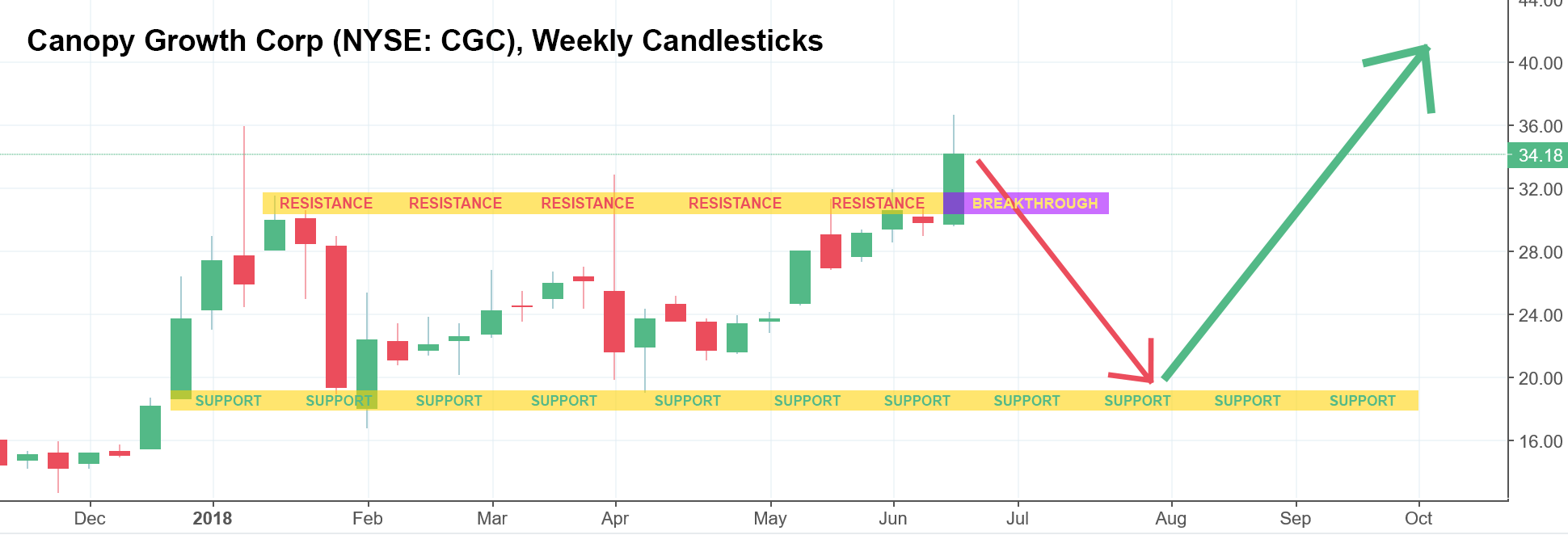

Second, it could turn around and start coming back down in value. If that happens, though, there’s no need to panic. Let’s remember the first word we defined earlier – support.

Support could hold the stock at that level and when the practical legalization of recreational marijuana in Canada begins on October 17th, this could cause the price to rise, breaking through that resistance again without looking back. Sales go through the roof; the company is making money hand-over-fist:

Both scenarios are extremes (and could absolutely happen), but the reality is that we are likely somewhere in the middle. Yes, Canopy can go up some more.

But I believe for the short-term, Canopy Growth will take a little break. It might hang around this area for a few weeks, gathering its energy for another very nice jump in value.

In this situation, you do have a few choices. If you are aggressive, you are going to go and buy Canopy first thing in the morning. That might not be a bad idea in this case.

The second choice would be to wait and watch the stock’s price movement in order to gauge investor attitude on the company. Perhaps it will come down in value, and you can get it for an even better price.

Before you make a decision, though, a word of warning:

If you buy it at the opening bell: It could come down in value. An optimist would say great! I can now buy even more shares.

If you decide to wait: You could completely miss the boat. The price might just keep rising and you will have to pay a higher price for those same exact shares.

Ultimately the choice is yours, and at this point there isn’t a right or wrong answer. Time will ultimately be the deciding factor in this decision.