Stocks gained this morning despite the Fed’s hawkish FOMC announcement yesterday.

The Dow rose 254 points (+0.8%) while the Nasdaq Composite went up by 0.5%. The S&P split the difference, climbing 0.7%. Bond yields were down while value shares led the charge. The S&P’s ascent today saw it reach a new 13-month intraday high as the index has enjoyed its best week since March 31.

Dylan Kremer, co-chief investment officer at Certuity, posed a question for the market as value stocks finally outperformed growth:

“Can value and cyclical stocks catch up to growth and tech?” he asked. “If they can, that momentum could help keep the market climbing.”

The S&P is on its longest winning streak since November 2021 and is now trading roughly 23% above its October low. The index is up 14% on the year. Meanwhile, the tech-heavy Nasdaq Composite has risen over 30% in 2023.

And for leading tech stocks, the good times continued today. Shares of Microsoft and Oracle rose by more than 2%. Alibaba’s stock climbed 2.1%, too, despite a hawkish Fed dot plot that indicated two more hikes were coming this year.

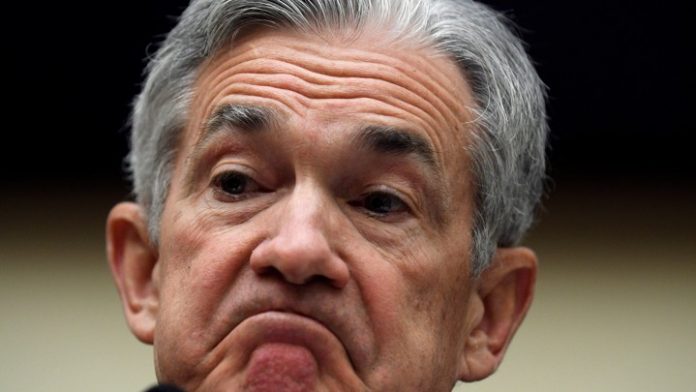

Fed Chair Jerome Powell spoke in a press conference after the FOMC meeting concluded, saying the Fed would use the six weeks until its next meeting to “think about the overall tightening of monetary policy.” He added that they haven’t yet decided what to do at July’s meeting, which rescued stocks from an intraday selloff yesterday.

Today’s upswing shows investors are still willing to gamble despite the uncertainty heading into the July meeting. The CME Group’s FedWatch tool puts the odds of a 25 basis point rate hike at 67% next month.

Powell did say that the central bank will probably raise rates more this year, and that the Fed will continue to base its decisions on data each month. Stocks were up and down during Powell’s comments on Wednesday before ultimately closing flat.

Temporarily denting sentiment this morning were weekly jobless claims, which came in a bit higher than expected (262,000 reported vs. the 245,000 claim estimate). US retail sales unexpectedly climbed as well (+0.3% month-over-month), bucking expectations of a monthly retail contraction.

This cast doubts on whether inflation would subside enough next month to avoid a rate increase as persistently high retail prices likely contributed to the majority of the retail gain.

“May’s retail & food services sales report was much stronger than expected and continued to point to the staying power of the American consumer, something that tends to support the Federal Reserve (Fed) Chairman’s concern regarding inflation,” explained Raymond James Chief Economist Eugenio Aleman.

“It is clear that this staying power will keep inflation stronger than the Fed’s target so this report supports the Fed’s view that they need to keep increasing interest rates if the economy continues to show resilience.”

Nationwide senior economist Ben Ayers agreed:

“The upside for retail spending does have a downside, however, in the form of continued inflationary pressure,” Ayers wrote.

“Higher interest rates haven’t tamped down consumer demand enough to meaningfully slow price growth, especially on the services side of the economy. These hot trends for consumers could lead to another interest rate hike by the Fed in July.”

Yet stocks still rallied today due to a value boom. Will it be enough to push the major indexes higher still? Possibly. But the market can’t rally forever; a selloff is coming.

And the higher stocks go amid overbought conditions, the more likely it is that they come crashing down in a wicked short-term correction with the Fed’s hawkish shift yesterday serving as a potential catalyst.