|

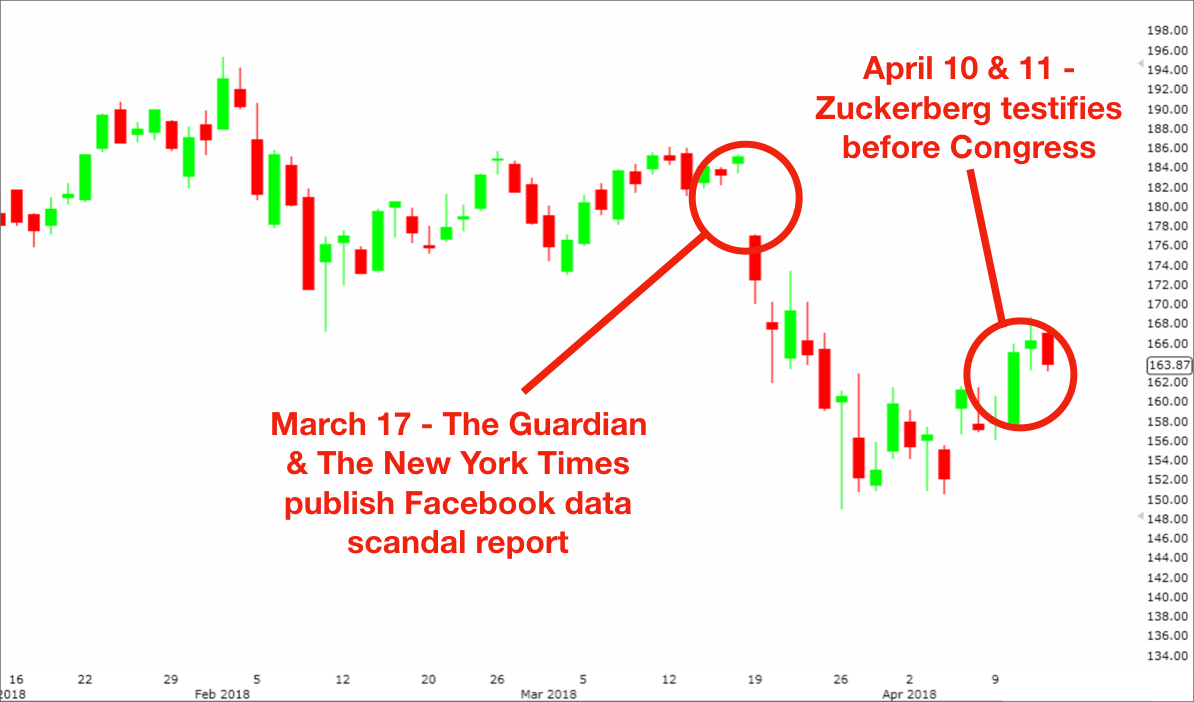

In the wake of the Committee on Energy and Commerce grilling Mark Zuckerberg for over 10 hours, many are asking if Facebook’s business model is now in jeopardy. Is this is the beginning of the end for Facebook? The reason for calling Zuckerberg to Washington to testify is Facebook’s involvement, if any, in alleged Russian election interference and the Cambridge Analytica data breach. Of course, not all politicians have pure motives in mind and many would just love to regulate Facebook for the sake of regulation. Other politicians thankfully understand that while some level of regulation is needed, overregulation can be just as dangerous as no regulation, something Washington has not demonstrated they’re good at sorting out. Nevertheless, new regulations are sure to come and we can all hope that in the end there will be the appropriate level of regulation that serves the needs and interests of Facebook users as well as the company. But let’s look at the impact this “scandal” has had on Facebook stock:

On March 17 (Saturday), the Guardian and the New York Times published reports on the Cambridge Analytica data harvesting. When the market opened on Monday, Facebook’s stock price begin a nosedive, which hit a low of 149.02 on March 26th, nearly a 20% drop from the March 16th high. But by the time Zuckerberg testified before Congress, Facebook’s stock continued to climb in a deliberate fashion. In my view, Zuckerberg acquitted himself admirably for such a young man or for any age CEO for that matter. He came across honest and forthright, doing his best to answer the questions asked, so I think the Facebook investors are relieved that his testimony went fairly well and can now get back to doing the business of Facebook. Given the recent selloff in Facebook stock since early February, it goes without saying this is a better time to buy Facebook then it was back then. Is this the best time to buy Facebook? No one knows of course, but it is certainly a better time. |

| Whenever there is negative news about a company that can be remedied in one fashion or another and the stock drops accordingly, history has shown that that is generally a good time to buy and I think that is the case here with Facebook.

So, I think Facebook is here to stay. It has not been damaged permanently by this testimony and in the long run this will probably help the company because regulation is inevitable, and this testimony may have served to facilitate the appropriate level of regulation enabling the company to thrive well into the future. |