Stocks tumbled again this morning as the market selloff intensified. The Dow, S&P, and Nasdaq Composite all slipped modestly, driven lower by rising yields. The 10-year Treasury yield jumped to 3.88%, notching a near 50-day high.

“Markets have turned choppy as trading winds down for the year,” said XM analyst Raffi Boyadjian in a pre-market commentary.

“With just three trading days remaining and very few significant developments for investors to sift through, the bond market is taking [center] stage amid the lack of direction in equity and foreign exchange markets.”

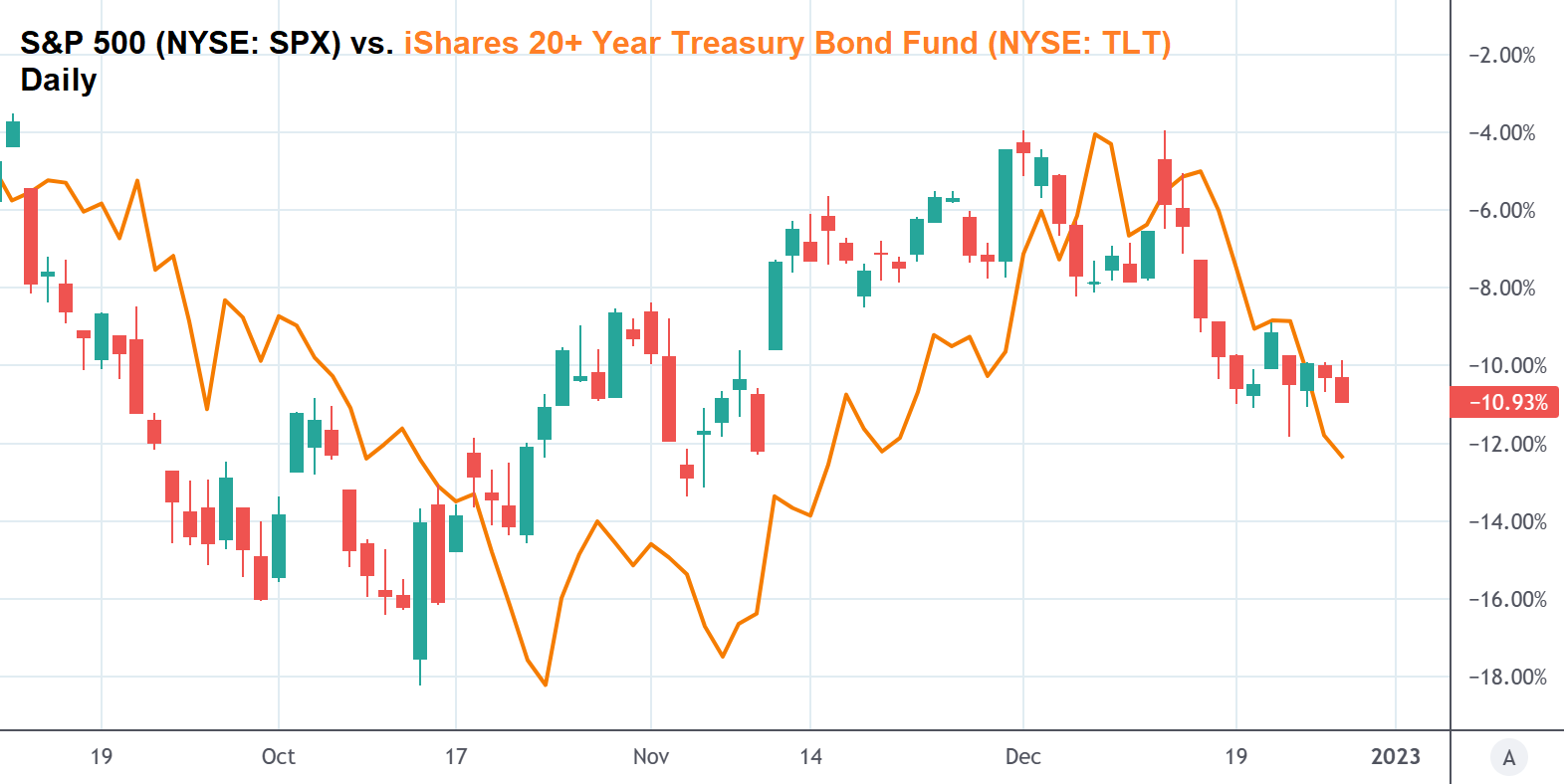

Equities remain above their lows from last week but it may only be a matter of time before they race below support, catching up with the cratering bond market.

Long-term Treasurys are often good predictors of market breakouts. In this case, the iShares 20+ Year Treasury Bond Fund (NYSE: TLT) has already fallen well below its recent lows. Fears that the Fed will keep rates elevated next year have weakened long-term Treasurys. This type of underperformance from bonds usually pulls stocks lower. Based on the chart above, it appears as though the S&P will soon fall beneath last week’s low, either in the last two sessions of this year or early on into January.

Pessimism surrounding China’s reopening should only help a bearish breakout arrive more quickly.

“The question is no longer about the speed with which China reopens,” remarked China Beige Book International Managing Director Shehzad Qazi.

“The real question now is how quickly can Beijing undertake the policies that are necessary for it to gain control of the virus?”

Qazi continued:

“We haven’t hit the peak of Covid cases — that is still ahead of us — which means that some of the bad news is still ahead of us, and until we are past that point, we can’t really start talking about an economic recovery.”

Qazi’s comments were equal parts bearish and oxymoronic (or, more accurately, just moronic) in that an economic reopening and “gain[ing] control of the virus” could go hand-in-hand. To Beijing, controlling Covid means welding citizens inside their apartments. That’s not reopening. Neither are Covid “bug shields,” social distancing guidelines, or capacity limits on gathering places.

The best thing for everyone – both investors and the Chinese people – would involve Covid acceptance, not another attempt at “control.” Qazi’s right in that Beijing still has to get over the hump, but will China’s outbreak really have a profound impact on sentiment?

It’s not going to change the Fed’s stance on rates unless something truly catastrophic happens, which seems unlikely given that the rest of the world has more or less moved past Covid.

Moving forward, there will be plenty of speculation about Chinese infection totals, but don’t make the mistake of missing the forest for the trees. The market only cares about rates and data that could influence rates (inflation, jobs reports, etc.). Everything else, even a stilted reopening in China, is just noise.