Stocks are flat this morning as February’s strong start slows to a crawl. All three major indexes are trading near level as of noon.

Bullish exhaustion – something we’ve mentioned in the past – might be setting in. The market has little to go on at the moment pending a $1.9 trillion stimulus package, much of which is unlikely to pass. Wall Street expects a smaller $1.1 trillion relief measure to be approved instead, which could disappoint investors.

“Is the path to much higher equities becoming smaller […] to put it differently, are the bulls attempting to thread a needle? Seems that way near term,” explained Dennis De Busschere, macro research analyst at Evercore ISI, in a note.

And according to the University of Michigan’s February Consumer Sentiment reading, released today, that could be a difficult endeavor for bulls.

U.S. consumer sentiment sunk to a six-month low, falling well below analyst expectations. Personal income outlook dropped as well while inflation anticipation soared, hitting a 7-year high. Consumers expect a year-ahead inflation rate of 3.3%, signaling a rapid resurgence in inflationary fears.

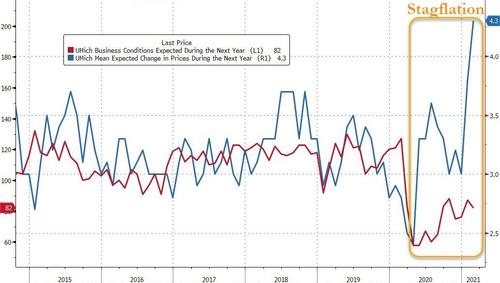

But the most alarming data set revealed in the survey concerned expected business conditions and price changes for the next year.

With business conditions expected to decline and prices expected to soar, consumers are essentially predicting stagflation – a state of persistent high inflation combined with high unemployment and stagnant economic demand.

The U.S. has already been through a period of stagflation before. In the 70s, inflation appeared both uncontrollable and unconquerable by central bankers. Paul Volcker eventually stepped in as Fed Chair and spiked rates in the 80s, plunging the country into a short-term recession. His gambit did work, though, and the U.S. economy was saved as inflation sunk.

At the time, he was mostly hated for his decision to raise rates in historic fashion. But, he was also the only “adult in the room” willing to take action, difficult as it may have been.

Current Fed Chair Jerome Powell had his own “adult” moment, too, in late 2018 when he attempted to roll-back post-2008’s quantitative easing (QE) by inducing quantitative tightening (QT). Powell raised rates and the market instantly cratered. Economic indicators flipped upside down in unison as rate panic took hold.

QE has often been compared in the past to a roach motel. Once your economy “checks-in,” it can’t “check out.” Powell more or less proved that hypothesis to be true with his rate hike, and was forced to lower rates shortly thereafter.

Now, at (hopefully) the tail end of an economy-wrecking pandemic, Powell probably wishes that he would’ve kept rates higher. Aggressive fiscal policy has put the dollar in a precarious spot.

Moreover, it should only get worse from here. The Fed’s in a position where, if inflation spirals out of control, it won’t easily be able to react.

Raising rates now would be economic suicide. Volcker induced a recession with his inflation countermeasure. If Powell spikes rates like Volcker did, forget about a recession.

A full-blown depression could easily follow as the entire financial system comes undone.

And so, Powell’s current role is that of a custodian, entrusted with leading the U.S. economy to the edge of a cliff. He has the option to either push it off ahead of time, kicking and screaming, or to lower it down more gradually.

At some point, however, the Fed will run out of rope if stagflation hits. That’s what consumers are expecting, at least, according to February’s sentiment survey.

Let’s just hope (for the market’s sake) that they’re overly pessimistic, and ultimately, proven wrong in the year ahead.