Stocks fell this morning as the market’s recent bout of volatile price action continued. The Dow ticked moderately lower while the S&P and Nasdaq Composite both sunk more than 1.00% on the day.

Friday’s major jobs “beat” did little to boost sentiment. The big story, however, came Friday evening when investors learned that Elon Musk’s attempted Twitter (NYSE: TWTR) acquisition fell through.

Musk officially terminated the deal (worth $44 billion) shortly after the market closed, citing Twitter’s lack of transparency concerning bot/fake account disclosures as his primary reason for doing so. The Tesla CEO wanted an accurate audit of the social media platform’s bot accounts before he would move forward with the acquisition.

But, according to Musk, Twitter never provided him with the information he needed. Twitter, on the other hand, claims that it did, and that Musk is simply trying to find a way out of the deal.

TWTR shares plunged over 7% in response this morning, falling below the lows of late May before Musk submitted his initial offer.

That had little to do with today’s broader market skid, though, which was driven by a convergence of several bearish pressures.

Shanghai detected its first case of the BA.5 subvariant over the weekend and closed its Macau casinos as a precaution, causing US-traded hotel and casino stocks to plummet. Wynn Resorts (NASDAQ: WYNN), which operates hotels in Macau, fell as much as 8%.

But Covid isn’t just making a comeback in China. Cases are up in the West, too, conjuring fears of new lockdown measures in the US and Europe.

“COVID headwinds aren’t just a Chinese phenomenon – cases are climbing globally, although the risk of lockdowns in the US and EU remains extremely low,” wrote Vital Knowledge founder Adam Crisafulli.

And though some analysts pointed to Covid headlines as the main driver of today’s selloff, it’s more likely that a quickly approaching earnings season has bulls feeling nervous.

“With recessionary fears weighing on the markets, investors are hyper-focused on corporate earnings for greater clues about the health of corporate America and the broader US economy,” said Greg Bassuk, chief executive officer at AXS Investments.

“A sharper lens will be needed to dissect these earnings reports, as a strong second-quarter might be accompanied by very conservative outlooks. As commodity and other producer costs remain high, companies will be factoring in the extent to which those heightened prices can be passed on to consumers and, likewise, how to keep earnings vigorous amid economic, geopolitical and other key headwinds.”

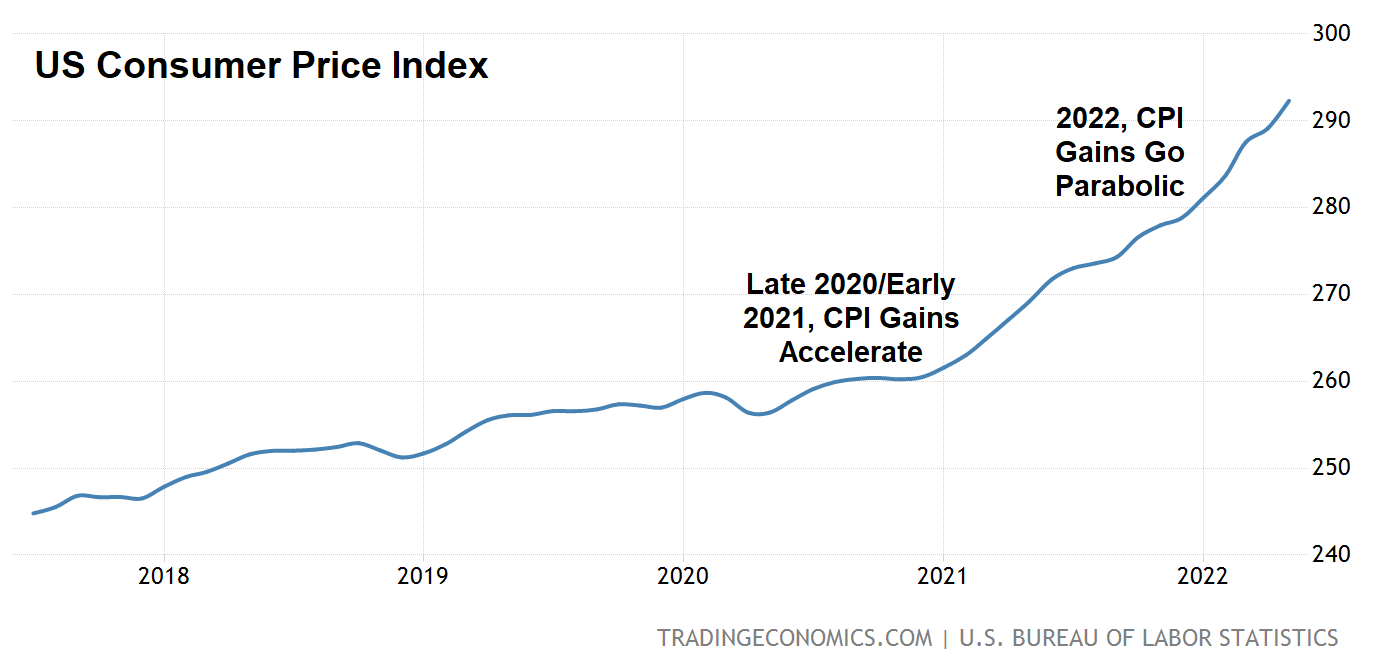

Also coming down the pipe this week is a key Consumer Price Index (CPI) reading, due out Wednesday morning. Dow-polled economists expect the June CPI to rise 8.8% year-over-year, beating May’s yearly gain of 8.6%.

That might not seem like that much of a difference, but another jump to 8.8% means the CPI’s already parabolic move will only intensify.

The chart above shows the CPI in terms of its actual reading each month, not monthly or yearly percent changes. It’s easy to forget how quickly the CPI has advanced over the last year and a half when digesting the CPI purely in percentage points. You can see that in late 2020/early 2021, CPI gains began to accelerate.

Then, in late 2021/early 2022, the CPI’s slope steepened further as it rose exponentially. If the June CPI consensus estimate is correct, we’ll see another major spike higher at the end of the chart.

That’s the Fed’s worst nightmare with a recession seemingly here already according to the Atlanta Fed’s latest Q2 GDP growth estimate (via GDPNow), which showed that US GDP contracted in Q2. It’s also the kind of thing that could cause bulls to panic sell the minor bear market rally of the last few weeks.

Add in what’s looking to be a rough earnings season and you’ve got the makings of a major market capitulation, regardless of how the perma-bulls on Wall Street try to spin it in the coming days.