Stocks opened significantly lower this morning before rallying fiercely through noon. The Dow, S&P, and Nasdaq Composite all gained on hopes that the regional banking crisis would halt Fed rate hikes. Most stocks were up on the day despite plunging bank shares. Yields, meanwhile, collapsed. The 2-year Treasury yield fell the most since Lehman Brothers imploded in 2008.

Precious metals stackers were happy to see gold finally rally following a multi-week selloff. Bitcoin surged, too.

It’s clear that the market believes the Fed is done raising rates because of the threat to US banks. That should pump up risk assets, especially those that investors view as inflation hedges. Goldman Sachs released a note last night giving many traders the sign to start buying the dip amid significant economic uncertainty.

“The Treasury, Federal Reserve, and Federal Deposit Insurance Corporation (FDIC) made two major policy announcements intended to stabilize the banking system in response to recent bank failures and the risk of continued deposit outflows,” wrote Goldman Sachs’ chief economist Jan Hatzius, who was one of Wall Street’s biggest hawks prior to the Silicon Valley Bank meltdown on Friday.

“We expect these measures to provide substantial liquidity to banks facing deposit outflows and to improve confidence among depositors. In light of recent stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its March 22 meeting with considerable uncertainty about the path beyond March.”

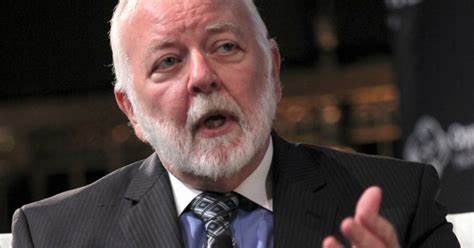

Odeon Capital Group strategist and banking expert Dick Bove highlighted why rate hikes are probably finished and the next round of quantitative easing (QE) could soon begin.

“There are many banks in the United States that have hundreds of billions of dollars in deposits, which are not backed by deposit insurance because those deposits exceed $250,000,” Bove said.

“The government, panicking now, has decided in the case of [Silicon Valley Bank], that it will back the deposits of that particular bank whether they’re insured or not. And, apparently, they’re saying the same thing for Signature Bank.”

Bove continued:

“But if you total up the amount of money that is uninsured in the banking system in the United States, it is vastly greater than the insurance available through the FDIC. If people have lost faith that their money is protected in these banks, and they start pulling it out because their money manager is telling them that they’re at risk, then these banks are going to have to deal with huge outflows. And they can’t sell Treasurys to become liquid to meet these huge outflows! Therefore, the question becomes: where does the money come from to meet these huge outflows? Well, the Federal Reserve has to print it.”

In Bove’s interview on CNBC Asia yesterday, he added that the Federal Reserve finds itself in a similar situation as Silicon Valley Bank; it too is sitting on a huge pile of unrealized losses, to the tune of $1.1 trillion. Unlike Silicon Valley Bank, though, the Fed can simply print itself out of trouble to pay for those losses.

Big banks are also receiving a major windfall as a result of the small bank meltdown as a new borrowing program emerged for banks over the weekend. Any bank can now borrow money from the Fed to offset its unrealized Treasury losses so long as the bank pays back the Fed with the par value of those bonds at a later date.

Collectively, the “Big 4” banks (JP Morgan, Wells Fargo, Bank of America, and Citigroup) are sitting on $210 billion in unrealized Treasury losses, meaning that they’re about to get a nice payday. Small banks will get this, too, but the Big 4 will take the majority of it.

So, regardless of how you slice it – either via bank “borrowing” programs (ie, free money) or the Fed printing cash to cover its losses in the event of a bigger bank run – the US economy is getting QE again due to a credit event, just like it did in 2008 when the giant QE cycle began.

Stocks obviously love that, but it’s also a massive blow in the fight against inflation. That’s why precious metals soared this morning.

The Consumer Price Index (CPI) comes out tomorrow. If traders see a soft print, you can kiss the bear market goodbye. A hot inflation reading, on the other hand, could result in an enormous selloff as the market loses complete faith in the Fed’s ability to “right the ship,” so to speak, independent of whether bank runs start to sweep the nation in the coming days.