Just How Bad Has October 2018 Been for Global Markets?

If you’re concerned for your portfolio or IRA, you’re not alone, as the last few weeks have put the entire 9-year bull market into doubt. During that time, global capital markets have lost a total of $9 trillion dollars.

That’s the biggest and fastest drop since the Lehman Brother collapse in 2008 – a scenario that investors would really like to avoid repeating. The plunge has been so significant that most of the world is in a full-blown bear market already, while U.S. markets are hovering around break-even for the year.

According to data gathered by our analysts, only two times in history have so many asset classes taken a negative turn for the year: the 1970s stagflation, and the 2008 financial crisis. The S&P alone has dropped 15 times in October. The last time it did that was October 2008. The S&P, Nasdaq, and the Dow Jones are officially below their 200-DMAs.

High-risk portfolios have been hit especially hard as most relied on just a handful of tech stocks. FANG stocks (Facebook, Apple, Netflix, and Google) have been decimated this month, along with the rest of the Nasdaq. Netflix is down 9.4%, Facebook and Alphabet Inc. (Google) are down 5% (and Facebook is down nearly 30% since July), and Amazon is down around 20% from its highs in September.

U.S. Markets Were Going Strong. Then Came the October Effect, Right?

September saw new highs for every major U.S. stock index, until October crashed the party.

The “October Effect” is a term coined to describe the perceived bearish sentiment that occurs in the month of October. Significant bearish events have occurred during this month, including the Panic of 1907, the 1929 stock crashes which ushered in the Great Depression, Black Monday in 1987, which led to a 22% drop in the Dow in a single trading day. And of course, the mortgage crisis of 2008.

These crashes left many traders with serious PTSD, which in turn created a perception that October brings about more bear markets than any other month. The reality, however, is more complicated. While data shows October to be one of the most volatile trading months, our analysts have found that it is not a consistently bearish month. In fact, many significant bull markets took off in the month of October.

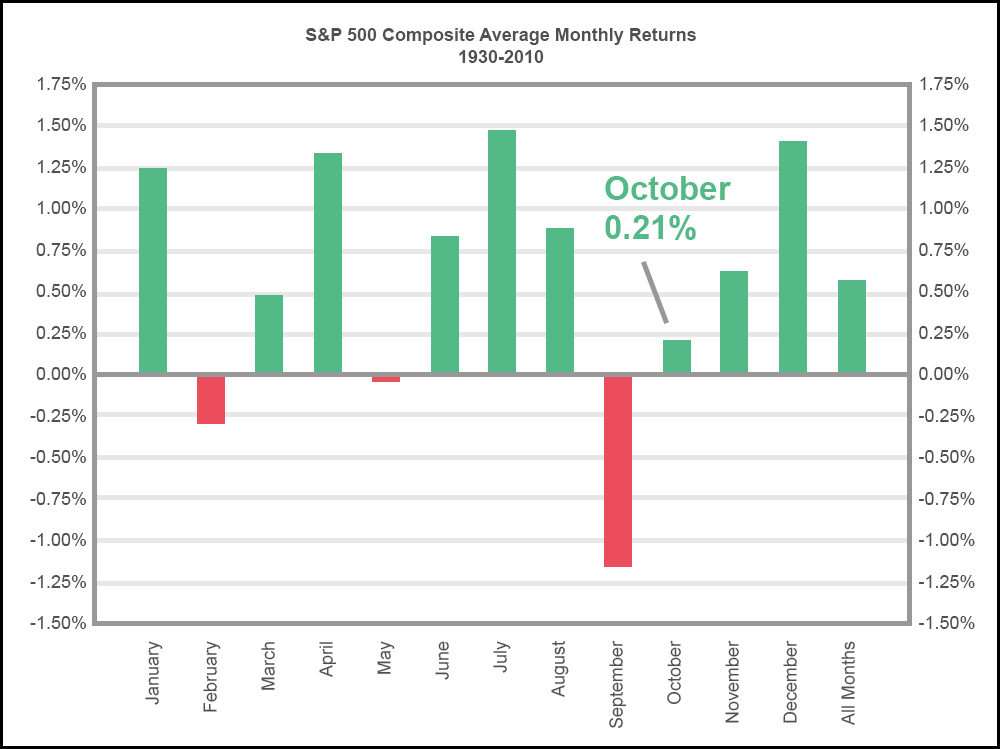

Historically, from 1930-2010 the month of October has seen an average growth of 0.21% for the S&P 500

While many contrarian traders play on the fears of October to buy stocks that are in oversold territory, there are also indications that we’ve either reached, or are closing in on, a new wave of buying.

Some Octobers Have Led to Full Blown Bear Markets. This One Probably Won’t, and Here’s Why

The 2018 economy could be the first to mint a 3.0%+ GDP growth since 2005. The economy’s strength has allowed the fed to raise interest rates to levels not seen since before the financial crisis. Clearly, the economy itself isn’t showing signs of strain, even though there may be signs of growth cooling off.

The stock market on the other hand has been straining for new highs. While there’s been great news from an economic standpoint, U.S. equity markets seem to have hit a wall. The question is, does that indicate a major market drop?

One interesting fact about bull markets is that they peak in a process. Money gets shifted many times over the course of a bull market, as overvalued stocks get dropped for more promising stocks in different sectors of an economy.

It’s far more likely that the market is preparing for such a shift right now, rather than preparing for a significant meltdown across the board. And we expect the real casualty here may be FANG stocks – not the whole market.

FANG, along with tech stocks in general, have seen valuations skyrocket, far outpacing other areas of the economy. It’s entirely possible that this correction sets the stage for a major market shift, as people walk away from now-stagnant tech stocks and seek new areas of the market to invest in.

We’re more inclined to bet on new trends and different market sectors leading to a continuation of this bull market, rather than a major market crash occurring in the last quarter of this year and into 2019.

Because it looks like, after all, the only thing to fear in October is the hijinks that ensue near Halloween – NOT the “October Effect”.