Stocks plunged this morning as the selloff that started Wednesday went from bad to worse. The Dow, S&P, and Nasdaq Composite all tumbled while yields surged. With over $4 trillion in notional options expiring this afternoon, today’s session will be the market’s second largest quad-witching – a day in which stock index futures, stock index options, stock options, and single stock futures all expire.

As the market draws closer to the “witching hours,” aka the final hours of trading, intraday swings should intensify. That means today’s early losses could easily snowball heading into the close.

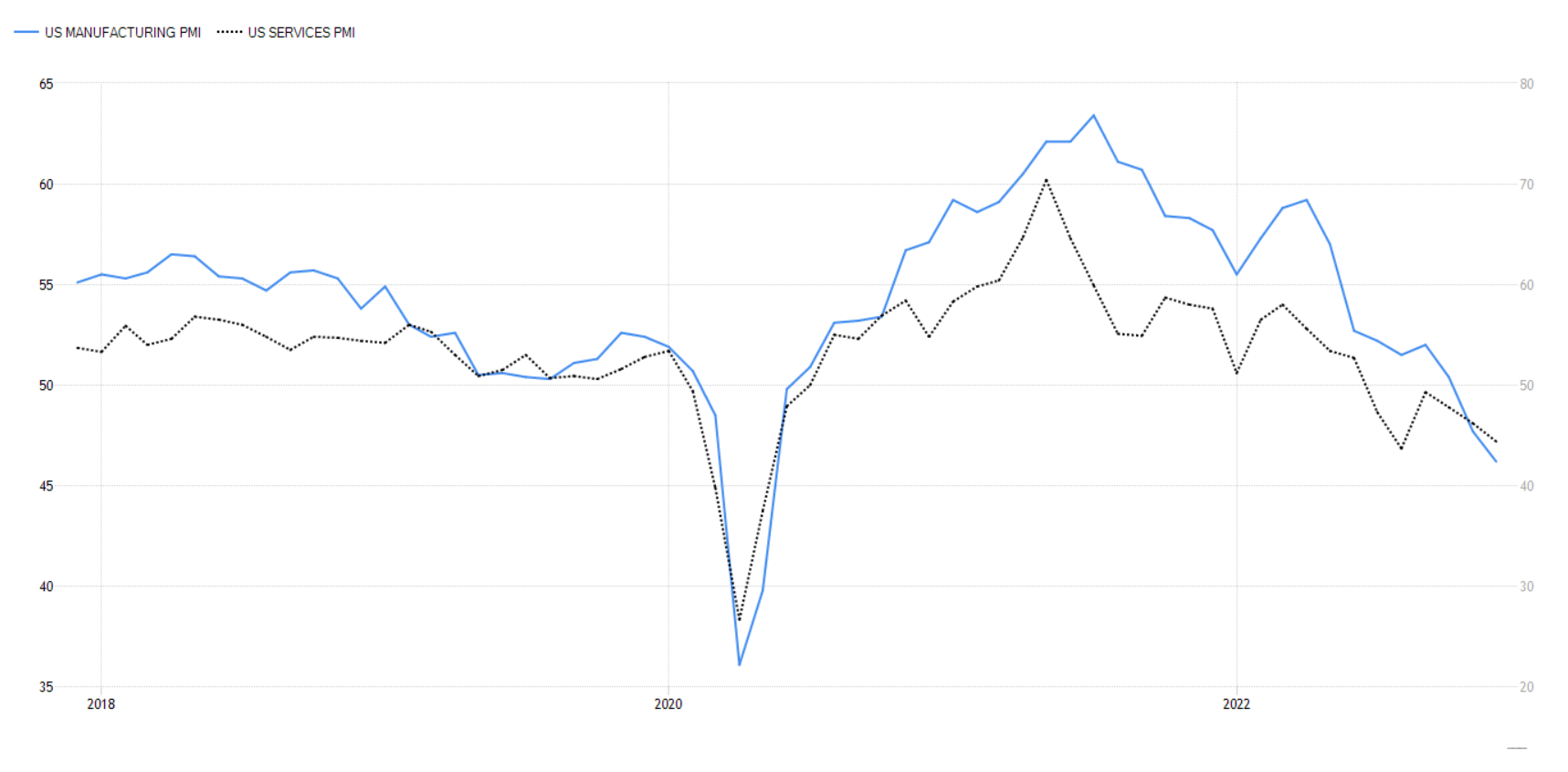

The market got off to a rough start this morning following the release of S&P Global’s PMI surveys, which practically shouted that a recession is on the US economy’s doorstep. Manufacturing PMI fell from 47.7 to 46.2, well below an expected gain of 0.1 (to 47.8). Services PMI missed even worse, sinking from 46.2 to 44.4 vs. an expected gain of 0.3 (to 46.5).

Both surveys are still officially in contraction as a result.

This is data bulls simply do not want to see after the Fed just raised its median rate for 2023 from 4.6% to 5.1%. Analysts have started throwing temper tantrums in response to mounting evidence of an imminent recession.

“I think the Fed is making a terrible mistake,” said Wharton professor of finance Jeremy Siegel on CNBC this morning.

“Their plan, their dot plot, is way too tight. Inflation is basically over, despite the way Chairman Powell characterizes it.”

But is inflation really “over?” Experts were making similar statements back in July before inflation ramped even higher. Sure, inflation may have peaked, but that doesn’t mean it will come crashing back down to the Fed’s target rate of 2.0% any time soon.

Rising energy costs through the winter, coupled with financial conditions that remain stubbornly loose despite the Fed’s rate hikes, could easily result in “sticky” inflation regardless of how much the economy slows down.

“Stagflation” is the name of the game, here. History shows that when developed markets (like the US) rise above 5.0% inflation (we’re currently at 7.1%), it takes roughly 10 years for inflation to fall back down to 2.0%. And it might take longer than that if the Fed listens to “experts” like Siegel.

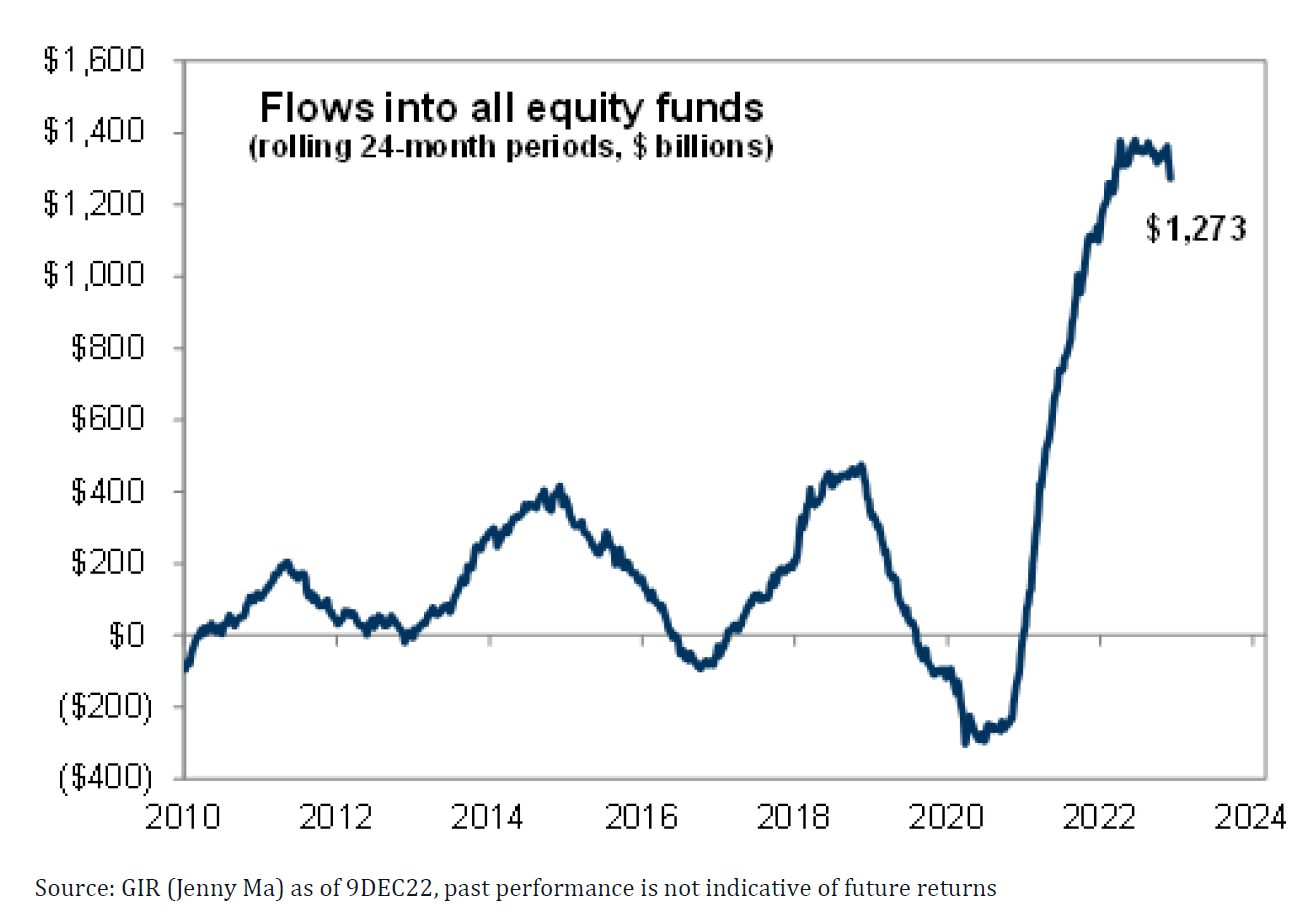

Crushing demand alone won’t fix inflation. There’s just too much cash out there in the market following the Covid pandemic. Here’s a chart illustrating the absolutely unprecedented equity fund inflows over the last two years relative to the pre-Covid period.

That “Covid money” had to go somewhere, after all. Equity fund inflows over the last two years completely dwarfed the previous record-setting blast from mid-2016 to mid-2018, which wrapped up prior to the Fed’s first attempt at quantitative tightening (QT) that cratered stocks.

Inflows started dropping before flipping deeply negative when Covid hit. The last decade’s worth of data suggests that when inflows peak and start to head lower, they typically return to baseline (or worse), dragging stocks down in the process.

What happens when inflows shrink this time around? The S&P fell by roughly 20% from peak to trough in 2018 when inflows went from $600 billion to $0. Inflows topped out at almost $1.4 trillion earlier this year.

If they go to $0 again, the S&P would theoretically fall by more than twice as much, so around 40% to 50%. We’re currently down roughly 20% from the 2021 highs, another 20% would bring the S&P to 3870. Try explaining that one to pensioners.

This also creates a problem for the inflation equation as cash would no longer flow into equity funds like it once did, allowing it to splash elsewhere.

Overall, this suggests that stagflation is still absolutely on the table for 2023 despite claims that inflation is “done.” The reality is that we won’t see 2.0% inflation for many, many years, and once the economic turmoil becomes too great for even the Fed to bear, Powell will surrender by raising his inflation target to 3.0% (or higher), allowing central banks worldwide to finally start cutting again.

That would lift markets, of course, but inflation would also explode higher like it did earlier this year, likely resulting in only nominal gains for stocks as CPI outstrips market returns once more.