Stocks are on the rise again Tuesday, as some arguably oversold tech stocks look to drag the rest of the market with it on a strong recovery day for the sector. Adding to the recent rally’s momentum is even more optimism surrounding the U.S./China trade war, after the President candidly tweeted about the ongoing meetings in Beijing.

Will it be enough to sustain the market’s burst since Friday? Or will bears finally get their confirmation that the market is indeed slumping? At this rate, it looks like bulls may have gotten the belated Christmas gift they were waiting for, even if it required a Chinese surrender.

The Dow Jones Industrial Average leapt a whopping 300 points at the opening bell this morning, with shares of Nike and United Technologies leading the way. The S&P 500, meanwhile, rose 0.95% and the NASDAQ Composite gained 1.1% soon after.

Even the FAANG stocks got in on the action, as Facebook, Amazon, Apple, Netflix, and Google all opened the day with a nice gain, and some climbed even further in the a.m. hours.

Each company (sans Apple) had a good run after what was some downright disappointing Q3 and Q4 performance for investors. Since Christmas Eve, Amazon is up a staggering 23.5% and Facebook has enjoyed a 13% (albeit less impressive) surge. Google rose 10% over that same time period and Netflix managed to log an explosive 30% burst upwards.

FAANG stocks looked arguably oversold around Christmas, and a recovery – especially for blue-chip stocks that sold-off so violently – seemed inevitable, eventually.

But thanks to cooling trade tensions between President Trump and Xi Jinping, American tech came back with a vengeance sooner than expected, surprising even some of the most bullish investors.

On Monday, U.S. Commerce Secretary Wilbur Ross told CNBC that both China and the U.S. could realistically reach a settlement “they can live with, and that addresses all the key issues.”

China’s Foreign Ministry added to the newfound east-meets-west optimism, adding that Beijing had “good faith” to work with Trump’s envoys on reaching an agreement ahead of the March tariff deadline – a date which threatens to capsize the Chinese economy.

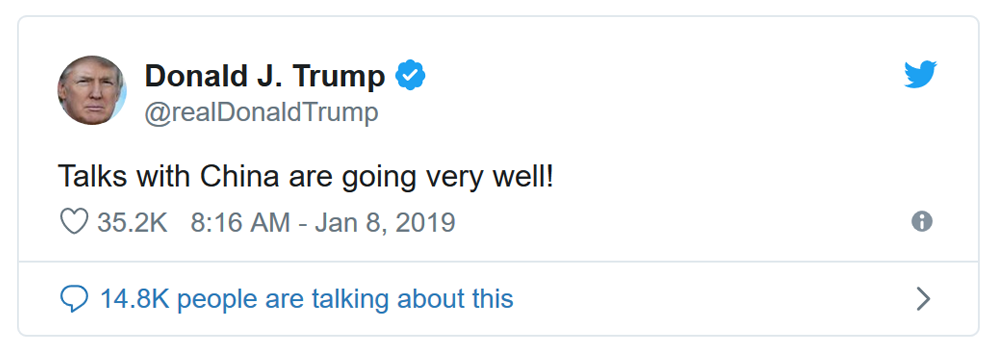

President Trump provided the cherry on top, tweeting the following message earlier this morning:

And though many investors would undoubtedly see a trade war ceasefire as a victory for the United States, considering that the Chinese have lost their competitive edge in multiple arenas, several Wall Street players have a different view entirely.

Strategists at MRB Partners, an independent investment strategy firm, see the Beijing meetings as the beginning of a long, arduous stalemate between two of the world’s biggest economies:

“The U.S.-China power struggle will persist for years, but both economies are now slowing and neither government has the latitude to pursue policies that could threaten to trigger a global recession,” said MRB representatives. “The Argentina handshake will morph into a near-term truce.”

While it’s true that the U.S. economy is slowing, it’s important to remember what America is coming down from: a 4.1% GDP growth “high” that was grossly unsustainable.

Even though economic activity looks set to retract, a glowing jobs report and future trade victory for the United States could just be enough to keep the good times rolling, with equities led by strong FAANG performance, as is customary in today’s market.