Stocks stumbled again today in response to rising yields. The Dow, S&P, and Nasdaq Composite all slipped after St. Louis Fed President James Bullard delivered a hawkish speech this morning.

“The policy rate is not yet in a zone that may be considered sufficiently restrictive,” Bullard said.

“The change in the monetary policy stance appears to have had only limited effects on observed inflation, but market pricing suggests disinflation is expected in 2023.”

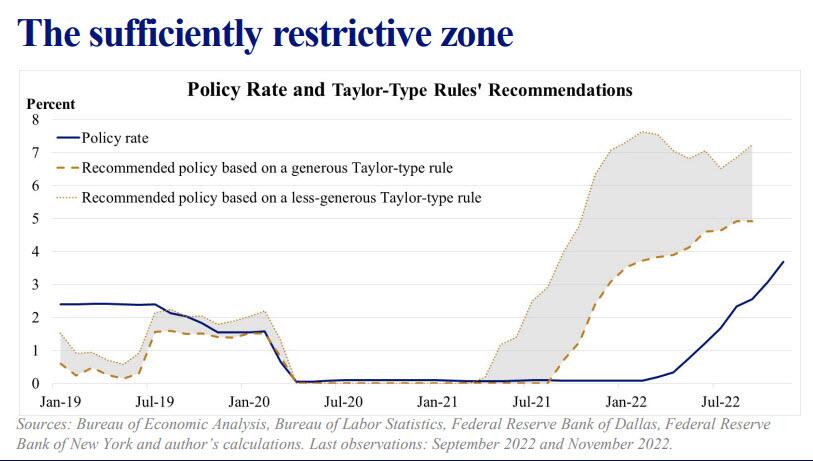

He continued, adding that “to attain a sufficiently restrictive level, the policy rate will need to be increased further.” Bullard then provided the following chart, showing the “sufficiently restrictive zone” as a range of 5%-7% for rates.

Bullard’s comments came one day after Kansas City Fed President Esther George wounded sentiment in a Wall Street Journal interview.

“I’m looking at a labor market that is so tight, I don’t know how you continue to bring this level of inflation down without having some real slowing, and maybe we even have contraction in the economy to get there,” George said.

Many analysts agree that a recession is looming, including UBS Global Wealth Management CIO Mark Haefele, who dashed hopes for a bull market in a recent note.

“Additional monetary tightening and the cumulative impact of this year’s rate hikes suggest recession risks remain elevated,” wrote Haefele.

“We continue to believe that the macroeconomic preconditions for a sustainable rally—that interest rate cuts and a trough in growth and corporate earnings are on the horizon—are not yet in place.”

That narrative was reinforced this morning by Bullard’s speech, which translated to a yield and dollar surge. The 10-year Treasury yield advanced to 3.76%, up from 3.69% yesterday, as the US Dollar Index (DXY) climbed 0.60%.

But short-term yields saw the largest increases. The 2-year rate ripped higher to 4.42% immediately following Bullard’s speech.

A sinking dollar and falling yields contributed greatly to the market’s recent rally. Yields especially need to remain suppressed if stocks are going to continue their short-term uptrend.

It all depends on whether Fed officials continue to make hawkish statements (hint: they probably will) in response to soft economic data. The most important coming release is the November jobs report, due out December 2nd. A weak print there would do wonders for bulls.

And, given the recent string of major firings among America’s top corporations, it’s probably going to be a rough report. Stocks should rally in response with a rate hike looming on December 14th.

But if Fed officials slap the market with another series of hawkish interviews, stocks could easily retrace in a hurry. That’s what transpired over the last week following a far cooler-than-expected CPI release.

History doesn’t necessarily repeat itself, but it often rhymes. Investors should be prepared for additional volatility heading into December as a result.