Despite the World Health Organization’s (WHO) best efforts to calm folks down, coronavirus panic is beginning to take hold. The major indexes are bleeding value this morning as the illness spreads. Over 9,700 are infected now, while 213 have died. The coronavirus isn’t as deadly as SARS was in 2003, but it’s far more contagious.

China will eventually put a lid on the outbreak, but to investors, it’s becoming clear that the virus will likely have an impact on next quarter’s earnings.

As a result, precious metals are beginning to rise. Gold and silver already had an impressive 2019 in response to heightened trade war tensions (and an arguably oversold precious metals market). Now, the asset class could be approaching another moderate-term rally.

Not all metals are created equal, though. Copper, considered a precious metal by many investors, didn’t join in on the 2019 gold rush. The Global X Copper Miners ETF (NYSE: COPX) only gained 11% last year, vs. the SPDR Gold Trust ETF’s (NYSE: GLD) almost 18% gain. In 2020, GLD is up 4.52%.

COPX, by comparison, has fallen 13.78%.

And based on copper’s current price action, certain copper miners appear destined to drop further. Freeport-McMoRan Inc. (NYSE: FCX), one of the world’s top copper producers, is one of them.

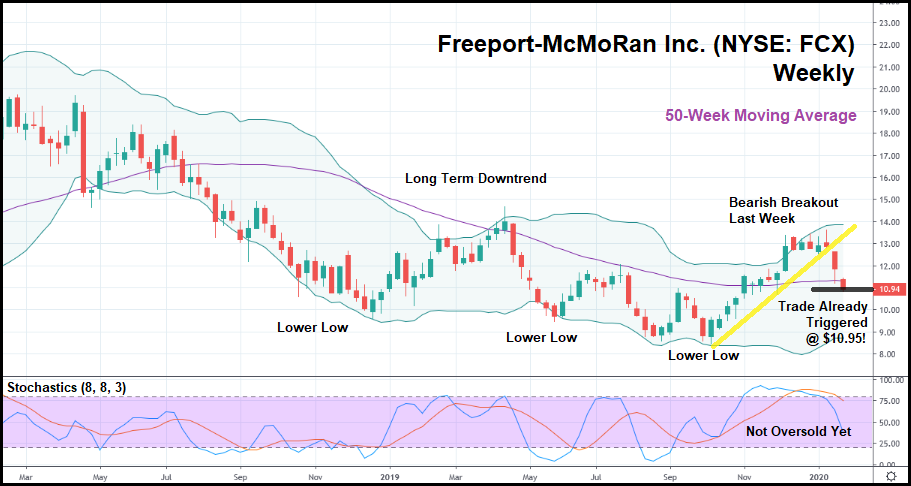

In the weekly candlestick chart above, you can see that FCX has been in a somewhat consistent downtrend since March 2018. The stock has attempted to recover several times now – particularly toward the end of last year – but is now retracing much of its recent gains.

Last week, FCX broke out below its minor bullish uptrend (represented by the yellow trendline). This week, it actually passed below the 50-week moving average and last week’s low – both natural points of key support.

In doing so, FCX passed what would’ve been our trade trigger at $10.95, meaning the stock’s already in “shortable” territory. Best of all, FCX is sitting on top of a freshly set lower-low, which typically indicates a downtrend continuation. The stochastics indicator supports a deeper dive, too, as it remains above 20 (suggesting that the stock is not yet oversold).

Should FCX remain above $10.90, it might make sense taking the stock short at the current price. Anything below that, and FCX will have descended too far for a new trade.

Some analysts believe copper could stage a comeback and “return to form” with the other precious metals in 2020. That might be true, but as of yet, the recent price action suggests we’re still a ways away from that actually happening. Until it does, it might be better to take the “easy money” with a short-term trade.

Regardless of whether gold keeps climbing or not.