Oil prices continued their climb this morning right alongside stocks, which are risings as well. With West Texas Intermediate (WTI) crude futures firmly “back in (the) black,” bulls seem ready to celebrate.

How long the good times last, however, is still the big question.

The Dow, S&P, and Nasdaq Composite are up 1.4%, 1.3%, and 1.35%, respectively, as of midday. Chevron (NYSE: CVX) and Exxon Mobil (NYSE: XOM) – two American gas giants – led the charge, posting gains of over 3% by noon.

The energy sector as a whole is having a good day, driven higher by soaring oil. WTI futures for June delivery leaped 30% to almost $18 a barrel. Traders are expecting another OPEC+ production cut soon.

If they get one, oil’s likely to surge in the coming weeks.

But to some analysts, the economic damage stemming from an oil crash may have already been done.

“The resulting price action is highly damaging for many oil producers, and certainly implies a sharp fallback in US shale fracking, contributing to much weaker US exports and capex later this year,” Charles Dumas, chief economist at TS Lombard, wrote.

Frank Cappelleri, executive director at Instinet, has a similar opinion but maintains that an oil boom could help heal the economy’s wounds.

“Large single-day advances can’t alone solve the market’s woes, but they can be part of the solution,” Cappelleri said.

“This kind [of] scenario is what helps bullish patterns succeed and bearish patterns fade away […] which is what we’ve seen happen over the last month of trading.”

The major indexes are now up over 20% from the bottom of the COVID-19 crash. If equities are going to rise further, they’ll need help from American energy firms, and by proxy, strong crude prices.

And though most of the market remains fixated on WTI crude (“sweeter,” lower sulfur content oil that comes from the Permian oil basin in Texas and New Mexico), there’s also Brent crude, which primarily originates from 15 different oil fields in the North Sea, east of the U.K. and west of Denmark.

There’s a whole other world of oil out there, and in the coming weeks, the companies involved (including U.S. energy firms) could profit handsomely as oil – both domestic and abroad – recovers.

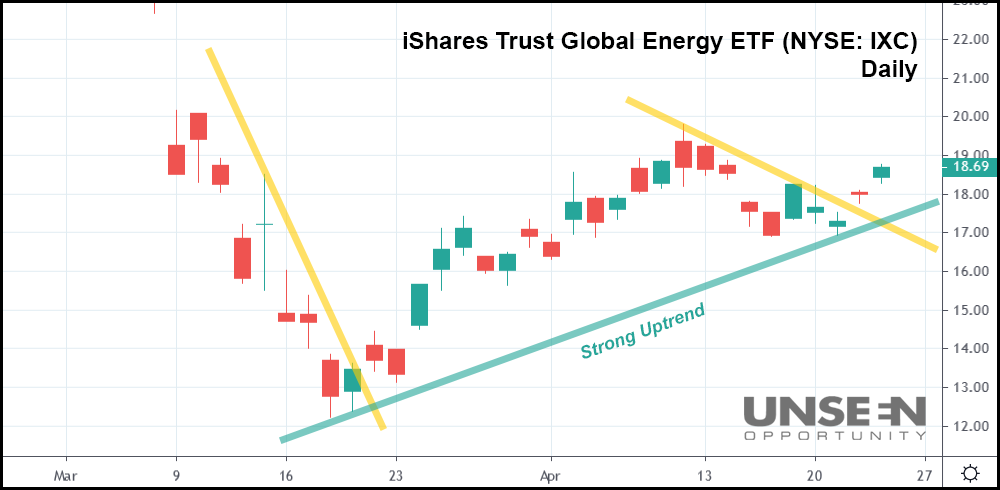

The iShares Trust Global Energy ETF (NYSE: IXC), which tracks many global energy companies, has done very well since bottoming on March 18th. Back in mid-April, however, IXC topped-out and began falling.

Unlike the rest of the general market, global energy companies have only seen one post-crash sell-off.

And now, after rising on surging oil, this group of stocks has potentially locked-in a solid uptrend (line in green) after surpassing its bearish trend (line in yellow). The last time IXC broke out past its downtrend was in late March, right before the ETF soared for a gain of almost 60%.

Is there another “burst” upwards on the way?

Maybe, maybe not.

But if oil prices continue climbing, energy corporations could very well make another “moonshot.”

Even those not necessarily tied directly to WTI crude.