In the ongoing trade war between the U.S. and China, it seems as though President Trump holds nearly all the cards. The American economy just posted healthy GDP growth numbers for Q1 2019, and month-after-month, we continue to see glowing jobs reports.

And while it’s true that American importers are certainly feeling some tariff-induced pain, the truth is that China has it far worse. President Xi Jinping is facing immense internal pressure, and his nation’s economy has been run ragged over the last year.

The Shanghai Composite Index (SHCOMP), despite rallying much like the American stock market in 2019, still sits well below the highs of 2015 and even 2007.

By and large, though, the Chinese aren’t big into equities.

So, a sagging market isn’t nearly as big of a deal as it would be in the U.S.

They prefer owning real estate by a wide margin, and as a result, both land and buildings have exploded in value – creating a massive bubble that’s just waiting to burst. Many homes in China sit completely vacant and un-rented, instead being used as money pits where investors shelter their savings.

In fact, it’s gotten so bad that there are now “ghost town” apartment buildings, where each unit is owned by someone, somewhere, but not a single soul lives inside.

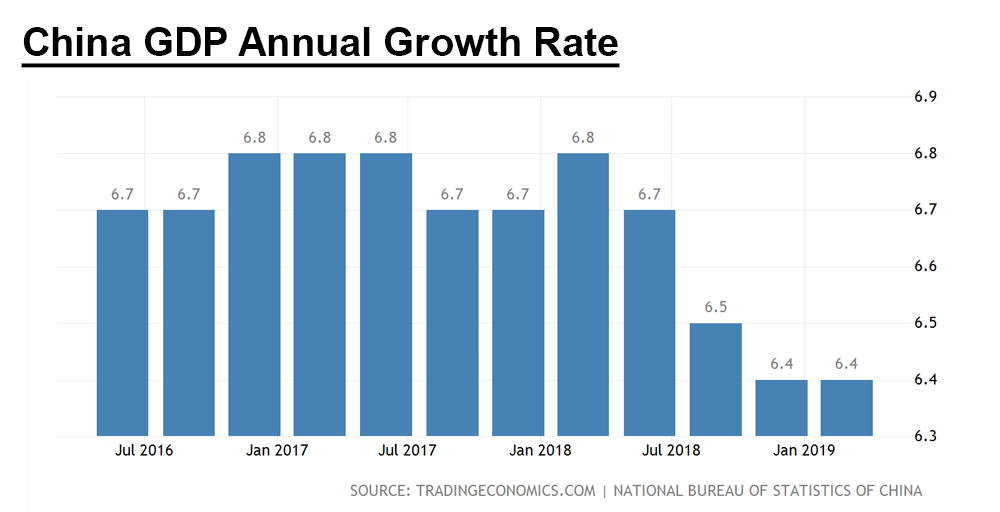

And the whole “house of cards” could come crashing down if China doesn’t keep growing at a high rate. Sadly, for the Chinese (who are known for off-the-wall GDP statistics), even that hasn’t been going so well.

So far, 2019 has not been kind to China. Trump just whacked them with another tariff hike, GDP growth has declined significantly in 2019, and now Huawei, one of their biggest companies, has been blacklisted.

But even with all this going against them, they still have an advantage (economically at least) in one regard:

China controls 95% of the world’s “rare earths” – a category of 17 elements found within the earth’s crust. These elements, which contain a unique set of properties that can make products more durable and efficient, have become critical ingredients in most (if not all) modern technologies.

Batteries, lasers, lighting equipment, and most importantly, electronic devices all require rare earth minerals to function.

The Apple iPhone, for example, relies on them heavily. Four different components in the phone (the camera, speakers, receivers, and taptic engines) can’t function without rare earths, and as of right now, the only way to get them large-scale is through mining.

And guess who has the world’s biggest natural supply of them?

Other countries have rare earth mineral deposits as well, but they don’t even come close to China’s quantity or mining capabilities. Over the last 4 years, demand for rare earths have shot up 91.7% according to Adamas Intelligence, a research firm that tracks metals and minerals.

So even though Trump is putting the squeeze on China in every which way, the fact remains that America’s electronic device-producing companies need those 17 elements from the Far East to keep their businesses running.

It’s something that President Xi Jinping undoubtedly intends to leverage in the coming weeks if trade war tensions boil over. He knows that with an election coming up, President Trump will do whatever he can to avoid an Apple stock collapse, which could ultimately sink equities further.

Out of all the U.S. companies affected by the trade war, though, Apple has mostly been ignored, in favor of corporations that depend on Chinese steel.

But Apple, more than anyone, could get skewered the most if Trump’s tariffs stick. Other electronics companies will feel the pain as well, but none of them are nearly as prolific as the one that produces the iPhone – an iconic symbol of capitalism that despite being technologically inferior to the competition, has endured the test of time.

If China has a shot at winning the trade war, they’ll have target America’s weak spot:

Our addiction to electronic devices.

Take away our “fix” and the people will be rioting in the streets.

That seems to be Xi’s plan, at least. Whether or not it succeeds in ripping Trump from the Oval Office is a different story.