While everyone worries about Treasury yields, there’s another set of bonds that should have investors arguably more concerned.

Negative-yielding corporate debt just recently passed the $1 trillion mark, signaling to some analysts that the global debt balance has gotten truly “out of whack”.

The new class of “negative bonds”, though similar, are decidedly different from fixed income instruments that carry little-to-no-yield. Zero-rate debt has been around for a long time now, and currently clocks in at approximately $15 trillion as a result of the Fed’s perma-low rate environment.

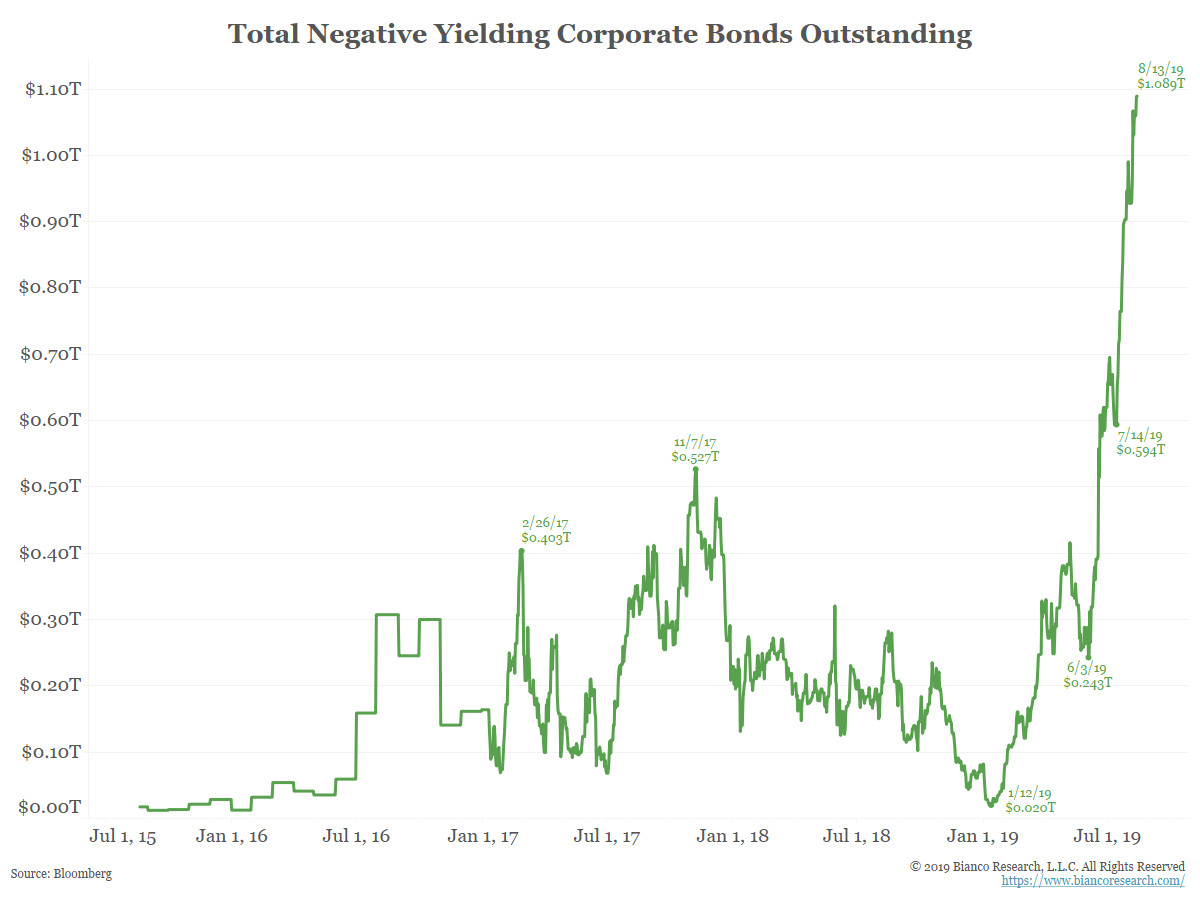

By comparison, negative-yielding corporate debt is relatively young. Starting out at just $20 billion in outstanding debt in January, that number quickly rose to $1 trillion by August 13th.

According to Jim Bianco, founder of Bianco Research (the firm that gathered the corporate debt information), this trend could scorch investors during the next economic boom.

“The interest rate risk that these bonds carry is huge,” Bianco warned.

“The financial system doesn’t work with negative rates. If the economy recovers, the losses that investors would take are unlike anything they’ve ever seen.”

President Donald Trump, however, disagrees with Bianco’s anti-negative rate sentiment. In fact, he even praised Germany this morning for the country’s newly attained negative debt yield.

“So Germany is paying Zero interest and is actually being paid to borrow money, while the U.S., a far stronger and more important credit, is paying interest and just stopped (I hope!) Quantitative Tightening,” he wrote on Twitter.

“Strongest Dollar in History, very tough on exports. No Inflation! WHERE IS THE FEDERAL RESERVE?”

Trump, in this case, is correct in assuming that negative yields would make the government’s debt load cheaper.

However, what he doesn’t mention is how counterintuitive negative rates are for the economy. Lenders would be forced to actually pay interest to borrowers, in the same way that Trump says Germany is getting paid to borrow money.

Unlike the governments of the world, however, lenders would just stop offering loans altogether as they would no longer generate interest. Without banks fueling economic growth with debt, economic progress would likely grind to a halt.

Because over the last decade, corporations have become increasingly dependent upon debt to grow revenues.

But Bianco says that the more imminent danger lies with bond investors. For example, he says that if yields on Swiss bonds go up just 2 percentage points, bond holders would stand to lose 50% of their position.

Retail investors who aren’t “all-in” on bonds would be able to absorb those losses.

Institutions, however, are unlikely to survive a yield hike without having their operations severely impacted.

And if the financial institutions of the world start falling, interest rates will be the last thing on anyone’s mind.

Bianco says that the hazardous negative-yield trend can be attributed to the European Central Bank (ECB), which pumped mountains of cash into their financial system.

Investors saw blood in the water and went “bond crazy” as a result, causing corporate debt prices to fly off the handle.

“They’ve so flooded their financial system with money that there’s not enough alternatives,” he said.

“That’s why you have people paying such astronomical prices that you wind up with negative yields.”

And so, while the ECB’s quantitative easing has certainly greased the wheels of the eurozone economy, it may have done so at a great price.

Institutions will have to offload a significant number of bonds before Europe even thinks about raising rates. But just the selling of bonds would cause yields to rise on their own.

So, both the institutions AND the central banks of the world have approached a true “damned if you do” scenario. The ECB simply cannot raise rates and institutions must retain their massive quantities of corporate debt.

As long as neither side “blinks”, everything should theoretically be fine. But if the European economy starts to improve, yields will undoubtedly rise as investors abandon their debt positions – putting the European financial system in an extremely tough spot.

And it’ll all happen because the central banks of the world went overboard once again, presenting investors with a red-hot bond market they simply couldn’t refuse.

Hopefully, Europe can avoid a bond reckoning.

But if they can’t, we’ll know exactly who to blame.