Stocks tumbled today after shockingly bad economic jobs data was released this morning. The Dow, S&P, and Nasdaq Composite all fell despite a sinking dollar. Oil retraced slightly, too, following yesterday’s short squeeze that was triggered by a surprise production cut from OPEC+.

The latest Job Openings and Labor Turnover Survey (JOLTS) data revealed a stunning plunge in job vacancies for the month of February, taking the number of openings below 10 million for the first time since May 2021.

Available positions totaled 9.93 million, down by 632,000 jobs from January’s number which was revised lower in this morning’s report by 261,000 openings. Wall Street expected 10.4 million vacancies, by comparison, making this a huge “miss” by all accounts.

In months past, a JOLTS reading this bad would have been celebrated.

The market operated on a “bad news is good news” narrative over the last two years, as bad economic data suggested that the Fed would cut rates sooner than anticipated. And bulls – particularly tech bulls – love rate cuts.

Now, though, with rates likely paused as a result of the banking crisis, bad news might just be plain old bad news again as an imminent recession approaches.

“The labor market is starting to loosen as the number of job openings declined in most sectors. As the economy slows, firms will likely cut openings and workers will be less likely to quit in search of better hours and higher pay,” said LPL Financial economist Jeffrey Roach.

“The Fed could consider pausing rate hikes at the next meeting but only if the upcoming employment report shows signs of material weakness and the March [consumer price index] report reveals lower inflation.”

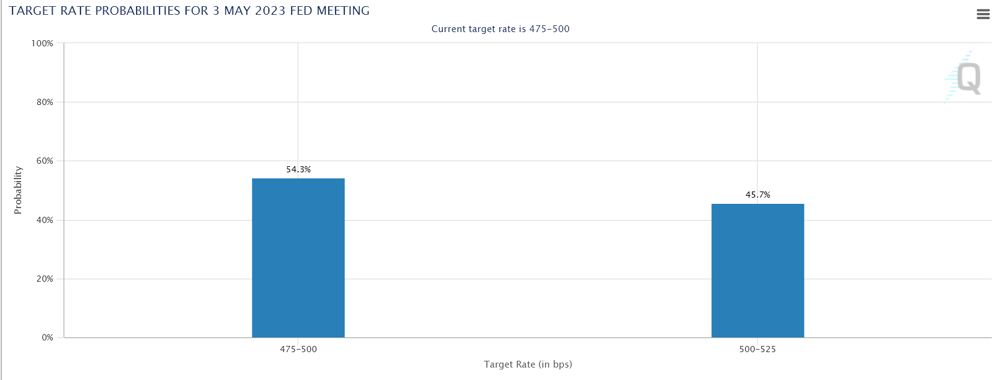

The CME Group’s rate hike odds dipped below 50% immediately after the JOLTS was published. Traders think it’s more likely that the Fed won’t hike at its next meeting in May (there’s no April meeting) due to the plunge in job openings.

And they’re probably right, even in the event that the next Consumer Price Index comes in hotter than expected. The wheels are quite obviously falling off the economy, and much faster than markets are comfortable with.

The March jobs report comes out this Friday. As we discussed previously, we predict an extremely weak number as a result of the recent spike in unemployment filings. If that’s what the Bureau of Labor Statistics delivers, the conversation could rapidly shift from “still strong economy, rate pause, and ‘soft landing'” to “imploding economy, rate pause, and ‘hard landing.'”

Critics will be quick to blame the Fed for a hard landing. And they should; Powell & Co. didn’t raise rates early or fast enough.

But the Fed was also flying blind for much of its tightening cycle. Powell said time and time again that he was taking a “data-driven approach.”

What did the data say? Inflation was high, but not catastrophically so, and the labor market was stubbornly strong.

That data made the problems seem mild. The problem, however, is that the data has been twisted by the government to look better than it is. That’s not conjecture nor “doomer” conspiracy; it’s really happening.

The “basket of goods” to measure inflation, for example, is a far cry from what it was in the 80s. Using an 80s-like inflation calculation would put the current rate of inflation at around +14% year-over-year (YoY) instead of the CPI’s reported +6.0% YoY.

Jobs reports have been total bunk as well. The last three January reports enjoyed the largest seasonal adjustments of all time, in addition to the largest revisions for the year prior. The end result is employment data that is not only unreliable but completely misleading. And that doesn’t even include the recent trend of quality jobs being replaced by part-time labor. Folks are switching from being “single jobholders” to “multiple jobholders” at a breakneck pace.

This is all contained within the last few jobs reports.

Remember that the Fed uses this data to adjust rates. Sadly, it’s utterly false, and now that the labor data is playing “catch up,” the Fed is being caught off guard.

Will that translate into stock market losses, though? If the March jobs report is truly dismal, then yes. Otherwise, equities could easily continue rising in the short term on soft landing optimism despite an otherwise ugly economic backdrop.