Tech shares led stocks today after Microsoft (NASDAQ: MSFT) and Alphabet (NASDAQ: GOOG) posted a pair of earnings “beats” last evening. The Dow, S&P, and Nasdaq Composite all gained alongside yields. The 10-year Treasury yield advanced to 3.43%, up slightly from yesterday, as the Treasury/equity disconnect continued.

And though both Big Tech stocks surpassed estimates, MSFT ran away with the lion’s share of the returns. MSFT shares jumped 8.50% higher through noon while GOOG eked out a 0.50% return.

“So far, Alphabet and Microsoft have delivered in the areas where it matters the most,” said Wall Street Alliance Group partner Aadil Zaman.

“We see that as a positive catalyst.”

Bank stocks continued their decline, however, as First Republic Bank (NYSE: FRC) dragged the industry lower once more. FRC plummeted another 20% today after falling over 50% yesterday. Lingering concerns over “hidden” banking hazards hamstrung the bank stock rally. Bitcoin – a likely hedge to banking instability – erupted higher over the last 12 hours as a result.

“Headlines of First Republic exploring an asset sale of up to $100bn of long-dated mortgages and securities, in addition to disappointing Q1 results, are rekindling concerns over whether the contagion risks in the US, and potentially global, banking sector are still alive,” read an early morning note from JPMorgan analysts.

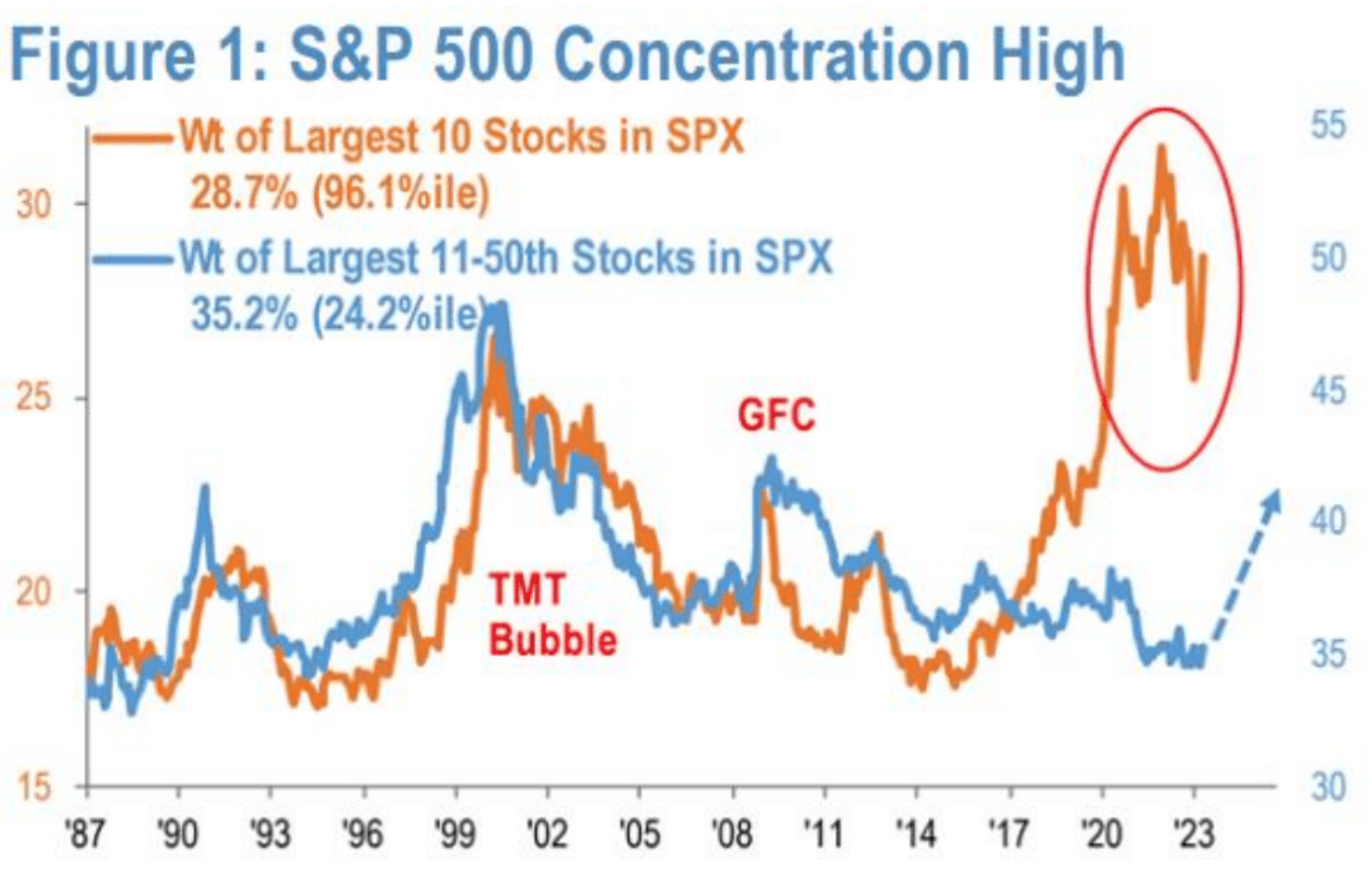

The note also touched on commentary from JPMorgan’s US equity strategist Dubravko Lakos-Bujas, who is concerned about increasingly narrow market breadth.

“We are currently seeing the narrowest stock leadership in an up market

since 1990s. Further, the equity upside we’ve seen YTD has been driven by a combination of very narrow growth leadership [in AI-linked stocks] and rotation into safety.”

The bank’s analysts continued:

“More simply put, the current degree of crowding implies the risk of recession is far from priced in. While in 2021, a broad market rally led by Cyclical factors (Growth and Value) drove concentration to the highest level seen since the Nifty-fifties, the current market concentration episode is less constructive for the broader market.”

Mega-cap crowding, AI-related stock dominance, and a sudden rotation into defensive shares have put the market at risk.

The top 10 S&P stocks currently make up roughly 28.7% of the S&P 500’s total market cap. Historically speaking, that’s very “top heavy,” albeit less so than in 2021. As JPMorgan analysts noted, though, the S&P reached that point in 2021 following a broad rally that was driven by growth and value stocks that were also cyclical.

“With regards to trades, Dubravko & team recommend investors to broaden allocation to stocks 11 – 50 by Size in S&P 500 where there is greater valuation support (trades at 7x turns cheaper than 10 largest Mega-caps),” the note concluded.

“At style and sector levels, they see further room for rotation into Defensives

(Low Vol, Quality, Healthcare, Utilities, Staples) from Value and Growth (Industrials, Consumer Discretionary, Tech, Financials) and Rate-sensitive (Real Estate, Small-caps).”

It’s certainly good (if not lengthy) advice. In short, JPMorgan’s equity strategists recommend favoring defensive stocks simply because the market has not adequately priced in a recession. When it does, those who bought defensive shares early could make a nice profit.

Or, at the very least, not lose as much money compared to investors who remain laser-focused on AI-related growth stocks, which still seem overbought following a rough handful of sessions.