Can traders catch a break these days? Apparently not after a report from The Wall Street Journal’s Nick Timiraos slammed sentiment into the gutter.

“Federal Reserve officials have signaled plans to raise their benchmark interest rate by 0.5 percentage point at their meeting next week, but elevated wage pressures could lead them to continue lifting it to higher levels than investors currently expect,” wrote Timiraos, who has long been viewed as the Fed’s unofficial “mouthpiece.”

“Brisk wage growth or higher inflation in labor-intensive service sectors of the economy could lead more of them to support raising their benchmark rate next year above the 5% currently anticipated by investors,” he added.

Timiraos’s hawkish report comes less than a week after Fed Chairman Powell sparked an epic afternoon melt-up with his speech last Wednesday. The result has been a choppy market that’s skewered bears and bulls alike.

The Dow, S&P, and Nasdaq Composite all sunk in response to The Wall Street Journal article. Due to Timiraos’s special relationship with the Fed – ie, Fed officials feed him information that they don’t other reporters – his predictions almost always come true.

Investors should expect a higher terminal rate for 2023 as a result. At the Fed’s next meeting, which ends December 14th, the FOMC will release an updated dot plot for rates. The last two dot plots showed an increase in the projected median rate for 2023.

In June, the median rate for next year was 3.8%. In September, that number climbed to 4.6%. The market had priced in a median rate of roughly 5% for the December FOMC meeting.

Now, though, a substantially higher median rate is likely on its way. That should undo any bullish excitement caused by a 50 basis point hike (vs. a 75 basis point one) in a few weeks, as Timiraos says another (previously unexpected) 50 basis point hike might happen in February.

“They want to guard against raising rates too little and allowing inflation to resurge, or raising them too much and causing unnecessary economic weakness, according to recent public comments and interviews,” Timiraos wrote.

“Some officials could seek to push through another half-point rate rise in February because they see a greater risk that inflation won’t decline enough next year. Without signs of slower hiring, they could worry that inflation could pick up again.”

It’s clear that Friday’s jobs report flung a hawkish wrecking ball into the Fed’s plans. A strong payrolls number was certainly disconcerting, but even worse were galloping wages. Rising hourly pay feeds into inflation, and Powell knows that unless monthly wage gains moderate soon, inflation could easily spike again.

The Fed would rather overdo it when raising rates than let inflation run away like in the 70s. Back then, the Fed moved too slowly on rates to prevent a vicious period of stagflation.

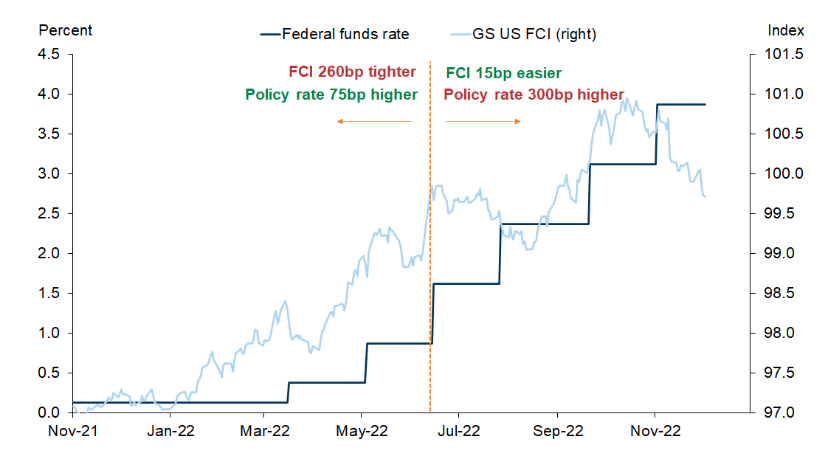

In addition, Goldman’s Mike Cahill warns that the recent rate increases have done little to actually tighten financial conditions in the US.

“This is a big challenge for the Fed. it demonstrates why slowing the pace + guiding to a higher terminal rate is pretty counterproductive. and, also why I’m personally skeptical of the idea that there’s this big lagged policy effect about to drag on the economy — most of the FCI tightening happened in Q2 2022, and on our models we are already moving through the peak negative impulse from that,” Cahill explained.

The Goldman Sachs US Financial Conditions Index (GS US FCI) vs. the Fed funds rate. A higher GS US FCI reading indicates looser financial conditions.

“So, if one of the huge questions for next year is calibrating the ‘long and variable’ lag effects of the hikes that have already come to pass, this would suggest the Fed needs to keep the pressure on,” Cahill said.

In other words, financial conditions are loosening, and inflation hasn’t come down as much as expected despite the Fed’s tightening campaign. That’s not good, and it may ultimately serve as fodder for a major bearish continuation heading into next year as the market’s longer-term downtrend takes hold once more.