Stocks opened higher again today before giving up some of their gains through noon. The S&P and Nasdaq Composite rose modestly while the Dow traded flat. Yields remained mostly unchanged.

Chipmaker stocks led the market this morning, rising significantly across the board. The VanEck Vector Semiconductor ETF (NASDAQ: SMH) climbed 1.30% higher. Mega-cap tech did well, too, as Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), and Microsoft (NASDAQ: MSFT) all enjoyed moderate morning returns.

Outside of tech, however, the market’s price action was far less impressive. The S&P is elevated well above its recent lows nonetheless, causing some analysts to question whether a continued rally is sustainable at this point.

“Collectively, financial markets are pricing in the best of both worlds – a recession that allows rates to be low and brings inflation down sharply, yet one that does not have a massively negative effect on corporate earnings,” wrote Barclays analyst Ajay Rajadhyaksha.

In other words, investors are anticipating a “soft landing” – something the Fed says it can still achieve despite sticky inflation and a banking crisis that likely advanced the US’s recession timeline dramatically.

Q4’s GDP numbers were adjusted today, showing that GDP grew by 2.6% year-over-year vs. the previously estimated rate of 2.7%. This reduction, while small, could indicate slower-than-expected growth moving forward.

“The slight downward revision to Q4 GDP shows the economy ended 2022 with marginally less momentum,” wrote economist Oren Klachkin.

“Looking ahead, the economy will face the full brunt of tighter credit conditions and Fed policy this year, and inflation is set to stay above its historical trend. The recent banking sector turmoil will affect the economy mainly through tighter lending standards and a reduction in the availability of credit.”

The economist from Oxford Economics is absolutely correct, here. Credit is the lifeblood of a growing economy. Without it, growth slows immensely.

The market was already anticipating tighter financial conditions as a result of Fed rate hikes. What it didn’t see coming, however, was a banking crisis that rapidly tightened lending standards as well. That was supposed to happen much later.

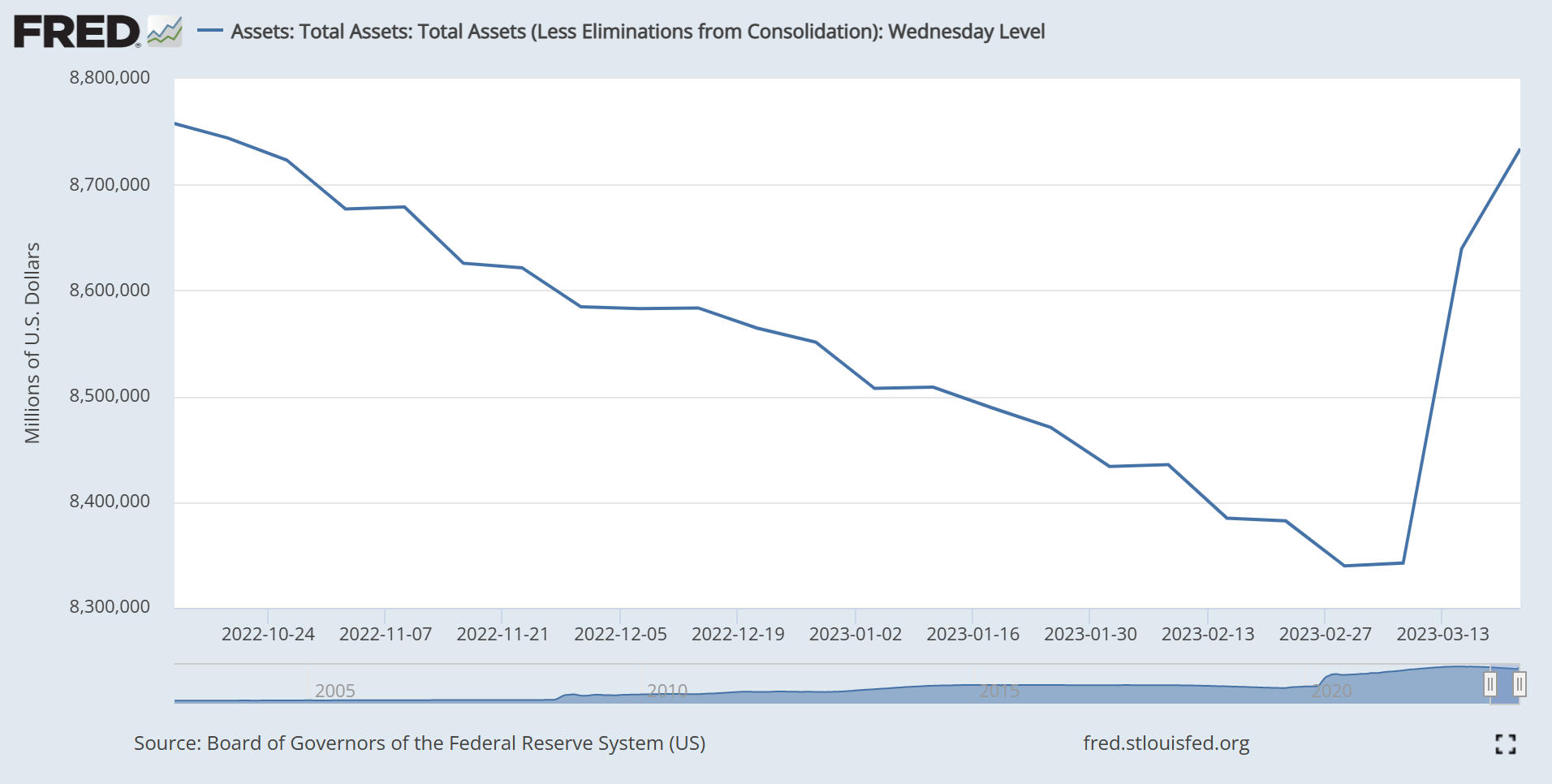

On the other hand, the Fed’s balance sheet exploded higher over the last two weeks in response to the banking crisis. The Fed added roughly $391 billion to its balance sheet, effectively kickstarting quantitative easing (QE) again.

Powell & Co. insist that this is a temporary measure, and it certainly could be. Keep in mind, however, that this is how QE started back in 2008 following the Global Financial Crisis. The Fed enacted QE as an emergency measure only for it to last another 9 years.

Bulls are hoping for a repeat performance as the economy slows.

We’ll see if they get it. For now, though, the market’s looking a little confused as it waits for the next jobs report – arriving April 7th – to get a clearer picture of the economic situation.