Goodbye, morning rally.

Hello, uncertainty.

The market erased its gains from the open today as the major indexes went “belly up” by the close. At its highest, the Dow rose 937.25 points (+4.1%). It finished the trading session 26.13 points lower (-0.1%).

The other major indexes – the S&P (-0.2%) and Nasdaq Composite (-0.3%) – had similar experiences.

Analysts are blaming the drop on a number of factors, ranging from investors “cashing in” on their recent winnings to a statement made by David Kostin, Goldman Sachs’ chief equity strategist.

“Risk to the downside is greater than the opportunity to the upside from this point where we stand today,” he said this afternoon shortly before stocks sunk.

“I would just remind you that in 2008 in the fourth quarter there were many different rallies, I call them bear market rallies, some of which almost 20% a couple of times — but the market did not bottom until March of 2009.”

Goldman choosing not to buy caused scores of investors to sell, even though the coronavirus outbreak appears to be leveling off in the U.S. as well as internationally.

Some analysts are still convinced, however, that the economic situation will only grow more dire with time.

“My concern right now is avoiding a depression,” Alex Chalekian, CEO of Lake Avenue Financial, said.

“I wouldn’t be surprised if we hit 2,000 on the S&P 500.”

The S&P 500 closed out trading today at 2,659.40. A fall to 2,000 would represent another 24.7% drop.

Could it happen?

Absolutely.

Is it likely?

Probably not within the next few weeks.

If a depression’s going to hit the U.S., we won’t know it for a while. For now, stocks seem like they want to go higher. If a rally really gets going this week, I can guarantee that traders will be looking to capitalize on the positive momentum.

And certain stocks – like Tesla Inc. (NASDAQ: TSLA) – could serve as a way to do so.

TSLA is a controversial stock. Its sky-high valuation of just a few months ago, coupled with eccentric founder Elon Musk has made TSLA a frustrating company for many investors to trade.

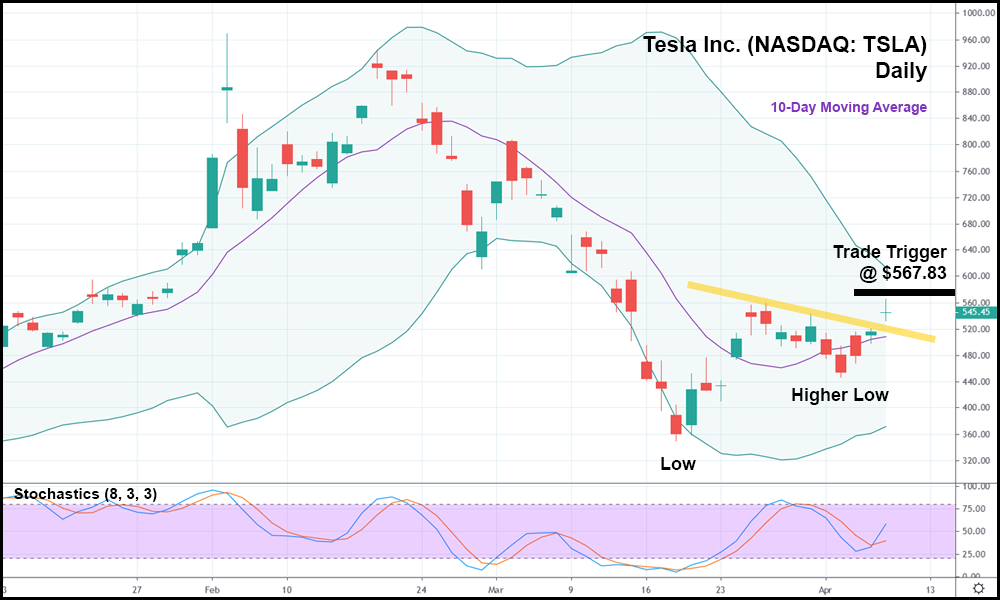

Since peaking in late February, TSLA got hammered by the COVID-19 crash (like everyone else) and sunk over 60%. Over the last few weeks, though, the stock has managed to do a bunch of different things right.

All of which indicate that it’s ready to move upwards when the general market gets serious about mounting a recovery.

TSLA set a higher low four trading sessions ago, and yesterday, it surpassed the 10-day moving average. Today, it managed to breach its minor bearish trend (represented with the yellow trendline), signaling that TSLA is nearing its “post-coronavirus” breakout. The stochastics indicator is below 80 to boot, suggesting that the stock isn’t overbought.

If TSLA trades above today’s high by a significant amount, it might make sense to go long on the stock with a trade trigger of $567.83. The major indexes, despite today’s stumble, still appear poised to rise.

If they do, TSLA will rise with them, but likely much faster (and higher).