Ever since the Venezuelan economic crisis began back in 2012, the entire country has been locked in a constant state of chaos. Food shortages, drought, and slumping oil prices have taken a dire situation and made it unimaginably worse.

It even got to the point where government offices only stayed open a few days a week in order to save electricity. The country’s GDP contracted faster and more severely over the last 6 years, than the GDP of the United States during the great depression.

Venezuela is an oil producer, and like many other oil-producing nations, its economy has become dependent upon oil exports. When prices were high, the government would go on spending sprees – using the money for ventures that never created any domestic goods or productive industries.

So instead, they just used their excess cash to import goods. Like with oil, Venezuela became dependent on something else – imports – because they couldn’t produce goods at home.

While oil prices were high, everything was running (somewhat) smoothly.

And that plan would have worked out just fine for Venezuela if oil prices never fluctuated.

However, the world oil market does indeed fluctuate quite often, and when prices dropped, the nation suddenly had much less money to spend on imports.

This resulted in a country-wide shortage for nearly all goods, food and other necessities included.

When that happens, it can absolutely devastate an economy – and over the last 6 years that’s precisely what occurred in Venezuela. Their president, Nicolás Maduro, has done very little to help the situation.

Instead, he’s arguably made the economic crisis even worse.

The United States was forced to pass sanctions on Venezuela, blocking American companies from buying their debt – including debt and accounts receivable from Petróleos de Venezuela, a government-owned oil company – after Maduro had been caught using domestic oil companies to enrich himself and his senior administration.

In other words – while his country languishes and his people starve, Maduro lines his pockets illegally via threads of corruption that are sewn deeply into the Venezuelan oil industry.

Because of all of this (the reliance on oil, imports, the widespread government corruption, and recent sanctions), Venezuela’s national debt continues to climb, and the economy is in complete disarray.

But that’s not all! No, actually the worst part about this whole fiasco is the hyperinflation that the Venezuelan national currency, the Bolivar, is experiencing.

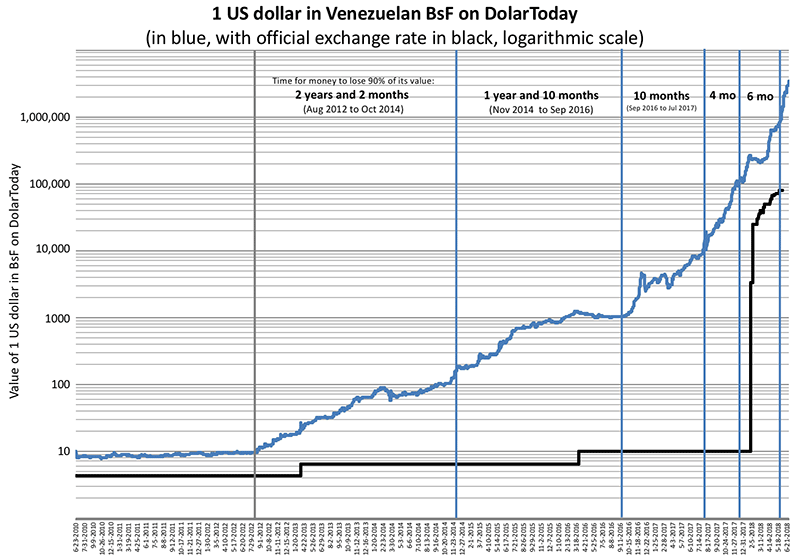

Back in 2011, before the economic crisis in Venezuela began, the 1 US Dollar was worth roughly 10 Bolivars on the black market. The official exchange rate was lower than that, at around 7 Bolivars.

After the crisis began, though, the Bolivar lost 90% of its value on the black market in a little over 2 years, trading at over 100 Bolivars for just 1 US Dollar.

As bad as that might seem – it gets far, far worse.

By 2016, the going rate for 1 US Dollar was a stunning 1,000 Bolivars.

By last May, you’d need over 1 million Bolivars to buy just a single American dollar on the black market.

You can see in the chart below just how bad things got, and how it happened in such a short amount of time. The line in blue represents the price on the black market, while the line in black represents the official exchange rate offered by the delusional Venezuelan government.

I think it’s safe to say that by now, the Venezuelan economic crisis is no longer just a “crisis”…

It’s a full-blown catastrophe.

Because the Bolivar is now virtually worthless, a need for a stable currency has arisen in Venezuela. It’s currently illegal to use any other currency besides the Bolivar, but that hasn’t stopped thousands of Venezuelans from turning to digital currencies as a means of payment or storing funds.

President Maduro has even tried his hand at it, releasing the Petro, an oil-backed cryptocurrency in February of this year. It was created to circumvent sanctions passed down on Venezuela by President Trump, but ultimately the newly minted coin was labeled a scam by the global crypto community.

Instead of inventing a solution for his country, Maduro is trying to use the Petro to finance Venezuela’s mountain of national debt while simultaneously making himself even wealthier. Anyone investing or buying Petro coins may as well be throwing their money straight into the trash – because no exchange in their right mind would ever list the coin for trading, and nobody would accept it for payment.

After all, it’s actually illegal for Venezuelan citizens to own the Petro – the coin that is supposed to be their salvation!

So instead of waiting for their government to disappoint them yet again, Venezuelans are now using cryptocurrencies to inject relief directly into their communities.

Last week, a Venezuelan Reddit user by the name of Windows7733 made a post about how he received 0.5 NANO, or half of a single NANO token, as a donation to help pay for food and other necessities.

As of right now, 1 NANO is worth roughly $2.30, so half of a single token doesn’t sound like very much money to most people.

However, in Venezuela, it’s enough to provide food and essential medicine for families in need.

According to Windows7733:

“0.5 NANO is almost one entire monthly salary in my country. It’s more than I made last month.”

The post soon gained traction, and other Reddit users were quick to chip in their share as well. Windows7733 announced shortly after that he actually found a food merchant willing to accept NANO directly for payment, and more donations streamed in.

With the funds raised, he was able to buy 100kg of food and distribute it to the starving members of his community.

Since then, Windows7733 has received even more donations – an astounding 44,334 NANO tokens from anonymous donors – totaling roughly over $100,000 worth of crypto. With the help of his family, friends, and community, he plans on using this money to start distributing food and essential goods on a larger scale.

And for the first time ever, a cryptocurrency was used for direct humanitarian aid in a suffering economy.

But the real story here isn’t just that some guy on the internet managed to raise money for his community (as great as that is)…

What really gets me excited is this:

Because of NANO’s lightweight nature and high “transactability”, Venezuelans are abandoning the Bolivar in favor of NANO for day-to-day, physical transactions.

Even though it is illegal to do so, Venezuelans are now replacing their national fiat currency with a digital, decentralized one.

To me, this is absolutely incredible.

Up until now, cryptocurrencies haven’t really been used as actual currency. They’ve been used, more or less, to store funds digitally in a secure manner.

However, the situation developing in Venezuela could change the way we view digital currencies. We’re seeing the humble beginnings of what could be the world’s first entirely crypto-based economy, at least on a small scale.

In addition to that, we could also be looking at the roadmap for how to revive a ruined economy being held captive by a worthless national currency.

Back when Bitcoin was first developed in 2009, inventor Satoshi Nakamoto created digital currencies to spark a financial revolution – to provide people with monetary freedom from governments, regulators, and central banks.

In a recent interview with Windows7733 regarding the donations, he said:

“People ask when Venezuela will collapse, but we already have. The final stage of this collapse is the large number of people who have died from starvation – entire families are already being found dead in their own houses because they couldn’t buy food and couldn’t find any help. I wish I was exaggerating but that’s already the reality in my country.

People benefiting from your contributions are really thankful because they know this is something special you guys are doing for us, and it isn’t only about helping someone struggling to get food but also it’s about giving economic freedom to these people under the Venezuelan dictatorship.”

Even though it took 9 years, I’d say that we have gotten at least one step closer to fulfilling Satoshi’s original vision.

And to me, that is something to be excited about.