Stocks were down this morning amid a big January jobs report “beat.” Yields jumped, too, in response to last month’s far better than expected payrolls data. 467,000 jobs were added in January according to the Bureau of Labor Statistics (BLS), surpassing the 150,000 payroll estimate with ease as unemployment climbed to 4% from 3.9%. The BLS also adjusted December’s payroll gain from 199,000 to 510,000 and November’s total jobs added from 249,000 to 647,000.

It was a huge shock to Wall Street analysts, many of whom were predicting a major jobs contraction. Even the White House warned last week that the numbers would come in low due to the Omicron variant.

Instead, US labor roared.

Or did it?

While the headline print was impressive, a deeper dive into the January jobs report showed what truly drove the 465,000 payroll gain:

A massive, unprecedented seasonal adjustment by the BLS.

Unadjusted, payrolls actually fell in January (as they often do). Historically speaking, many holiday-related jobs are no longer needed as the economy transitions from December to January. The BLS uses seasonal adjustments to account for the resulting reduction in employment.

And while there’s usually a significant tick lower that needs to be adjusted for in January, last month’s post-Christmas drop was a doozy. 2.8 million jobs were lost in January (unadjusted), meaning that the BLS adjusted last month’s jobs number higher by over 3.2 million payrolls (to reflect a 467,000 payroll gain), which included adjustments for seasonality, Covid, and population – the last of which is done every January each year. The seasonal adjustment alone totaled 309,000 jobs, the most ever for the month of January.

But they didn’t stop there. The BLS also revised lower the jobs data from March-July by removing 1.061 million payrolls. August-December saw an upward revision of 817,000 jobs.

This calls into question virtually every jobs report released in 2021. January’s report, however, was truly special. As we just mentioned, there had never been a January seasonal adjustment of this magnitude. The population adjustment was huge, too.

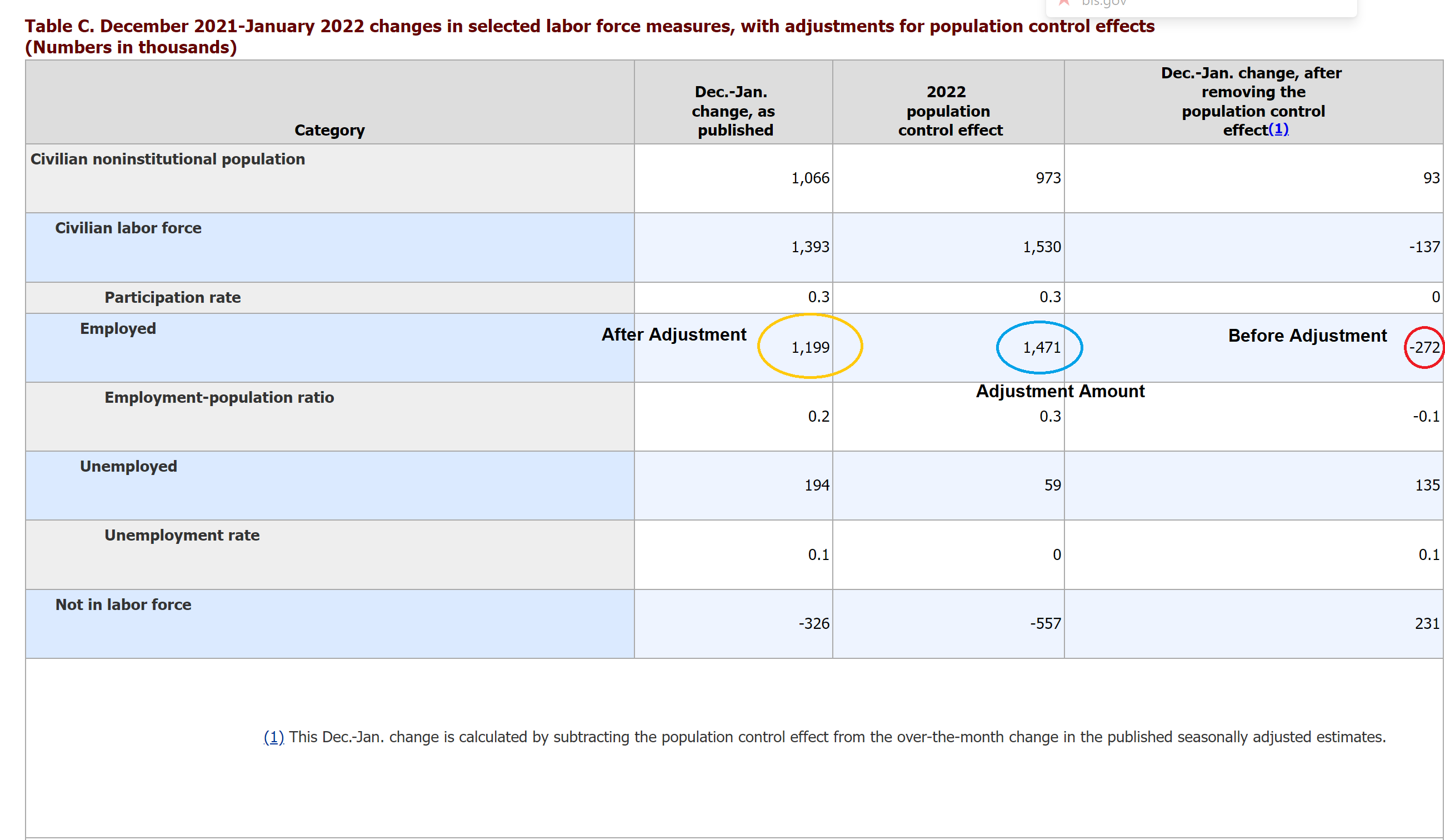

Last month, the BLS issued a +1.471 million payroll adjustment (blue oval) due to “population control” alone. January’s Household Survey, from which the national unemployment rate is derived, showed a “real” 272,000 monthly payroll reduction (red circle). The BLS adjusted that number higher by 1.471 million (again, due to “population control”), leading to a net gain of 1.199 million payrolls (orange oval).

This is all data included in the January jobs report. It’s not compiled by outside analysts or Wall Street banks. It’s the government’s official tally.

What this means is that, as we had suggested several times last year, the market was trading on misleading jobs data for months. The BLS’s seasonal adjustments of 2021 were way behind what they actually should have been, and now, they’re playing catchup by over-adjusting in the opposite direction.

This also suggests that January’s jobs data is as good as it will get in 2022. Everything from here will see adjustments to the downside. February’s jobs report is likely to include a significant downward revision to January’s tally.

Investors took this morning’s report as a sign that the Fed would stay on course with its plan to hike rates in March. And they’re right; today’s data did little to dislodge the Fed’s current position. But not because of the massive payrolls “beat,” which was really the result of some truly staggering adjustments.

What should really incentivize the Fed to keep “the pedal to the metal” were January’s hourly earnings, which rose 0.7% month-over-month (vs. 0.5% expected) and 5.7% year-over-year, crushing the +5.2% consensus estimate. That’s the fastest annual increase in hourly wages since May 2020 when the US was beginning to reopen after months of economy-strangling lockdowns.

This surge in wages will only add to inflation moving forward, which the Fed fears far more than any additional labor gains for the US economy. After all, Fed Chairman Jerome Powell said that the US already reached “full employment” several months ago. Jobs have little bearing on monetary policy now as a result.

So, the market got it right this morning in thinking that the Fed is still on track to hike rates in March. They were accidentally right, of course, in that they probably used the wrong data – payrolls instead of hourly wages – to justify their reaction. But their conclusion was correct all the same.

That could threaten the market’s ongoing bullish bounce, which now dangles within range of a retracement to the recent lows. That hasn’t happened yet, but it certainly could as March draws closer with each passing day and rate hike-driven fears continue to mount, encouraged further by “juiced-up” BLS reports.