Stocks rallied at the open today despite strong payroll data. The Dow, S&P, and Nasdaq Composite all surged in the face of the October jobs report, released pre-market. Yields climbed again as well as the 10-year Treasury yield topped out at 4.19% on the day.

Bulls were worried that the October jobs report would reveal a big payroll gain. “Good news is bad news” is still the case as any positive economic indicators (outside of falling inflation) would keep the Fed on its current rate hike schedule.

But instead of plummeting in response to the jobs report, stocks rallied fiercely. The Bureau of Labor Statistics (BLS) reported today that the US economy added 261,000 payrolls last month, beating the 195,000 job estimate with ease. Wages remained roughly the same as well.

So why did stocks rally again (temporarily, at least)?

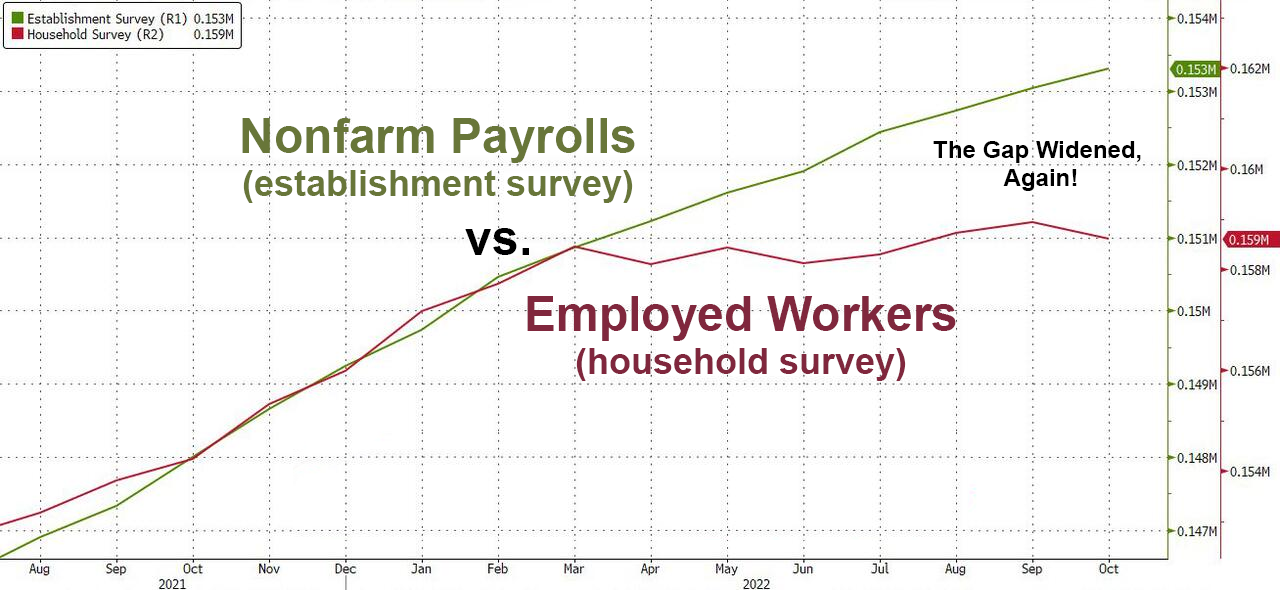

It was all because the unemployment rate unexpectedly spiked to 3.7% according to the jobs report’s much more reliable household survey, which measures the number of employed workers. The establishment survey – the other half of the monthly jobs report – measures payrolls.

And, last month, employed workers fell by 328,000, meaning that the household survey has remained flat for seven straight months after plateauing in March of this year.

The gap between the two surveys continues to grow as a result. It hit 2.3 million as of last month if the BLS’s data is accurate.

The unemployment rate is derived from the household survey, which explains why it jumped to 3.7% in October from 3.5% in September.

But perhaps the most shocking stat in the household survey was the disparity between full-time and part-time workers.

In October, full-time workers declined by 433,000 while part-time workers increased by 164,000.

Tracking this data back to March, the US has lost 490,000 full-time employees while gaining 492,000 part-time employees. 126,000 of those workers became multiple jobholders.

In other words, the number of actual working Americans in the US has not changed since March. Instead, many people lost their full-time jobs and were forced to take on lower-paying, part-time positions. And among that group, a significant number (roughly 25%) had to hold multiple jobs to make ends meet.

I don’t think you have to be an economist to realize that’s bad news. And, like we’ve said numerous times, the market is still living in “opposite land” where bad news is good news for equities with a Fed that’s fighting inflation.

Bloomberg chief economist Anna Wong doesn’t think the Fed’s plans will change following today’s uptick in unemployment, however.

“The jobs report for October sends mixed signals about the labor market, with one survey showing robust job gains while another shows a big jump in unemployment,” Wong wrote.

“Filtering the noise in the data, our takeaway is that the labor market is still very tight and much adjustment still needs to occur before unemployment is close to a neutral level. We expect that the Fed will ultimately have to raise rates to 5% next year.”

There’s no doubt that unemployment will continue to climb, however, even if more part-time workers are added.

Within the last 48 hours, the following companies have announced major layoffs:

Lyft (13% of workers), Opendoor (18%), Stripe (14%), Chime (12%), Morgan Stanley (percentage yet to be disclosed), and Twitter, which terminated 50% of its employees today.

The November jobs report is due out on December 2nd, twelve days before the FOMC meeting wraps on December 14th.

If the November jobs report reveals a big uptick in unemployment (given the recent firings, it probably will), the Fed may finally pivot, launching the year-end “Santa rally” that bulls have been waiting for.