After much anticipation, the rate cut finally arrived.

And even though investors expected a quarter basis-point reduction, that doesn’t mean they were happy about it following Powell’s announcement.

That’s something you can thank Wall Street for.

In the weeks leading up to yesterday’s FOMC meeting, analysts filled everyone’s heads with visions of a half basis-point rate cut.

It wasn’t likely, they cautioned, but that didn’t stop them from commenting ad nauseum on how wonderful a half point slashing would be.

And so, for most of July, investors got overly excited. Nasdaq stocks were being investigated by the FTC, but bulls didn’t care.

They just kept buying and buying.

Even in the wake of a record-breaking $5 billion fine levied against Facebook.

The stock market seemed downright untouchable. Not even a federal probe could provide sturdy headwinds.

That shouldn’t come as a surprise, though. Since 2008, the only thing the market truly cares about is the Fed and interest rates.

Because bulls want to “have their cake and eat it too”. They want a strong economy AND low rates.

A combination that Fed Chairman Jerome Powell seems happy to provide.

But even then, a rate cut alongside stronger than expected economic indicators (like the consumer confidence index) wasn’t enough to satisfy investors.

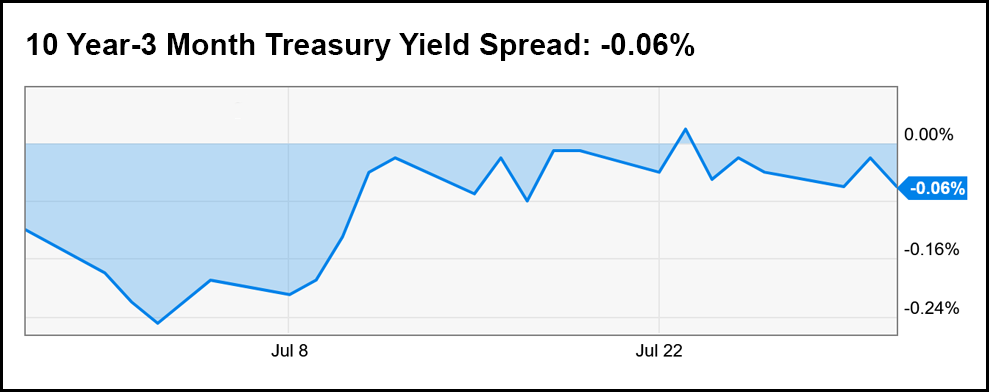

Nor did it cause the yield curve to un-invert – a presumed goal that the Fed hopes to achieve by the end of the year.

Instead, it just made things worse.

In the chart above, you can see that 10 year vs. 3 month treasury yield spread actually dropped lower after yesterday’s rate reduction announcement. A yield curve inversion like this has preceded the last three recessions.

To Powell & Co., getting the 10 year vs. 3 month spread out of negative territory seems to be important. Why else would they cut rates if the economy isn’t truly in recession?

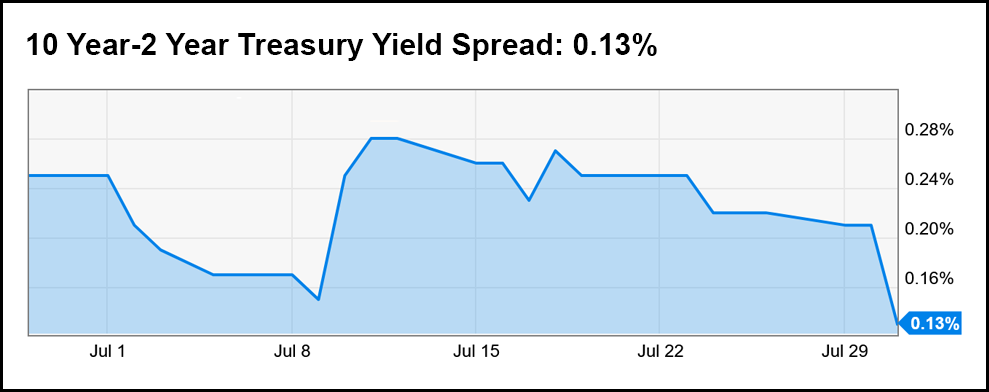

Similarly, the 10 year vs. 2 year treasury yield spread dropped as well, albeit not into the negatives.

Still, this isn’t what the Fed had planned. Not even close.

So, if a yield curve un-inversion was the reasoning for yesterday’s rate reduction, then it failed.

Miserably.

But based on what we’re seeing, I don’t think that’s the end of the story.

Powell, despite his flaws, is a highly intelligent and qualified man. He’s got a team of the world’s brightest economists and analysts at his disposal.

More importantly, he’s getting economic information that’s not yet been released to the general public.

In addition to announcing that the Fed would slash rates, Powell also left the door open for another rate cut down the road.

Possibly this year.

If they were going to simply cut rates and be done with it, the Fed would’ve (in my opinion) gone with a half point reduction.

But they didn’t. They reduced rates by a quarter point instead with the intent of potentially rolling out a few more cuts in the near future.

Why?

Because the Fed might know something we don’t; that the United States is already in a recession, or at the very least, extremely close. Powell needs to save ammunition for the coming battle against inflation and contracted growth, so if he slashes rates too much right now, he might not be able to later on.

That’s not to say the Fed is playing with a full deck to begin with, though.

They aren’t. The post-2008 economy saving maneuvers set a dangerous precedent for the Fed, and in the perma-low rate environment that’s existed since, they’ve remained mostly disarmed.

Unable to “fire back” against true economic strife – something we haven’t seen in 11 years.

Did the rate cut work, then? When it comes to yield spreads, absolutely not.

But that’s not all there is to it. This could simply be the first step in a multi-part rate manipulation, all to prevent a prolonged recession.

If that’s true, Powell won’t come out and admit it, though. If he did, the stock market would crumple.

So, he’s playing with his hand close to his chest (as he should). Because if the truth gets out and investors don’t like what they hear, the whole house of cards could come tumbling down.

While an anemic, overweight Fed sits on the sidelines, powerless to stop it.