Even though the market enjoyed its biggest day-after-Christmas rally of all time, many investors are convinced that the run of the last two days could simply be fool’s gold – a knee-jerk reaction to current events and oversold conditions around the holidays.

A few more green candlesticks leading into the new year could set equities up for a nice 2019 recovery, but there’s still reason for bulls to worry, as history has shown us that plenty of these daily surges are nothing more than a “bear trap” in disguise.

Even after rocketing upwards on December 26th, the Dow continued to climb, closing higher on Thursday and erasing a 600-point loss from Christmas Eve. Similarly, the S&P saw more gains as well, opening lower yesterday before reversing to the upside, much like the Nasdaq Composite did.

The last two trading sessions have been a nice reprieve for bulls, who have endured crushing losses across the market these last three months. FAANG stocks, which led the way for much of the historic bull run, got hit especially hard, tearing down portfolios just as quickly as they built them up.

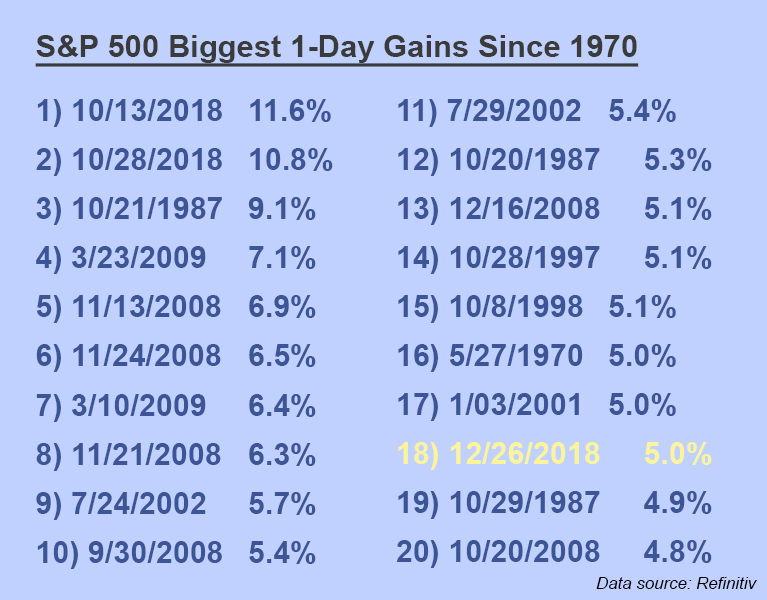

The major indexes dipped into bear market territory, trading at or near 20% losses from recent monthly highs before the Christmas surge brought stocks back to life – leading many analysts and investors unconvinced that the recent rally is anything to get excited about. They’re not wrong to temper their expectations given the market’s current landscape, and especially due to what’s happened after some of the biggest one-day percentage gains for the S&P 500 since the 1970s:

Data gathered by our in-house analysts showed that 3 out of the 20 historic boosts came during the aftermath of the October 1987 stock market crash, when buying after the huge daily surges would have been a good idea. Two others came in March of 2009, following the financial crisis. Again, a sound time to buy as the market had just bottomed before starting its current bull run.

But on the other hand, 8 of the 20 daily gains over 5% for the S&P 500 came during the 2007-2009 bear market, and 3 others happened during the 2000-2003 downturn, making 11 out of the 20 “big days” for the market nasty bear traps, that ultimately hurt plenty of opportunistic, trend-reversal-seeking bulls.

And it looks like we have a similar situation on our hands this time, as the quick post-Christmas surge shows signs of slowing during today’s trading session. Savvy traders seem ready to cash-out their rapid-fire gains earned over the last two days, which could ultimately cause another plunge.

If the market can set new, higher lows over the next few days, though, investors could be in for a nice little recovery in early 2019. That’s not to say that a full-bore bear market isn’t in the cards, as long-term indicators are still pointing downwards, but it could mean that short-term traders are in for a quality trend-reversal setup.

However, in that same vein, if the market sells off and dips below the December 24th lows, a further run to the bottom will likely foil any new year’s plans investors may have had.

For now, it might be wise to hold off on the champagne, at least until equities can give us a little more data.