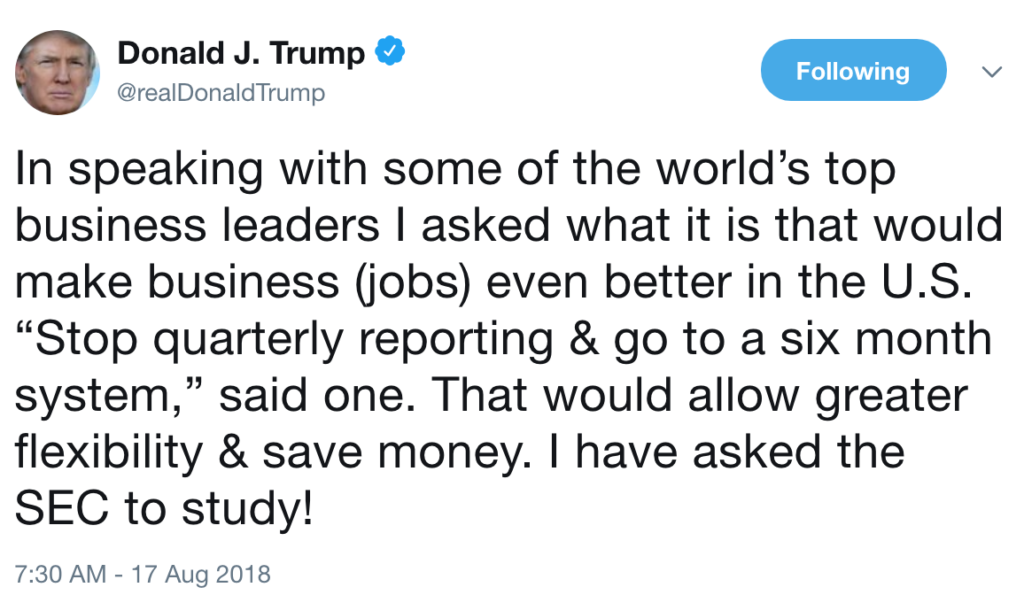

Last Friday, Trump took a break from taunting CNN and surprised traders (and companies alike) with the news that the SEC was looking into eliminating quarterly earnings reports, with the intent to switch to a 6-month schedule:

The suggestion—like everything else that comes out of President Trump’s Twitter feed—brought a wave of criticism from the news media and even some traders and business owners. But the shift to 6-month reporting isn’t as cut and dry as the negative commentary would have you believe, so before we make any rash decisions, let’s take a closer look into who supports the new six-month earnings concept, who hates it, and who stands to benefit most from it.

Has 6-Month Reporting Ever Been Attempted?

As a matter of fact, a precedent does exist for bi-yearly reporting, and the idea itself is hardly novel. The current quarterly reporting standard only began in 1970. Before that, companies had relied on a bi-annual schedule since 1955.

Furthermore, companies and individuals have advocated for 6-month reporting for years. In 2015, the influential law firm Wachtell, Lipton, Rosen & Katz proposed ridding the U.S markets of quarterly reports altogether, which they considered excessive and distracting.

Larry Fink of BlackRock has been an advocate of 6-month reporting for as long as anyone can remember. And Baruch Lev, a professor of accounting and finance at the Stern School of Business at NYU, has made similar proposals. “This is not new to me. I’m for it,” he said in a phone interview with Yahoo Finance.

Even Hillary Clinton proposed reforms to “help CEOs and shareholders alike to focus on the next decade rather than just the next day.” In other words, this should be an idea which both parties could, in theory, support.

Great! But What Are the Critics Saying?

President Trump and the SEC will have to fight serious headwinds if they have any hope of going from the current quarterly earnings system to a bi-yearly reporting schedule. Advocates of quarterly reporting are many, and have more than enough funds to lobby against the changes on Capitol Hill.

Critics of 6-month reporting often cite three main issues: a lack of transparency, inefficient markets, and a reduced need for fundamental analysis.

Lack of transparency: Public companies can hide poor earnings and major losses for a longer period of time with bi-yearly reporting. Furthermore, an increase in accounting abuses due to fewer required reports is also possible.

Inefficient markets: Some critics suggest that reducing the number of yearly reports would mean more guesswork goes into the markets, leading to confusion over value and even greater volatility in stock exchanges.

Reduced need for fundamental analysis: This hits the Warren Buffett’s of the world hardest. Fundamental analysis has always been tied to earnings reports. Lengthening the amount of time between reports means fundamental traders may have to rely more on technical analysis for guidance.

6-Month Reporting Could Mean Fewer Distractions, More Economic Growth

While the critics may have some valid concerns, most of their fears will almost certainly never materialize. Here’s what we know for certain:

- Fundamental traders will have a rough time with the new reporting, because there will simply be less information available to go off of. Conversely, technical traders will have half as many “interruptions” (in the form of earnings reports) to deal with, and market movements could last longer. This means bigger rallies, dips, and more potential opportunities to capture large profits – as long as you have a proven trading method to rely on.

- Earnings reports will play a much larger role when they do come out, and price swings during earnings calls could be significant. But the everyday movement of the market is almost certain to become more deliberate and easy to trade, as less noise often means staying focused on the bigger picture.

- Quarterly reports keep public companies focused on short-term earnings to appease investors and stockholders. Longer time frames between reports changes the focus of companies toward building long-term growth and profitability, rather than nitpicking over results of a 3-month time frame.

- Lengthy earnings reports require significant resources to compile and create. Reducing those reports to two times a year instead of four saves significant resources for these companies.

As with anything, there will be winners and losers regardless of the SEC’s decision – but due to how the market has evolved since the 70’s, the constant demands for earnings reports every three months is far less relevant than it used to be, and the whole reporting process eats up far more resources than it needs to. Moving to a 6-month schedule could potentially be better for traders, investors, and possibly even America’s economy.

And who wouldn’t want that?