America’s Economy Smashes Estimates with Renewed Wage Gains and Record Unemployment

Stocks may have been a sea of red on Friday, but the most recent slew of economic indicators couldn’t have been better.

Some of the highlights of the most recent jobs report:

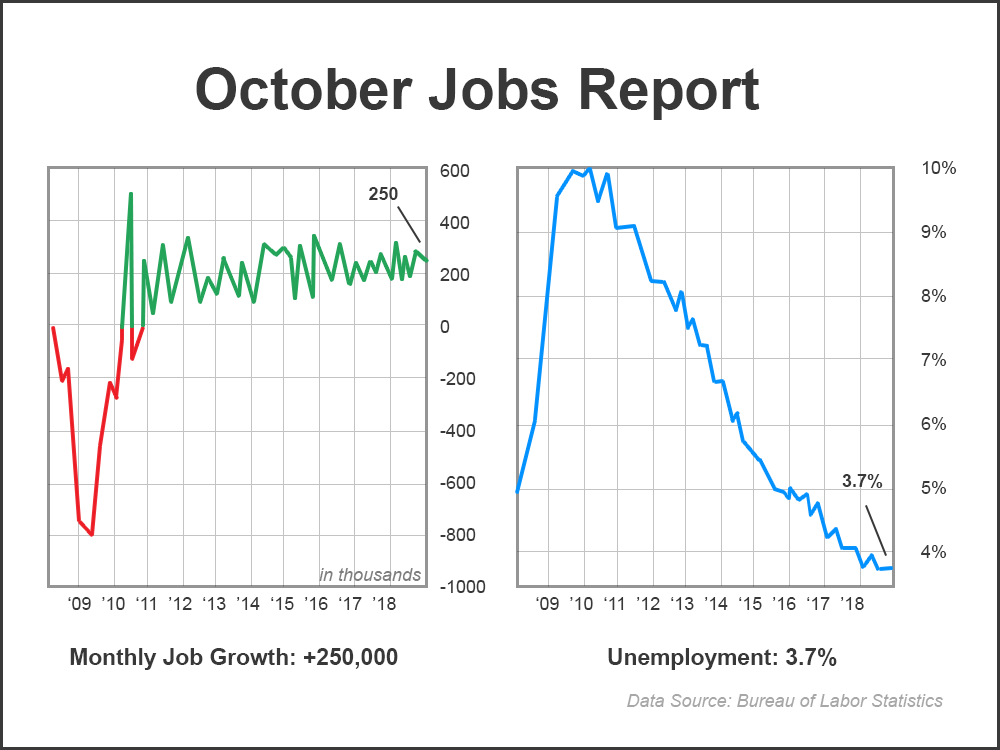

- Nonfarm payrolls increased by 250,000 for October. That’s far surpasses the original estimates of 190,000 from analysts.

- Some 32,000 manufacturing jobs—just over 1,000 per day—were added in the month of October.

- Unemployment stayed at 3.7%, the lowest since December 1969.

- Hourly earnings increased by 5 cents an hour (or 83 cents year-over-year).

All of this is great news, but it was wage growth that stunned economists the most. This indicator has flatlined since the Great Recession, but it’s finally showing signs of life. October saw hourly earnings increase by 3.1%. We haven’t seen growth like that for almost a decade.

Despite the Strong Economic Outlook, Traders Remain Skeptical

With October’s 11% crash still fresh in the minds of many traders and a disappointing earnings beat from Apple on Thursday, the market was not receptive to another day in the green. Markets on Friday came close to erasing the gains of the day before. And while they made some progress later in the afternoon, it was unclear whether the buying would continue into next week.

Jeff Mills, an analyst for PNC, noted on CNBC’s Squawk Box that “significant technical damage” had been done to every major U.S. equity market, and more downside in the short term was very possible.

“We broke through the 200-day moving average pretty significantly,” said Mills, “so you think about other corrective phases like 2011, 2015 where we did the same, and it took a while to work back through that volatility.”

Mills notes that on both occasions, the 200-day moving average became a ceiling holding stocks from hitting new highs.

Technical analyst Carter Worth of Cornerstone Macro also chimed in on October’s drop, noting that a 22% drop was entirely possible, bringing most markets back to the bottoms of their ascending channels.

These Three Things Could Kill Off Last Week’s Rally and Send Markets Lower

Despite the age of this bull market, there are signs it could still go higher. However, the chances of this drop significantly if any one of these events take place:

The Fed Hikes Rates in December: The days of easy money may be over as the Federal Reserve continues to raise rates and shrink its balance sheet. The Fed is apace to hit its 3%+ target in 2019 and an upcoming rate hike in December could cause more market panic.

Bad News from November’s G20 Summit: As Trump stands ready to enact hundreds of billions of dollars in tariffs on the Chinese, the G-20 summit taking place in Buenos Aires in late November may be the last bastion of hope for market bulls. If both sides walk away from the negotiating table, it could send U.S. markets plummeting and leave Chinese stocks at levels not seen since the financial crisis.

Another FAANG Bloodbath: FAANG stocks took to parabolic heights in 2016 and 2017. But the peaks made in 2018 may spell the end for these market leaders. Apple’s attempt to paint lipstick on a pig by raising iPhone prices to hide slowing sales could be the final nail in the coffin for the FAANG, which could take the whole market along with them.