It’s been a confusing morning for the market.

The Dow’s down (-0.50%), the S&P’s flat (+0.05%), and the Nasdaq Composite is up (+1.00%). Meanwhile, investors digest another surge in unemployment claims.

One that suggests the economic damage is only getting worse, not better.

Earlier today, the Labor Department reported that 5.245 million Americans filed for unemployment benefits last week. U.S. jobless claims now sit at a total of 22 million during the COVID-19 outbreak.

And though it might be disappointing to see that number rise, some economists believe it could slow down considerably by the end of the month.

“It’s not exactly good news when the pain is compounding but it should be peaking,” said Grant Thornton Chief Economist Diane Swonk, who explained that jobless claim growth declined last week.

“We are going to be disbursing 1.3 million plus small business loans. They have to start using that money within 10 days, which means we’ll people brought back on the payrolls in May and June.”

In the second half of her statement, Swonk raises an important point:

Most of these jobs will return when the economy re-opens.

At present, the coronavirus pandemic has managed to wipe out all of the U.S.’s job gains since the 2008 financial crisis.

But instead of recoiling in horror to the jobless claims, stocks are treading water. The market knows that these losses are temporary.

When America gets back to work, much of the damage will be quickly reversed.

Investors keen on timing the recovery could send equities on a “moonshot” well before the economy officially re-opens. President Trump is set to reveal his economic roadmap later today.

If bulls like what they hear, stocks should soar.

And one sector, in particular, could experience a massive resurgence as a result.

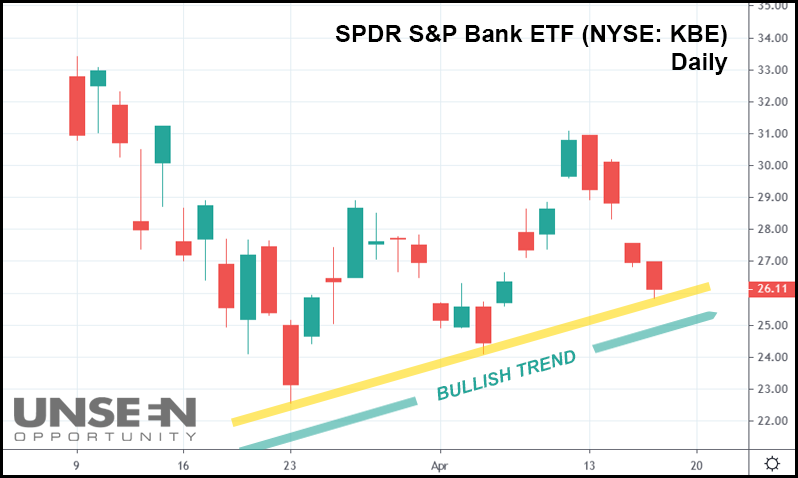

Yes, believe it or not, the ice-cold banking industry will likely heat up in a hurry when the general market rises. The SPDR S&P Bank ETF (NYSE: KBE), which measures the performance of 25 S&P-listed bank stocks, suggests that the industry is at a critical juncture.

Despite their recent earnings-driven losses, banks still have a shot of continuing their bullish trend. KBE is up over 16% since it bottomed on March 23rd. And back on April 3rd, it set a “higher low,” establishing a bullish trendline (in yellow in the chart above).

Today, the ETF rests squarely on that trendline. With more banks set to report earnings in the coming days, bank stocks could easily fall further.

However, as each new batch of earnings is released, investors haven’t learned anything new. Every bank has the same story from last quarter:

Worse-than-expected profits and better-than-expected trading revenues.

Banks made a killing off the rising bond market while their profits got crunched. There won’t be any surprises from the industry moving forward.

So, with the damage already “priced-in” by investors, bank stocks seem more likely to rise than fall for the rest of the month.

And if Trump can get America back to work sooner, rather than later, bank shares could absolutely erupt.

Potentially outperforming every other group of stocks in the process.