Stocks were mixed this morning with the tech-heavy Nasdaq experiencing a modest rise of about 0.4%. The S&P and the Dow, on the other hand, were mostly flat through noon. This comes after both the Dow and S&P closed Tuesday at their highest levels since early 2022, with the Dow achieving its third-highest close ever.

Investor attention is currently fixed on the Fed’s impending interest rate decision, expected later in the day. The market will be looking for any hints from Chair Jerome Powell about a potential halt to interest rate hikes, in addition to the Fed’s updated dot plot.

The consensus is that the Federal Reserve will likely maintain the status quo on rates, a sentiment reinforced by Tuesday’s consumer inflation report. The debate now pivots on whether the Fed believes its efforts have sufficiently curbed inflation to justify rate cuts before summer.

However, market expectations of imminent interest rate cuts might not find support in the Federal Reserve’s dot plot today. The Summary of Economic Projections (SEP) is anticipated to continue echoing the ‘higher-for-longer’ stance, which, if unchanged, should have a neutral impact on bond and money markets post-settlement.

The central bank’s SEP adds a layer of complexity, allowing FOMC members to anonymously forecast future directions for fed funds, growth, inflation, and unemployment rates. This has turned market analysis into a more intricate exercise, particularly with the SEP’s introduction.

Currently, the market is leaning towards expecting more significant rate cuts next year, with a total of 110 basis points now priced in. This expectation veers into ‘hard-landing’ territory, which suggests that the market doesn’t believe the US can avoid a deep recession next year.

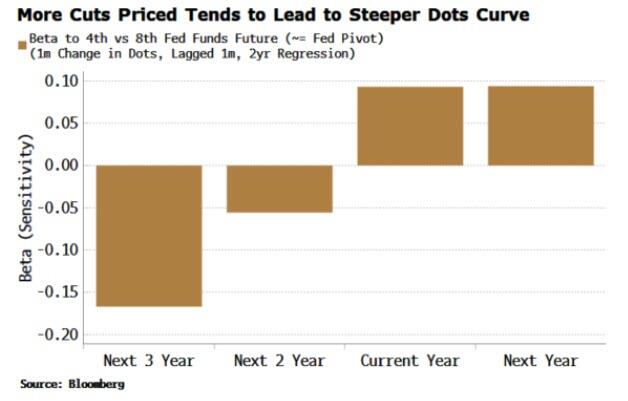

When the market anticipates more cuts (the so-called ‘Fed pivot’), it often leads to a steepening of the dot curve by the FOMC. The chart below illustrates the sensitivity of each dot to the 4th vs 8th fed funds future contracts, lagged by one month. Therefore, when the fed fund curve flattens, the FOMC tends to counteract this by steepening the dots curve.

Put more plainly, when the market starts to price in cuts, the Fed typically disappoints investors by showing a more hawkish dot plot.

Given the recent flattening of the fed funds curve, a similar FOMC reaction should result in a steeper dots curve in today’s meeting. This would align with the trend from a year ago when lower spot rates were coupled with slightly higher forecasted rates.

This approach will reinforce the ‘higher-for-longer’ message, while the Fed can use other forecasts in the SEP to indicate a slowing economy and potential rate cuts if inflation doesn’t flare up again.

Specifically, they are likely to revise their growth forecasts downward and unemployment forecasts upward. They might also lower their inflation forecasts, but any reduction is expected to be modest to avoid sending a premature signal of optimism, especially considering the recent uptick in core CPI.

Goldman Sachs strategist Mike Cahill suggests that we might see a scenario akin to early 2022, where central banks initially lagged behind market expectations but eventually aligned with market direction. This time around, that would result in a more hawkish Fed over the next few months prior to a major dovish capitulation once economic data starts to soften. How dovish the Fed gets at that point will depend on how sticky core inflation remains.

That’s a “tomorrow problem,” though, and for now, a more hawkish Fed is the most likely outcome. As we’ve mentioned repeatedly over the past week, financial conditions have eased considerably due to November’s runaway Treasury rally. This pushed yields lower to the point at which the much-watched Goldman Sachs Financial Conditions Index (FCI) is at lows unseen since June 2022.

In other words, a hawkish display from the Fed today could be an easy way for Powell to tighten conditions again – sparking a Treasury selloff – without resorting to additional rate hikes.