GameStop (NYSE: GME), AMC Entertainment (NYSE: AMC), and others plunged today.

And, as predicted, Wall Street couldn’t have been happier. Stocks finished for a big gain in response to the “squeeze squash” that had speculators questioning the war on hedge funds.

GME closed 60% lower. The Russell 3000’s 10 most shorted stocks, which no longer includes GME, continued to sink as well.

It seems that short interest – the quantity of stock shares that investors have sold short but not yet covered or closed out – can’t keep speculators in the fight. Users on the WallStreetBets subreddit are imploring others to hold GME at all costs. Many have been gouged in the rapid selling after buying near the peak.

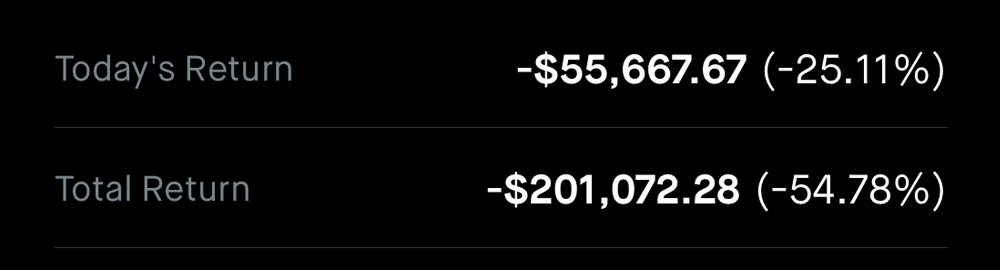

Subreddit user FewPhase8020 posted the image above as evidence of their blind faith in the short squeezes. They managed to get long on AMC in premarket trading at $21.96 per share, which was actually above its recent high from last Wednesday. AMC closed trading today at $7.82.

It’s a shocking loss to be sure, but one that’s not at all unique. Many other “short squeezers” got burned as a result of the GME/AMC slump.

Still, WallStreetBets continues to double down. A Swedish trader who goes by the name SagarisTVR posted their buy orders while thanking hedge funds for the “discount shares.”

Even billionaire entrepreneur Mark Cuban chimed in.

“If you can afford to hold the stock, you hold,” he wrote in a post on the subreddit.

“I don’t own it, but that’s what I would do.”

Cuban continued, adding that “when Robinhood and the other online brokers open it back up to buyers, then we will see what WallStreetBets is really made of.”

He finished by saying that “the lower [GME] goes, the more powerful WallStreetBets can be stepping up to buy the stock again.”

Bulls cheered Cuban’s comments and the buying frenzy found new life. Many of the shorted stocks rebounded after Robinhood lifted trading restrictions earlier this morning. Overall, though, they remain well below their recent highs.

Silver, meanwhile, also sunk. But it didn’t recover from this morning’s selling quite like GME initially did.

The iShares Silver Trust (NYSE: SLV) was targeted by Reddit traders as well in an attempt to force a short squeeze. Yesterday, it surged. Today, it’s trading below where it opened last Friday. Physical silver, on the other hand, is still scarce as 1 oz. silver eagles trade for a premium of roughly $10.99 above spot.

Bullion sellers are running low on supplies as a result of yesterday’s pop higher and the U.S. mint simply isn’t producing enough coins to meet demand. Silver rounds – privately minted coins – are trading for a lower premium, but one that’s comparatively higher than before WallStreetBets set its sights on silver.

A larger rift has formed between the physical and paper silver markets as a result.

Out of the two speculative plays – the other being GME – silver seems like the one that has the best chance of enjoying longer-term success. Unprecedented fiscal and monetary policy already had investors worried about fiat currencies.

This week’s short squeeze efforts have only drawn more attention to silver and gold alike.

That should bode well for silver miners, too. Especially if physical silver supplies dwindle further.

Which, at this rate, appears likely given that bullion merchants are so low on stock and, according to industry reps, aren’t expecting to have a new crop of coins any time soon.

Do some research, it takes all of 30 seconds of “investigating” to find out reddit has not now and never has been pushing for silver, in fact the majority of top posts yesterday where warning against it.

Do your job report the truth.