Stocks advanced this morning ahead of a critical Fed rate hike and economic projection. The Dow, S&P, and Nasdaq Composite all climbed modestly as yields slid. As is usually the case during an FOMC day, trading activity was muted through noon.

Analysts offered a myriad of takes on what the Fed will do this afternoon.

“While we expect the Fed to slow the pace of rate rises at its Wednesday meeting, policymakers are likely to stress that the job of curbing inflation is not yet over,” wrote UBS strategist Mark Haefele.

“A slowing of job creation and wage growth will be needed before the Fed can stop hiking.”

Haefele referenced the last jobs report in his note, which dented sentiment significantly when it was released back on December 2nd. Galloping wage inflation is expected to alter the Fed’s median rate for 2023 considering that, according to the November FOMC minutes, many FOMC members believed wage inflation had peaked.

The November jobs data showed that was not the case. Stocks fell in response to concerns that the Fed would extend its hiking campaign. The November Consumer Price Index (CPI), released yesterday morning, helped assuage much of that fear until the market began to realize that the cooler-than-expected CPI print may not have an impact on today’s meeting given how “hot” US labor continues to look.

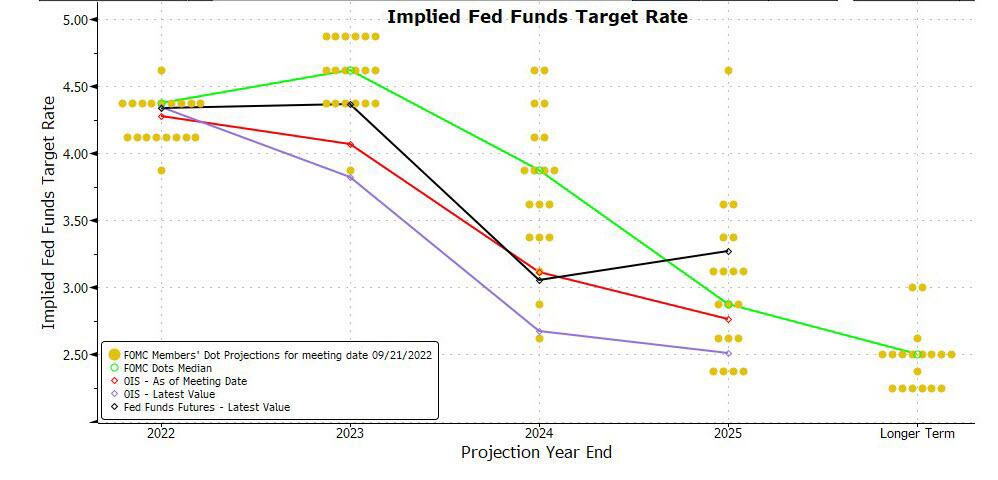

As for this afternoon’s rate hike, virtually everyone is expecting a 50 basis point increase. That won’t be the focus of the report, however, considering that the far more important Summary of Economic Projections – or “dot plot” – comes out today, too. The Fed updates its dot plot every three months.

In September’s dot plot (above), the median rate (green line) for 2023 was 4.6%. That was up significantly from June’s 2023 median rate of 3.8%.

Economists predict a median rate of 4.9% when the Fed unveils December’s dot plot this afternoon. Anything north of 5.0% would cause heavy selling.

The dot plot comes out right at 2 pm EST alongside the rate hike, meaning that the usual “rate hike rally” probably won’t arrive if the Fed raises rates as expected. The last handful of meetings saw stocks rally at 2 pm EST before diving lower on hawkish commentary from Fed Chairman Jerome Powell.

Today, it could be an entirely bearish affair if the median rate for 2023 is uncomfortably high. Alternatively, Powell may look to moderate the hawkishness in his post-hike press conference, lifting stocks intraday. Either way, investors should by no means expect “normal” post-FOMC price action today. The only guarantee here is that stocks will make major moves heading into the close.

Wall Street banks remain split on what’s coming next year. Many analysts will alter their predictions based on what Powell says this afternoon.

Morgan Stanley’s Mike Wilson, who has been one of the most accurate strategists this year, believes the CPI and FOMC won’t be able to stop what’s about to happen.

Wilson said it’s “very challenging to argue for higher valuations at this point, and with our expectation for falling earnings estimates, that leaves little, if any, upside to broader equity markets from here,” in a recent note.

“Bottom line, we think the CPI and Fed actions are unlikely to change this picture.”

Wilson pointed to low yields (which he feels won’t have much more room to fall), a still-hawkish Powell, and plummeting growth expectations for next year, which should drive rates lower, lifting equity risk premiums in the process.

Whether that’s true or not, until the Fed brings rates lower again, the market will remain an inhospitable place for bulls. And, based on the recent batch of inflation/jobs data, there’s nothing to indicate that the Fed’s plans are about to change dramatically any time soon.