Stocks fell this morning as the September FOMC meeting got underway. The Dow and S&P both tumbled while the Nasdaq Composite was only down slightly. Still, all three major indexes traded lower through noon.

And, as usual, FOMC-driven fears weighed heavily on risk assets. Treasury yields soared again today, pushing the 10-year rate to a daily high of 3.60%. That kind of move in yields would typically crush tech shares. Instead, tech traded relatively flat this morning opposite plunging Dow components.

Yields were provoked higher today not only by tomorrow’s Fed rate hike but by a surprising rate increase from Riksbank, the central bank of Sweden, as well. Riksbank raised rates by 100 basis points this morning, bringing Swedish rates to 1.75% in a bigger-than-expected hike. The Bank of England, Bank of Japan, and Federal Reserve will all raise rates within the next 48 hours. The market saw Riskbank’s hike as a potential indication that the BoE, BoJ, and Fed will uncork 100 bps rate hikes of their own.

It should be noted, however, that parts of the European economy are facing more dramatic inflation problems than in the US. Germany’s Producer Price Index (PPI), for example, was released this morning. Investors learned that the German PPI advanced a stunning 7.9% month-over-month in August, bringing the index’s yearly gain to 45.8%. The August PPI for the US was just +8.7% year-over-year by comparison. That’s still very high, but not anything close to 45.8%.

Nonetheless, the Fed’s messaging tomorrow should be consistent with its prior hawkish statements.

“Investors have pretty well digested the 75 basis point hike tomorrow but perhaps there’s some concern that the rhetoric at the press conference could be still extremely hawkish,” said Cresset Capital’s Jack Ablin.

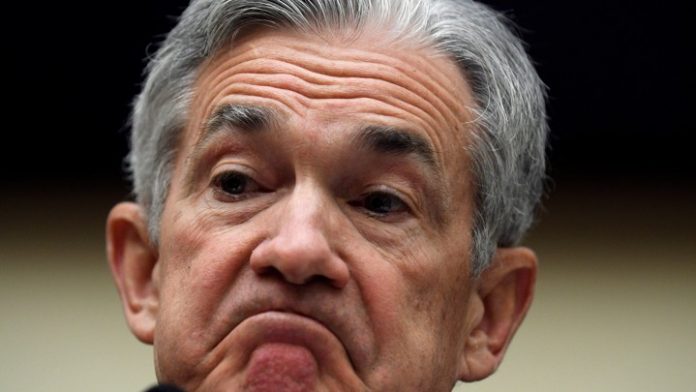

Ablin’s right in that the market is more afraid of Powell’s post-FOMC press conference than the hike itself (outside of a surprise 100 bps increase). Many investors are hoping that the Fed will stop raising rates so aggressively in response to soft economic data.

Powell said that wouldn’t be the case in his Jackson Hole speech in late August. If he reiterates that message tomorrow, it won’t necessarily be anything the market hasn’t heard already, but it also wouldn’t skew bullish. Confirmation that the Fed will hike rates into hard times is the last thing bulls want to see right now.

“The Federal Reserve is likely tightening policy straight into the teeth of a recession,” observed Danielle DiMartino Booth, CEO and chief strategist of Quill Intelligence.

“The stock market’s addiction to Fed easing when stocks decline may be what Jerome Powell is aiming to quash by aggressively hiking rates, in addition to inflation.”

Powell wants stocks to fall gradually now so as to not spark “flash crashes” down the road in response to future rate hikes. If that means he has to deliver hawkish remarks tomorrow to achieve that goal, he’ll probably do it. July’s rate hike was seen by investors as a “Fed pivot,” which obviously upset Powell. Fed officials hit back with extra hawkish rhetoric in the weeks that followed leading up to Powell’s appearance at Jackson Hole, where he delivered the killing blow to the summer rally.

Is Powell gearing up for another “stock-crushing” performance tomorrow? It’s certainly possible, if not probable, given that stocks are still well above their June lows, which is right around where stocks started soaring due to the Fed’s misinterpreted July meeting.