A bad jobs report and a repeat, albeit smaller, GameStop (NYSE: GME) surge dominated headlines this morning.

It’s the kind of stuff that would’ve hurt equities in the past. If WallStreetBets can spur on another short squeeze, stocks should eventually buckle in response.

For now, though, bulls aren’t feeling the heat. GME shares are up over 25% as of noon after Robinhood completely lifted trading restrictions on the stock.

Instead, investors were more focused on the meager January jobs report, in which the Labor Department revealed a payroll gain of only 49,000. Economists expected 50,000 jobs to be added last month, meaning it wasn’t too big of a “miss,” relatively speaking.

However, the Dow Jones estimate was viewed as overly conservative by many analysts. It was a low bar to hurdle and the U.S. labor market still fell short.

“The jobs number was particularly underwhelming as far fewer jobs were expected,” explained Chris Zaccarelli, chief investment officer at Independent Advisor Alliance.

“Ultimately, the stock market is anticipating continuing healing in the economy and has been moving higher because of Federal stimulus, which arguably is the bigger story.”

Ironically, the poor January jobs report should ultimately help stocks. It’s a relationship that’s developed over the last year. The worse things look, the more the government steps in to help.

That behavior has provided instant, artificial boosts to share prices almost across the board. The Fed has remained dovish as well due to the sluggish post-Covid recovery. Fed Chairman Jerome Powell is expected to keep rates low until he sees a marked improvement in the economy.

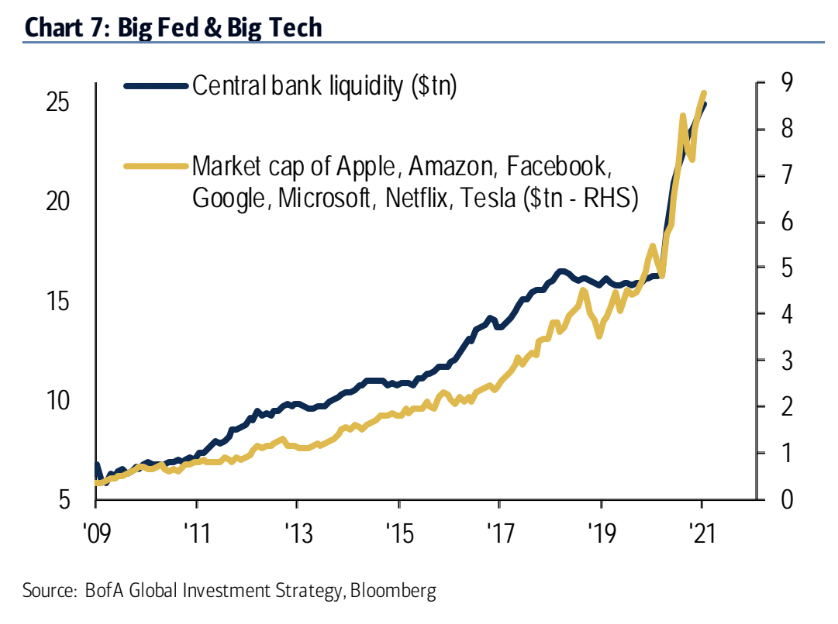

Powell’s stayed the course thus far, leading to a liquidity boom at an unprecedented scale. Perhaps the largest beneficiary of the Fed’s bond-buying has been Big Tech, which flourished since the pandemic began.

The broader market has followed central bank liquidity, too. But the correlation is far less “tight” after 2020. Big Tech outperformed in a major way as liquidity ramped-up to once inconceivable levels.

And that central bank liquidity currently sits at roughly $23 trillion. Big Tech investors have made a killing as a result.

But here’s the best part:

Another $6 trillion is expected to be deployed in the coming months, increasing the total liquidity amount by 26% (to $29 trillion).

Does that mean FAANG stocks (plus Microsoft and Tesla) are going to rise by the same percentage? They certainly could.

It only took Tesla one week to climb over 26% higher in mid-November. For the other, less explosive tech leaders, they required about 2-3 months’ worth of trading to achieve similar gains.

Investors need to remember that the market’s still in “opposite land.” Bad economic data makes stocks go up, and vice versa.

Because, as has been the case for almost a year, Fed liquidity is driving the market. You could argue that’s how stocks operated pre-Covid, too, thanks to post-Financial Crisis quantitative easing. These days, however, the Fed has far more control.

And that has bulls addicted to liquidity. So, until Powell throttles the liquidity “firehose,” equities are unlikely to slow their ascent. Only another wave of short squeezes or renewed taper fears seem capable of derailing the ongoing rally.

Especially if the U.S. economy continues stalling out in monthly reports.