Treasury yields are falling and a stimulus package is on its way.

Well, actually, yields were falling initially. But around noon they started to rise once again. The European Central Bank (ECB) made headlines this morning after it announced another round of bond-buying. The ECB made it seem like the purchases would happen soon, and on a frequent basis.

That had yields sinking and tech stocks surging.

Later, though, the ECB clarified that it would only make changes on a quarterly basis, instead of a weekly one like many investors had assumed.

Euro yields, like the German 10Y (Bund) yield, snapped back immediately. So too did the U.S. 10 Year Treasury Note yield, whipsawing from 1.50% to a daily high of 1.55% in a matter of hours.

And though bonds didn’t recover in a big way, stocks managed to hold on to their early gains. The Nasdaq Composite is still up big on the day. So too are the S&P and Dow, both of which hit new all-time highs.

A weekly jobs “beat” contributed to the bullish enthusiasm as well. The Labor Department said that first-time unemployment filings totaled 712,000 for the week ending March 6th. That’s below the consensus estimate of 725,000.

“The drop in jobless claims is another win for the week, and a solid sign that we’re making some strides toward pre-pandemic life,” explained E-Trade Financial managing director Mike Loewengart.

“Combined with stimulus relief in sight and a muted CPI read yesterday plus increased vaccinations and decreased business restrictions, there’s a pretty optimistic picture being painted.”

Really, though, it’s not much of a “beat.” And for an economy that’s making a “V-shaped” recovery, it could be seen as a disappointment. Sure, there’s been “V-shaped” spending activity, but the labor market has completely plateaued in the U.S.

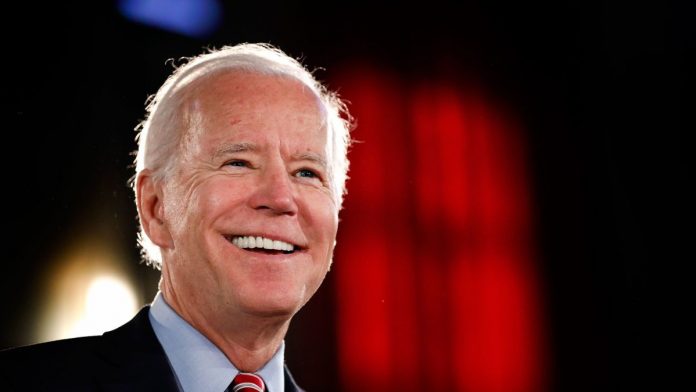

For President Biden, that may be reason enough to authorize another multi-trillion-dollar stimulus package – something that the White House could reveal as early as tonight.

Yes, that’s right, yet even more “government cheese” could be coming to qualifying Americans, as well as several other state-run projects. Biden said yesterday that he would unveil “the next phase” of his administration’s Covid-19 response in a primetime press conference scheduled for this evening.

“Tomorrow night, I’m going on primetime to address the American people and talk about what we went through as a nation this past year. But more importantly, I’m going to talk about what comes next,” Biden said.

“I’m going to launch the next phase of the Covid response and explain what we will do as a government and what we will ask of the American people,” he continued.

“There is light at the end of this dark tunnel over the past year. We cannot let our guard down now or assume that victory is inevitable. Together, we’re going to get through this pandemic and usher in a healthier, more hopeful future.”

Investors are most interested in the “what we will do as a government” portion of Biden’s remarks.

Fred Hickey, editor of The High-Tech Strategist, commented on what the President said.

“Up next (after the gigantic ‘infrastructure’ bill): curing cancer. Probably will only cost $100 trillion. But why not, when one has unlimited funds?,” asked Hickey via Twitter.

“Just have Jay Powell keep his finger on the money printing button a little longer.”

And while Hickey drew criticism for his sarcastic response, he makes a good point.

Will the most recent relief package be the last one? Or are we going to see several more? Don’t forget that Treasury Secretary Janet Yellen wants to reach “full employment” before shutting off the stimulus “firehose.”

U.S. labor has plenty of ground to make up before that goal is achieved. That could ultimately result in another year of back-to-back stimulus disbursements.

Even if inflation (and spending) both erupt as a result of economic reopenings across the country.