Stocks are trading flat today as investors try to rationalize rising Treasury yields. In a reversal from the trend of the last few days, Dow components are now down while tech stocks climb higher.

Some of this morning’s “sentiment flip” likely came from the personal consumption expenditures (PCE) index, which measured only a 0.30% increase for the month of January. The Fed watches the index to get a measure of inflation, and though last month’s gain exceeded expectations (0.20%), many investors feared a far bigger spike.

Year-over-year, the PCE index is up 1.50%, matching economist estimates.

But what’s surprising everyone still is the soaring 10 Year Treasury Note yield. As of noon today, the 10Y yield sits at roughly 1.50% – a level many analysts feared would be a major “sell zone” for equities.

And while stocks certainly fell as the 10Y yield approached 1.50%, a broader correction has yet to truly materialize. Nomura quant strategist Masanari Takada got the ball rolling on this discussion with a note released last week.

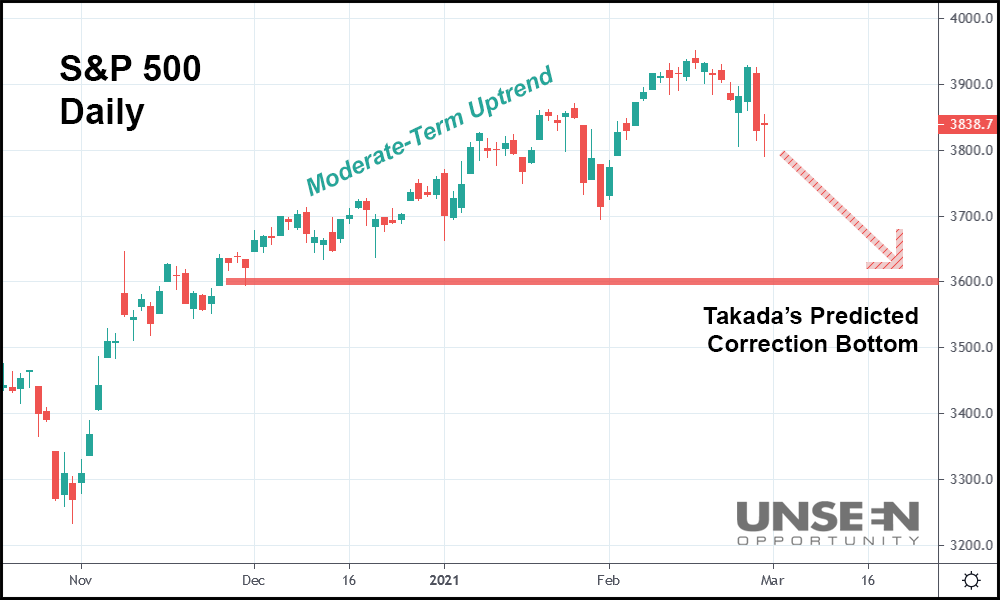

“[I] also envision a risk scenario in which [commodity trading advisors’] move to the short side in [U.S. Treasury] futures (TY) becomes essentially unstoppable, pushing the 10yr yield to above 1.5% and forcing US equities (the S&P 500) to adjust downward by 8% or more,” Takada said.

The S&P is down only 2.45% since the 10Y yield hit 1.50% yesterday. It needs to drop another 5.55% – to around 3,600 – for Takada’s prediction to come true.

But today, Takada’s reversing course. After significant short interest evaporated in 10Y futures, he believes yields should quickly sink, causing a bullish turnaround in the market.

“[Commodity trading advisors] now seem to have begun closing out short positions,” Takada said.

“Equity markets seem to have immediately adjusted downward so as to restore some kind of balance with bond yields. In terms of their consistency with equity markets, bond yields have gone about as high as they can reasonably go.”

He also blames the market’s recent volatility for the abrupt end to bearish 10Y futures activity. Takada identified commodity trading advisors as the primary cause for the spike in yields.

Now, though, he says they’re taking profits before Congress votes on Biden’s stimulus proposal – an event that could knock both Treasurys and stocks off-kilter in a hurry.

Still, Takada argues that the market will skew bullish in the long run amid loose monetary policy and aggressive government spending.

“We think we are still some distance from having to worry about a systematic, unbroken run of selling serious enough deepen and prolong this risk-off phase.”

Takada makes an excellent point:

With the Fed and Congress ready to keep the free money flowing, bulls are still in control. If he’s wrong, and stocks end up plunging again, that still doesn’t mean another Covid-like crash is coming.

Instead, it’ll likely just be a short “road-bump” (possibly a deep one) en route to the next rally continuation.

Thanks to who else, but Fed Chairman Jerome Powell and his buddies in Washington, ready to goose the U.S. economy until “full employment” is reached.

Or, inflation tears down the whole financial system – two outcomes of the current economic recovery plan that aren’t mutually exclusive.