If you’ve been avoiding the oil industry like the plague in recent years like many investors have, now may be the time to reevaluate the industrial commodity completely. Some recent news has Goldman Sachs bullish on American energy, as well as many other self-proclaimed expert traders.

Typically, when the whole world is in a tizzy about something – it’s usually too late to get involved (if you aren’t already). But in this case investors may have a good reason to be optimistic.

Bahrain’s Oil Minister recently expressed concern that declining petroleum demand by Chinese consumers could negatively impact Middle Eastern oil producing countries.

“I think there is a risk on the demand side,” Sheikh Mohammed bin Khalifa Al Khalifa said. In this case, that demand is China.

In the spirit of piling on, the Trump administration has slapped tariffs on a wide range of Chinese goods coming into the U.S. as well – forming the second part of a 1-2 punch to the Chinese economy.

This could very well cause a slowdown in Chinese manufacturing, which would be profoundly damaging to China’s export-based economy.

If the trade war between China and the U.S. continues to intensify — and considering what has happened so far, it seems highly likely — the Chinese economy would cool off, big time.

It’s already gone “cold” since the beginning of Trump’s tariff talks, just imagine what could transpire if things got worse.

Another Middle Eastern Oil Minister, Mohammed bin Hamad Al Rumhy of Oman, seems to agree with that sentiment. He recently posed a question to CNBC in an interview:

“What happens if China reduces its consumption?”

The answer is that the Middle Eastern countries that have been supplying China with its black gold will suffer immensely.

The Omani oil chief added, “And I think, and many people agree with me, that the demand will be impacted—so that’s not good for us.”

Really? One of your biggest customers could be walking away, and that’s “not so good”?

Talk about the understatement of the year.

China leaving the oil buyer’s club of the Middle East could be disastrous for the oil producing countries that reside there – Oman included.

But let’s not forget about Iran, one of the other countries in the region that has grown dependent on its oil exports.

U.S. sanctions on the OPEC member will curb supply coming out of the country, putting upward pressure on price. This, over time, will ultimately serve as something that will favor U.S. oil producers – resulting in a long-term American shale dominance over OPEC oil.

And as good as that sounds for the American energy sector, the question remains:

Could this really happen?

Yes, absolutely, and as time has progressed, it’s seemed increasingly likely.

The Trump administration has a target on Iran, and his foreign policy isn’t going to change anytime soon, giving us a glimpse into energy’s future.

A potential shale boom.

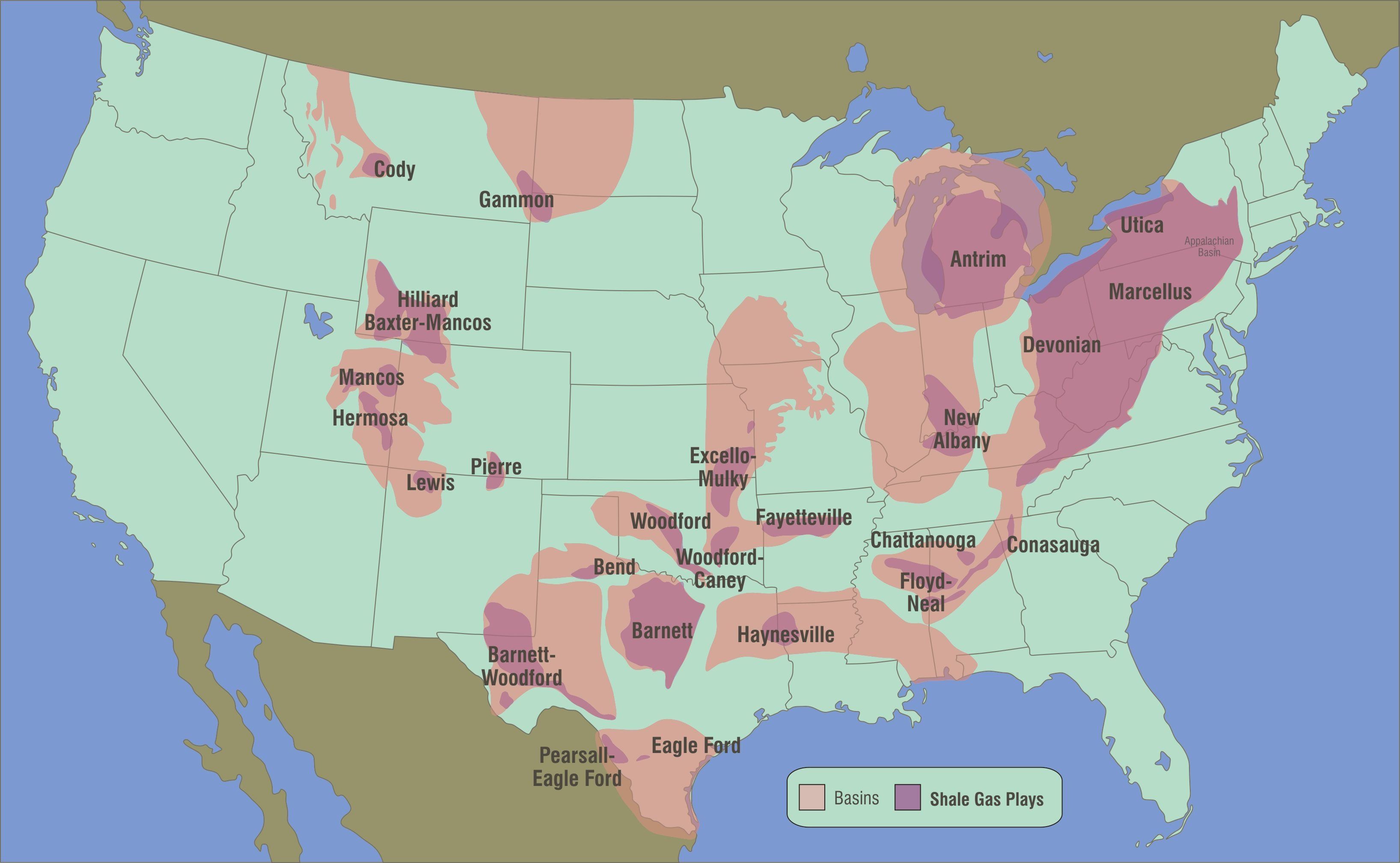

Stretching from North Dakota to west Texas, shale rich regions in the United States are looking more and more profitable as political tensions continue to rise.

So, it’s no wonder Goldman is so bullish on U.S. oil companies. They’ve even issued a buy rating for Occidental Petroleum Corp., which is up YTD around 11%. Now, that doesn’t mean you should run out and buy some up this instant, but it does mean that market sentiment on American energy companies may be beginning to turn.

Another stock that could be loaded with potential is EOG Resources, Inc., which has delivered around 10% so far this year. And ConocoPhillips, which has returned a very impressive 35%, could be on the precipice of a long-term trend should shale producers benefit from the strained conditions in the Middle East.

But before go shale-crazy, we need to take a step back here and compare oil to other choices in the market.

Despite all of the recent hype around American energy, U.S. oil stocks have actually underperformed the broader market so far in 2018.

Is that a deal breaker?

Definitely not. If you’ve read any of previous editions of this newsletter, you’d know that I find underperformance (before a major move) extremely enticing.

It means that the market hasn’t used up all of its energy yet, even if all of the “experts” are hot on a particular sector or industry. I don’t really care what the buzz surrounding American energy is, if the market is showing me that there’s still time to get on board before the train leaves the station.

Heck, even OPEC itself foresees U.S. shale accounting for roughly 94% of total petroleum liquids growth in 2018. This would be an increase of 4% from 2017 numbers. In the same press release, OPEC said that its production of crude decreased in March of this year, while the world’s total supply actually went up. The difference boils down to increased output from non-OPEC countries, meaning that producers in the United States are on track to flourish.

As the international markets stutter and falter, investors will turn back to the old reliable workhorse: the United States stock market. Make no mistake, with the way things are going, American energy companies could benefit mightily.

What ultimately will decide their fate, though, is if the rest of the market can get pumped up on U.S. oil.

And from what I’ve seen, I wouldn’t at all be surprised if that happened.