Get ready, America.

A check from President Trump might actually be on its way.

And sooner than you’d think.

That’s the scoop today after Treasury Secretary Steven Mnuchin laid out details of the Trump administration’s highly anticipated relief plan.

On Fox Business this morning, Mnuchin explained that $500 billion would be sent directly to Americans pending congressional approval. Leaders from both parties are currently discussing the payments.

Mnuchin commented that the funds would be divided into two parts.

“The first one would be $1,000 per person, $500 per child,” he said.

“So, for a family of four, that’s a $3,000 payment. As soon as Congress passes this, we get this out in three weeks.”

But the gravy train doesn’t end there. If the outbreak persists, another disbursement will be on its way.

“Six weeks later, if the president still has a national emergency, we’ll deliver another $3,000,” Mnuchin added.

With stocks falling and jobless claims rising, plenty of Americans are already asking for a monthly stipend. Trump intends to meet their demands (and then some) with his proposed $1 trillion stimulus package.

What’s fallen by the wayside, however, is the current state of treasury yields. After peaking on March 9th, bond prices have collapsed right along with equities, pushing yields higher.

If Trump’s sending out $500 billion worth of “government cheese,” inflation will likely rise. When investors worry that bond yields won’t keep up with the rising costs of inflation, bond prices typically drop – something that’s starting to happen.

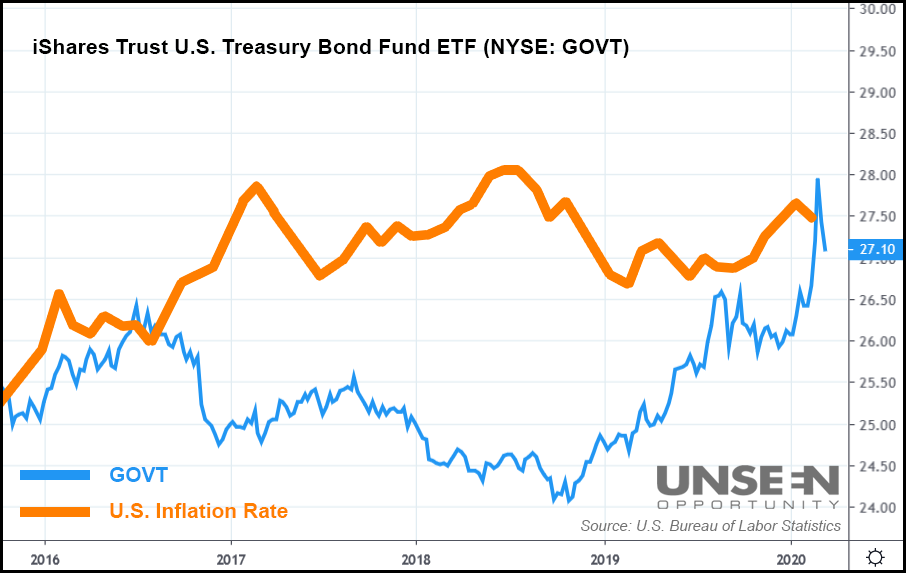

In the chart above, we’ve plotted the iShares Trust U.S. Treasury Bond Fund ETF (NYSE: GOVT) against the U.S. inflation rate (in orange), going back to 2016. Over the last few years, a clear inverse relationship has formed between inflation and bond prices.

As inflation went up, GOVT dropped. A rise in either interest rates or inflation will often cause bond prices to fall, as the two behave similarly to bond yields. When yields rise, bonds sink.

What’s unique about the current situation is that the Fed is slashing rates like it did after the 2008 financial crisis hit. However, despite the central bank’s best efforts to keep interest rates low, a bond collapse is sending yields higher.

Gold prices, which have finally stabilized after dropping 14% from a March 8th high, are showing signs of inflationary fears, too. Gold has historically been seen as a hedge against inflation.

If that still holds true, then investors are hedging. Or, at the very least, they see big value in sold-off precious metals.

Either way, a huge discrepancy is beginning to form. Inflation hasn’t been the “boogeyman” it was in decades prior. Odds are that we aren’t going to see a major inflationary scare.

Yes, Trump’s “checks in the mail” program will cause inflation to rise, but it won’t get out of control. The Fed still intends to keep interest rates low for the sake of the coronavirus-stricken U.S. economy. Eventually, bond prices will recover as a result.

That means that over the next few weeks, a massive bond revival could occur. ETFs like GOVT may soon be entering “buy territory” for opportunistic traders once the market realizes that inflation won’t be of significant concern.

Most importantly, we’re still in the thick of the COVID-19 outbreak. Investors have shown that they want bonds when uncertainty’s on the rise. If the recent reports are any indication, the nervousness over the disease won’t end any time soon.

Which, at present, is great news for short-term traders. Anyone looking to “poach” some gains off an oversold bond market might have a shot at doing so in the next few days.

All while the coronavirus continues to spread.